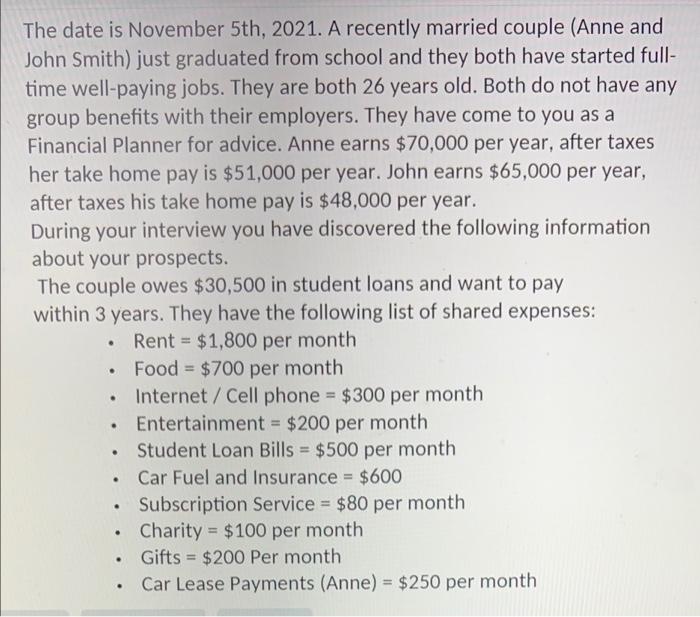

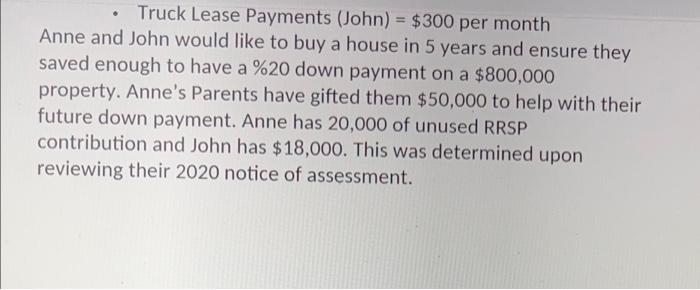

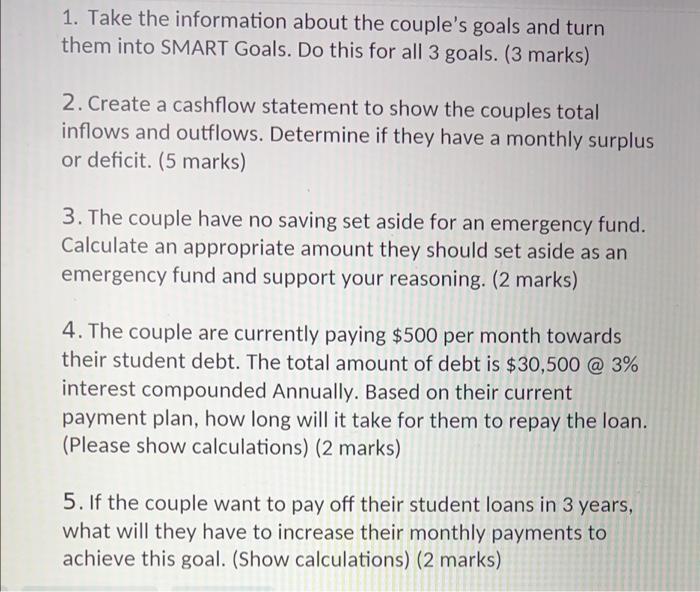

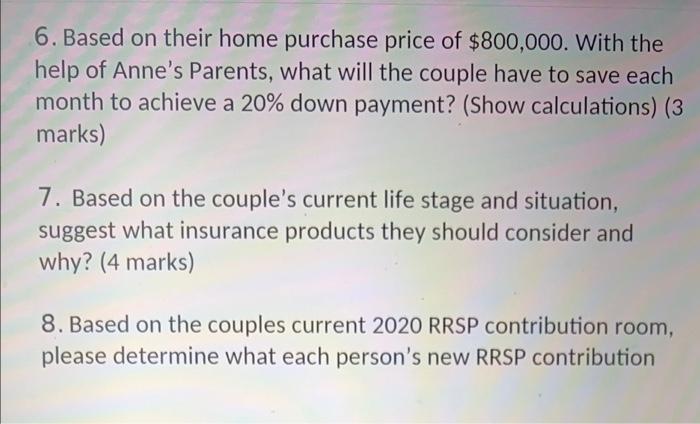

The date is November 5th, 2021. A recently married couple (Anne and John Smith) just graduated from school and they both have started full- time well-paying jobs. They are both 26 years old. Both do not have any group benefits with their employers. They have come to you as a Financial Planner for advice. Anne earns $70,000 per year, after taxes her take home pay is $51,000 per year. John earns $65,000 per year, after taxes his take home pay is $48,000 per year. During your interview you have discovered the following information about your prospects. The couple owes $30,500 in student loans and want to pay within 3 years. They have the following list of shared expenses: Rent = $1,800 per month Food = $700 per month Internet / Cell phone = $300 per month Entertainment = $200 per month Student Loan Bills = $500 per month Car Fuel and Insurance = $600 Subscription Service = $80 per month Charity = $100 per month Gifts = $200 per month Car Lease Payments (Anne) = $250 per month . . . . . . . . Truck Lease Payments (John) = $300 per month Anne and John would like to buy a house in 5 years and ensure they saved enough to have a %20 down payment on a $800,000 property. Anne's Parents have gifted them $50,000 to help with their future down payment. Anne has 20,000 of unused RRSP contribution and John has $18,000. This was determined upon reviewing their 2020 notice of assessment. 1. Take the information about the couple's goals and turn them into SMART Goals. Do this for all 3 goals. (3 marks) 2. Create a cashflow statement to show the couples total inflows and outflows. Determine if they have a monthly surplus or deficit. (5 marks) 3. The couple have no saving set aside for an emergency fund. Calculate an appropriate amount they should set aside as an emergency fund and support your reasoning. (2 marks) 4. The couple are currently paying $500 per month towards their student debt. The total amount of debt is $30,500 @ 3% interest compounded Annually. Based on their current payment plan, how long will it take for them to repay the loan. (Please show calculations) (2 marks) 5. If the couple want to pay off their student loans in 3 years, what will they have to increase their monthly payments to achieve this goal. (Show calculations) (2 marks) 6. Based on their home purchase price of $800,000. With the help of Anne's Parents, what will the couple have to save each month to achieve a 20% down payment? (Show calculations) (3 marks) 7. Based on the couple's current life stage and situation, suggest what insurance products they should consider and why? (4 marks) 8. Based on the couples current 2020 RRSP contribution room, please determine what each person's new RRSP contribution 7. Based on the couple's current life stage and situation, suggest what insurance products they should consider and why? (4 marks) 8. Based on the couples current 2020 RRSP contribution room, please determine what each person's new RRSP contribution room will be on their 2021 notice of assessment. (Show calculations) (3 marks) The date is November 5th, 2021. A recently married couple (Anne and John Smith) just graduated from school and they both have started full- time well-paying jobs. They are both 26 years old. Both do not have any group benefits with their employers. They have come to you as a Financial Planner for advice. Anne earns $70,000 per year, after taxes her take home pay is $51,000 per year. John earns $65,000 per year, after taxes his take home pay is $48,000 per year. During your interview you have discovered the following information about your prospects. The couple owes $30,500 in student loans and want to pay within 3 years. They have the following list of shared expenses: Rent = $1,800 per month Food = $700 per month Internet / Cell phone = $300 per month Entertainment = $200 per month Student Loan Bills = $500 per month Car Fuel and Insurance = $600 Subscription Service = $80 per month Charity = $100 per month Gifts = $200 per month Car Lease Payments (Anne) = $250 per month . . . . . . . . Truck Lease Payments (John) = $300 per month Anne and John would like to buy a house in 5 years and ensure they saved enough to have a %20 down payment on a $800,000 property. Anne's Parents have gifted them $50,000 to help with their future down payment. Anne has 20,000 of unused RRSP contribution and John has $18,000. This was determined upon reviewing their 2020 notice of assessment. 1. Take the information about the couple's goals and turn them into SMART Goals. Do this for all 3 goals. (3 marks) 2. Create a cashflow statement to show the couples total inflows and outflows. Determine if they have a monthly surplus or deficit. (5 marks) 3. The couple have no saving set aside for an emergency fund. Calculate an appropriate amount they should set aside as an emergency fund and support your reasoning. (2 marks) 4. The couple are currently paying $500 per month towards their student debt. The total amount of debt is $30,500 @ 3% interest compounded Annually. Based on their current payment plan, how long will it take for them to repay the loan. (Please show calculations) (2 marks) 5. If the couple want to pay off their student loans in 3 years, what will they have to increase their monthly payments to achieve this goal. (Show calculations) (2 marks) 6. Based on their home purchase price of $800,000. With the help of Anne's Parents, what will the couple have to save each month to achieve a 20% down payment? (Show calculations) (3 marks) 7. Based on the couple's current life stage and situation, suggest what insurance products they should consider and why? (4 marks) 8. Based on the couples current 2020 RRSP contribution room, please determine what each person's new RRSP contribution 7. Based on the couple's current life stage and situation, suggest what insurance products they should consider and why? (4 marks) 8. Based on the couples current 2020 RRSP contribution room, please determine what each person's new RRSP contribution room will be on their 2021 notice of assessment. (Show calculations)