Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Data Lightning Wholesale has opted to only carry two ski brands in 2010: Ogasaka and Nordica - The list prices for Ogasaka and Nordica

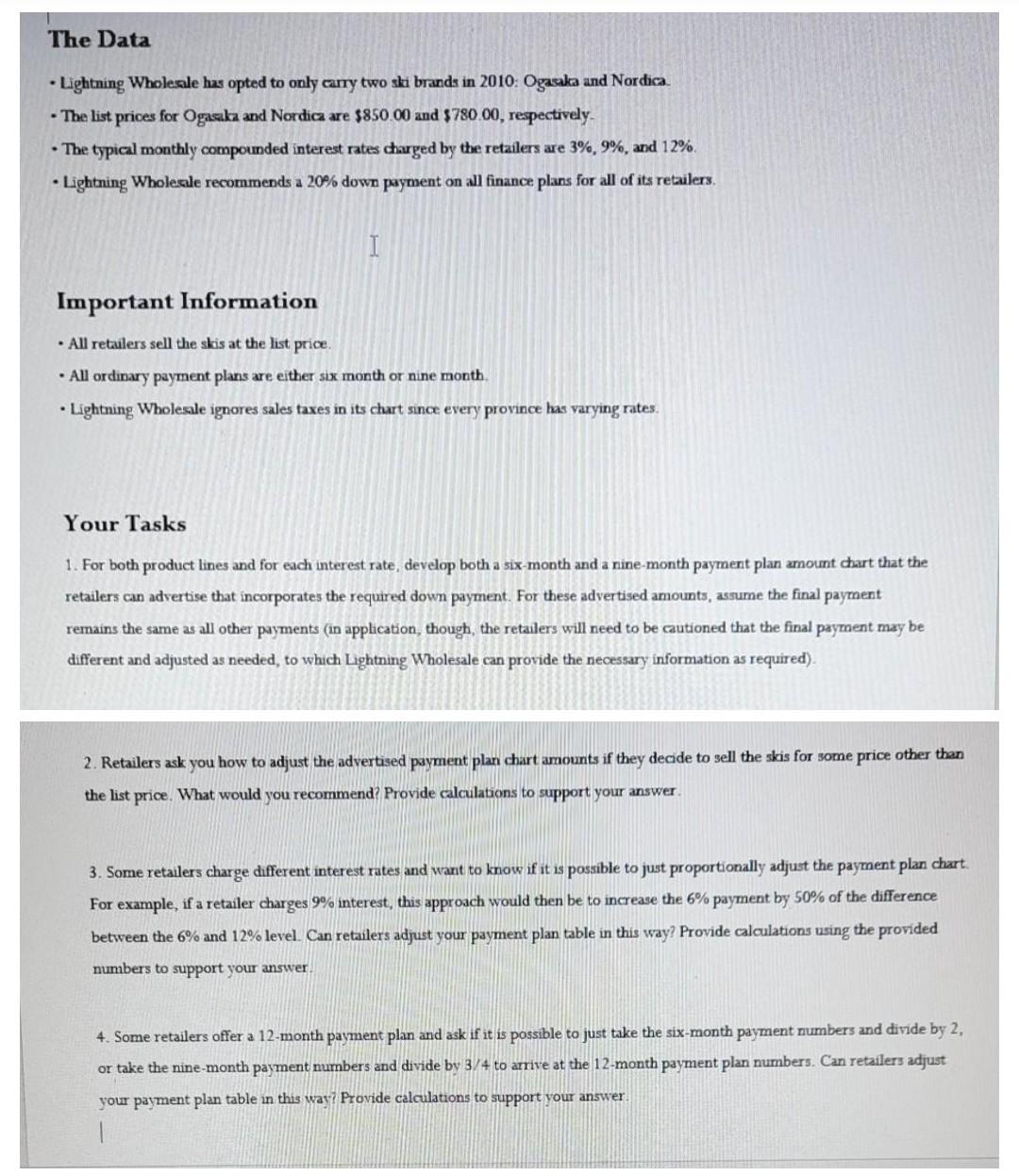

The Data Lightning Wholesale has opted to only carry two ski brands in 2010: Ogasaka and Nordica - The list prices for Ogasaka and Nordica are $850.00 and $780.00, respectively The typical monthly compounded interest rates charged by the retailers are 3%, 9%, and 12% - Lightning Wholesale recommends a 20% down payment on all finance plans for all of its retailers, I Important Information All retailers sell the skis at the list price. All ordinary payment plans are either six month or nine month Lightning Wholesale ignores sales taxes in its chart since every province has varying rates Your Tasks 1. For both product lines and for each interest rate, develop both a six-month and a nine-month payment plan amount chart that the retailers can advertise that incorporates the required down payment. For these advertised amounts, assume the final payment remains the same as all other payments (in application, though the retailers will need to be cautioned that the final payroent may be different and adjusted as needed, to which Lightning Wholesale can provide the necessary information as required) 2. Retailers ask you how to adjust the advertised payment plan chart amounts if they decide to sell the skis for some price other than the list price. What would you recommend? Provide calculations to support your answer 3. Some retailers charge different interest rates and want to know if it is possible to just proportionally adjust the payment plan chart. For example, if a retailer charges 9% interest, this approach would then be to increase the 6% payment by 50% of the difference between the 6% and 12% level. Can retailers adjust your payment plan table in this way? Provide calculations using the provided numbers to support your answer. 4. Some retailers offer a 12-month payment plan and ask if it is possible to just take the six-month payment numbers and divide by 2, or take the nine-month payment numbers and divide by 3/4 to arrive at the 12-month payment plan numbers. Can retailers adjust your payment plan table in this way? Provide calculations to support your answer The Data Lightning Wholesale has opted to only carry two ski brands in 2010: Ogasaka and Nordica - The list prices for Ogasaka and Nordica are $850.00 and $780.00, respectively The typical monthly compounded interest rates charged by the retailers are 3%, 9%, and 12% - Lightning Wholesale recommends a 20% down payment on all finance plans for all of its retailers, I Important Information All retailers sell the skis at the list price. All ordinary payment plans are either six month or nine month Lightning Wholesale ignores sales taxes in its chart since every province has varying rates Your Tasks 1. For both product lines and for each interest rate, develop both a six-month and a nine-month payment plan amount chart that the retailers can advertise that incorporates the required down payment. For these advertised amounts, assume the final payment remains the same as all other payments (in application, though the retailers will need to be cautioned that the final payroent may be different and adjusted as needed, to which Lightning Wholesale can provide the necessary information as required) 2. Retailers ask you how to adjust the advertised payment plan chart amounts if they decide to sell the skis for some price other than the list price. What would you recommend? Provide calculations to support your answer 3. Some retailers charge different interest rates and want to know if it is possible to just proportionally adjust the payment plan chart. For example, if a retailer charges 9% interest, this approach would then be to increase the 6% payment by 50% of the difference between the 6% and 12% level. Can retailers adjust your payment plan table in this way? Provide calculations using the provided numbers to support your answer. 4. Some retailers offer a 12-month payment plan and ask if it is possible to just take the six-month payment numbers and divide by 2, or take the nine-month payment numbers and divide by 3/4 to arrive at the 12-month payment plan numbers. Can retailers adjust your payment plan table in this way? Provide calculations to support your

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started