Answered step by step

Verified Expert Solution

Question

1 Approved Answer

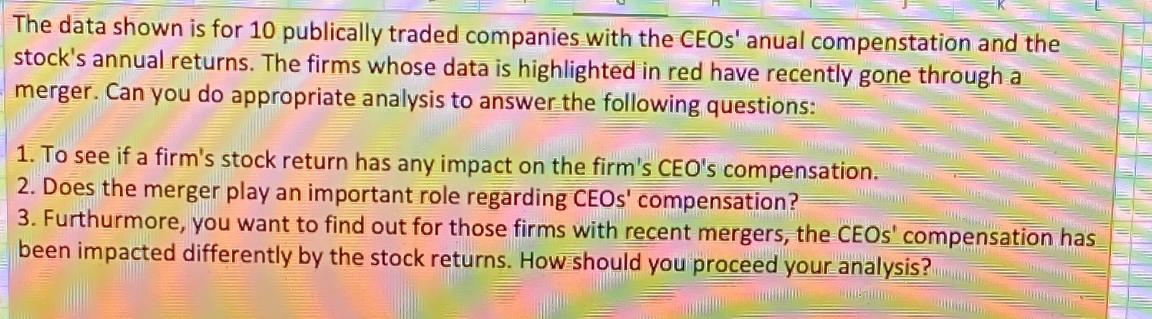

The data shown is for 10 publically traded companies with the CEOs' anual compenstation and the stock's annual returns. The firms whose data is

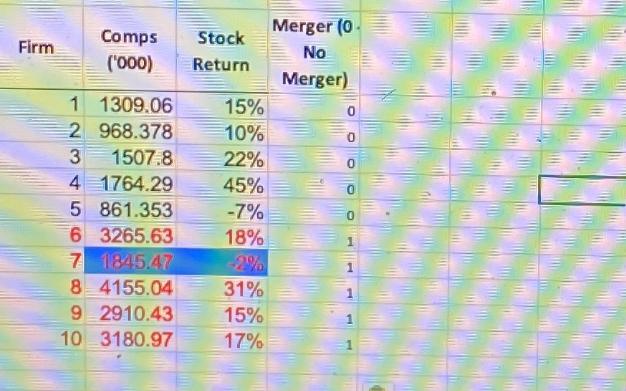

The data shown is for 10 publically traded companies with the CEOs' anual compenstation and the stock's annual returns. The firms whose data is highlighted in red have recently gone through a merger. Can you do appropriate analysis to answer the following questions: 1. To see if a firm's stock return has any impact on the firm's CEO's compensation. 2. Does the merger play an important role regarding CEOs' compensation? 3. Furthurmore, you want to find out for those firms with recent mergers, the CEOs' compensation has been impacted differently by the stock returns. How should you proceed your analysis? Merger (0 Comps Stock Firm No ('000) Return Merger) 1 1309.06 15% 2 968.378 10% 0 3 1507.8 22% 4 1764.29 45% 5 861.353 -7% 6 3265.63 18% 7 1845.47 -2% 8 4155.04 31% 9 2910.43 15% 10 3180.97 17%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To analyze the impact of stock return on CEO compensation and the role of mergers we can perform the following steps 1 Correlation Analysis Calculate the correlation coefficient between stock returns ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started