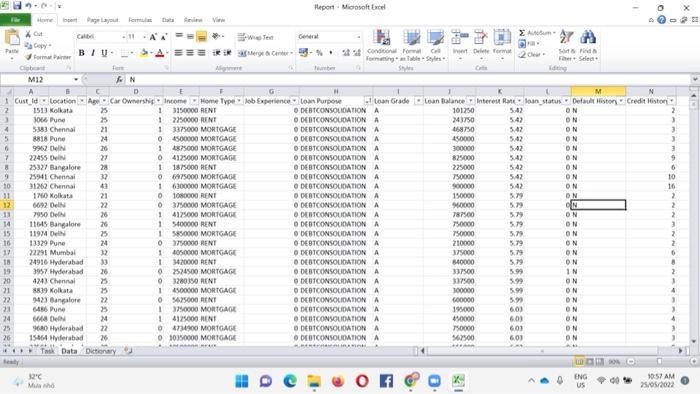

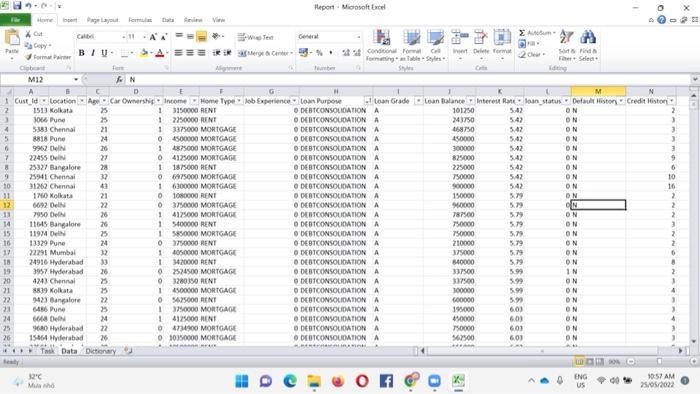

The data set consists of customers demographics, credit history and loan application details. Using this data set you would need to figure out those customers who are likely defaulted on their loan. This analysis will be beneficial for the bank to avoid the loss of money and improve its performance. You should have some sentences disscussing the key insights for each figure/table that you analyze and provide.

Deliverables

1) Final report in a well formated deck (5-7 pages).

2) Mention of which team member(s) have done what part of the solution

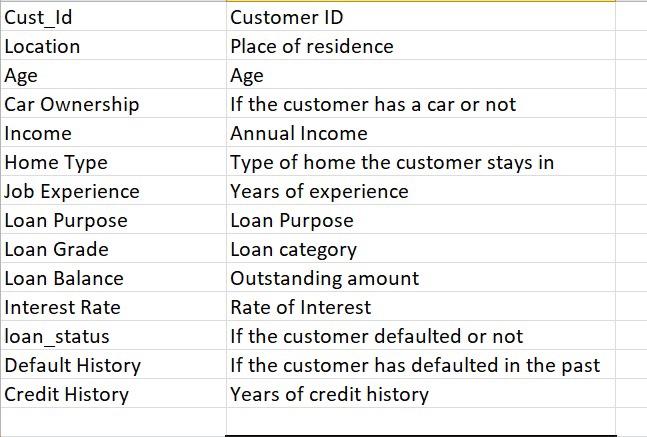

Parte Page Layout Formula Cata -11-AA BIU A fore Clipband M12 A & N D 1 Cust_id Location Age Car Ownership 2 1513 Kolkata 25 3 3066 Pune 25 4 5383 Chennal 21 5 8818 Pune 24 6 9962 Del 26 7 8 27 28 32 43 9 10 11 21 12 22 13 26 14 26 15 25 16 24 37 32 18 33 19 26 20 25 21 25 22 22 23 24 25 26 Copy- Format Pai 22455 De 25327 Bangalore 25941 Chennai 31262 Chennai 1760 Kolkata 6692 Deli 7950 Del 11645 Bangalore 11974 Del 13329 Pune 22291 Mumbai 24916 Hyderabad 3957 Hyderabad 4243 Chennai 8839 Kolkata 9423 Bangalore 6456 Pune 6668 Del 9680 Hyderabad 15464 Hyderabad 25 24 22 26 Task Data Dictionary Report Microsoft Excel Merge Center %2828 Conditional Format Call Formatting Table Styles Number H Income Home Type Job Experience toan Purpose 1 3150000 RENT 12250000 RENT 1 3375000 MORTGAGE 04500000 MORTGAGE 14875000 MORTGAGE 04125000 MORTGAGE 1 1875000 RENT O 6975000 MORTGAGE 16300000 MORTGAGE 01080000 RENT 0 3750000 MORTGAGE 4125000 MORTGAGE 5400000 RENT 1 1 1 5850000 MORTGAGE 3750000 RENT 0 1 4050000 MORTGAGE 1 3420000 RENT 02524500 MORTGAGE 0 3280350 RENT 14500000 MORTGAGE 05625000 RENT 1 3750000 MORTGAGE 1 4125000 RENT 04734900 MORTGAGE 0 10350000 MORTGAGE AME 32C Mua ho ODEBTCONSOLIDATION A ODEBTCONSOLIDATION A DEBTCONSOLIDATION A ODEBTCONSOLIDATION A ODEBTCONSOLIDATION A ODEBTCONSOLIDATION A ODEBTCONSOLIDATION A ODEBTCONSOLIDATION A ODEBTCONSOLIDATION A DEBTCONSOLIDATION A ODEBTCONSOLIDATION A DEBTCONSOLIDATION A ODEBTCONSOLIDATION A DEBTCONSOLIDATION A DEBTCONSOLIDATION A ODEBTCONSOLIDATION A ODEBTCONSOLIDATION A DEBTCONSOLIDATION A DEBICONSOLIDATION A ODEBTCONSOLIDATION A DESTCONSOLIDATION A DESTCONSOLIDATION A DEBTCONSOLIDATION A DEBTCONSOLIDATION A DEBTCONSOLIDATION A eert Delete format 20. & Find F-Select L N Lean Grade Lean Balance Interest Rate loan status Default History Credit History 101250 5:42 ON 243750 5.42 ON 468750 5.42 ON 3 450000 5.42 ON 3 300000 5.42 ON 3 825000 5.42 ON 9 225000 5.42 ON 6 750000 5.42 ON 900000 5.42 ON 150000 5.79 ON 960000 5.79 ON 787500 5.79 ON 750000 5.79 ON 750000 5.79 ON 210000 5.79 ON 375000 5.79 ON 840000 5.79 ON 337500 5.99 1N 337500 5.99 ON 300000 5.99 ON 600000 5.99 ON 195000 6.03 ON 450000 6.03 ON 6.01 ON 750000 562500 6.01 ON 0 ENG US 0 NO 0 10 16 2 2 2 10:57 AM 25/05/2022 "x 13 D Cust_ld Location Age Car Ownership Income Home Type Job Experience Loan Purpose Loan Grade Loan Balance Interest Rate loan_status Default History Credit History Customer ID Place of residence Age If the customer has a car or not Annual Income Type of home the customer stays in Years of experience Loan Purpose Loan category Outstanding amount Rate of Interest If the customer defaulted or not If the customer has defaulted in the past Years of credit history Parte Page Layout Formula Cata -11-AA BIU A fore Clipband M12 A & N D 1 Cust_id Location Age Car Ownership 2 1513 Kolkata 25 3 3066 Pune 25 4 5383 Chennal 21 5 8818 Pune 24 6 9962 Del 26 7 8 27 28 32 43 9 10 11 21 12 22 13 26 14 26 15 25 16 24 37 32 18 33 19 26 20 25 21 25 22 22 23 24 25 26 Copy- Format Pai 22455 De 25327 Bangalore 25941 Chennai 31262 Chennai 1760 Kolkata 6692 Deli 7950 Del 11645 Bangalore 11974 Del 13329 Pune 22291 Mumbai 24916 Hyderabad 3957 Hyderabad 4243 Chennai 8839 Kolkata 9423 Bangalore 6456 Pune 6668 Del 9680 Hyderabad 15464 Hyderabad 25 24 22 26 Task Data Dictionary Report Microsoft Excel Merge Center %2828 Conditional Format Call Formatting Table Styles Number H Income Home Type Job Experience toan Purpose 1 3150000 RENT 12250000 RENT 1 3375000 MORTGAGE 04500000 MORTGAGE 14875000 MORTGAGE 04125000 MORTGAGE 1 1875000 RENT O 6975000 MORTGAGE 16300000 MORTGAGE 01080000 RENT 0 3750000 MORTGAGE 4125000 MORTGAGE 5400000 RENT 1 1 1 5850000 MORTGAGE 3750000 RENT 0 1 4050000 MORTGAGE 1 3420000 RENT 02524500 MORTGAGE 0 3280350 RENT 14500000 MORTGAGE 05625000 RENT 1 3750000 MORTGAGE 1 4125000 RENT 04734900 MORTGAGE 0 10350000 MORTGAGE AME 32C Mua ho ODEBTCONSOLIDATION A ODEBTCONSOLIDATION A DEBTCONSOLIDATION A ODEBTCONSOLIDATION A ODEBTCONSOLIDATION A ODEBTCONSOLIDATION A ODEBTCONSOLIDATION A ODEBTCONSOLIDATION A ODEBTCONSOLIDATION A DEBTCONSOLIDATION A ODEBTCONSOLIDATION A DEBTCONSOLIDATION A ODEBTCONSOLIDATION A DEBTCONSOLIDATION A DEBTCONSOLIDATION A ODEBTCONSOLIDATION A ODEBTCONSOLIDATION A DEBTCONSOLIDATION A DEBICONSOLIDATION A ODEBTCONSOLIDATION A DESTCONSOLIDATION A DESTCONSOLIDATION A DEBTCONSOLIDATION A DEBTCONSOLIDATION A DEBTCONSOLIDATION A eert Delete format 20. & Find F-Select L N Lean Grade Lean Balance Interest Rate loan status Default History Credit History 101250 5:42 ON 243750 5.42 ON 468750 5.42 ON 3 450000 5.42 ON 3 300000 5.42 ON 3 825000 5.42 ON 9 225000 5.42 ON 6 750000 5.42 ON 900000 5.42 ON 150000 5.79 ON 960000 5.79 ON 787500 5.79 ON 750000 5.79 ON 750000 5.79 ON 210000 5.79 ON 375000 5.79 ON 840000 5.79 ON 337500 5.99 1N 337500 5.99 ON 300000 5.99 ON 600000 5.99 ON 195000 6.03 ON 450000 6.03 ON 6.01 ON 750000 562500 6.01 ON 0 ENG US 0 NO 0 10 16 2 2 2 10:57 AM 25/05/2022 "x 13 D Cust_ld Location Age Car Ownership Income Home Type Job Experience Loan Purpose Loan Grade Loan Balance Interest Rate loan_status Default History Credit History Customer ID Place of residence Age If the customer has a car or not Annual Income Type of home the customer stays in Years of experience Loan Purpose Loan category Outstanding amount Rate of Interest If the customer defaulted or not If the customer has defaulted in the past Years of credit history