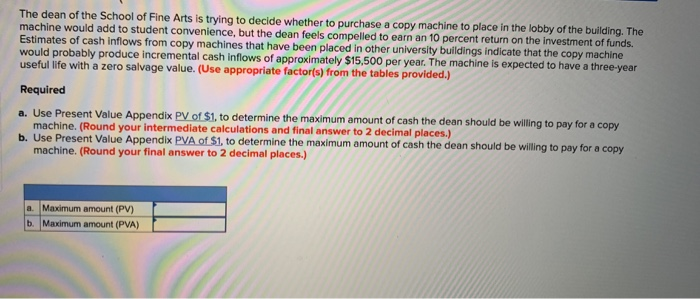

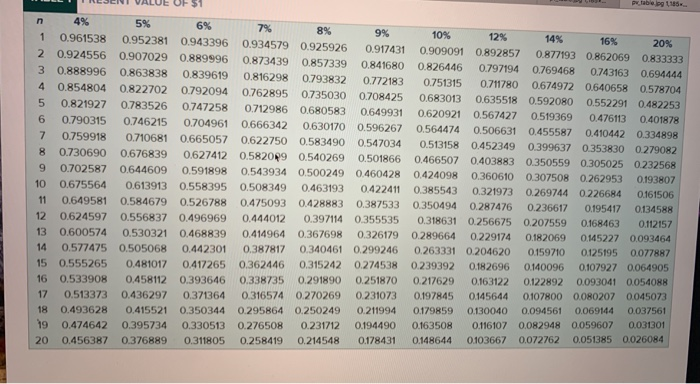

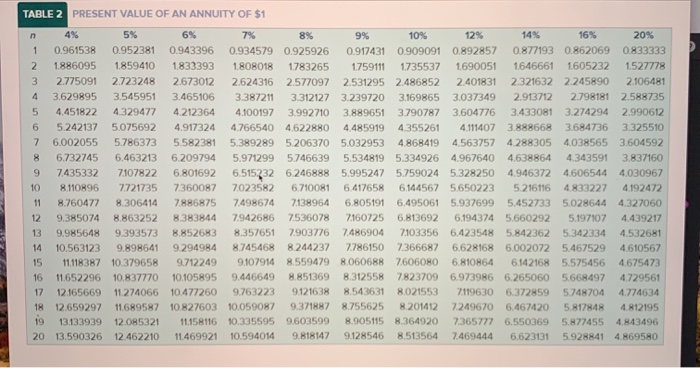

The dean of the School of Fine Arts is trying to decide whether to purchase a copy machine to place in the lobby of the building. The machine would add to student convenience, but the dean feels compelled to earn an 10 percent return on the investment of funds. Estimates of cash inflows from copy machines that have been placed in other university buildings indicate that the copy machine would probably produce incremental cash inflows of approximately $15,500 per year. The machine is expected to have a three-year useful life with a zero salvage value. (Use appropriate factor(s) from the tables provided.) Required a. Use Present Value Appendix PV of $1, to determine the maximum amount of cash the dean should be willing to pay for a copy machine. (Round your intermediate calculations and final answer to 2 decimal places.) b. Use Present Value Appendix PVA of S1, to determine the maximum amount of cash the dean should be willing to pay for a copy machine. (Round your final answer to 2 decimal places.) a. Maximum amount (PV) b. Maximum amount (PVA) HULTRLJENI VALUE UF$1 labe bg 18 6% n 4% 5% 7% 1 8% 0.961538 9% 0.952381 0.943396 0.934579 0.925926 2 0.924556 0.917431 0.907029 0.889996 0.873439 3 0.857339 0.888996 0.841680 0.863838 0.839619 0.816298 0.793832 0772183 4 0.854804 0.822702 0.792094 0.762895 0.735030 5 0.708425 0.821927 0.783526 0.747258 0.712986 0.680583 0649931 6 0.790315 0.746215 0.704961 0.666342 0.630170 0.596267 7 0.759918 0.710681 0.665057 0.622750 0.583490 0.547034 8 0.730690 0.6768390.627412 0.582099 0.540269 0.501866 9 0.702587 0644609 0.591898 0.543934 0.500249 0.460428 10 0.675564 0.613913 0.558395 0.508349 0.463193 0.422411 11 0.649581 0.584679 0.526788 0.475093 0.428883 0.387533 12 0.624597 0.556837 0.496969 0.444012 0.397114 0.355535 13 0.600574 0.530321 0.468839 0.414964 0.367698 0.326179 14 0.577475 0.505068 0.442301 0.387817 0.340461 0.299246 15 0.555265 0.481017 0.417265 0.362446 0.315242 0.274538 16 0.533908 0.458112 0.393646 0.338735 0.291890 0.251870 17 0.513373 0.436297 0.371364 0.316574 0.270269 0.231073 18 0.493628 0.415521 0.350344 0.295864 0.250249 0.211994 19 0.474642 0.395734 0.330513 0.276508 0.231712 0.194490 20 0.456387 0.376889 0.311805 0.258419 0.214548 0.178431 10% 12% 14% 16% 20% 0.909091 0.892857 0.877193 0.862069 0.833333 0.826446 0.797194 0.769468 0.743163 0.694444 0.7513150711780 0.6749720640658 0.578704 0.683013 0.635518 0.592080 0.552291 0.482253 0.620921 0.567427 0.519369 0.476113 0.401878 0.564474 0.506631 0.455587 0.410442 0.334898 0.513158 0.452349 0.399637 0.3538300279082 0.466507 0.403883 0.350559 0.305025 0.232568 0.424098 0.360610 0.307508 0.2629530193807 0.385543 0.321973 0.269744 0.226684 0161506 0.350494 0.287476 0.236617 0.195417 0134588 0.318631 0.256675 0.207559 0168463 0112157 0.289664 0.229174 0.182069 0.145227 0.093464 0.263331 0.204620 0.1597100125195 0.077887 0.239392 0.182696 0140096 0107927 0064905 0.217629 0.163122 0.122892 0.093041 0.054088 0.197845 0145644 0107800 0.080207 0.045073 0.179859 0130040 0.094561 0.069144 0.037561 0.163508 0.116107 0.082948 0.059607 0.031301 0.148644 0103667 0.0727620.051385 0.026084 TABLE 2 PRESENT VALUE OF AN ANNUITY OF $1 5% n 4% 1 0.961538 2 1.886095 3 2.775091 4 3.629895 5 4.451822 6 5.242137 7 6.002055 8 6.732745 9 7435332 108 110896 11 8.760477 12 9.385074 139.985648 14 10.563123 15 11118387 16 11.652296 17 12.165669 18 12.659297 19 13.133939 20 13.590326 6% 7% 8% 9% 10% 12% 14% 16% 20% 0.952381 0.943396 0.934579 0.925926 0.917431 0.909091 0.892857 0.877193 0.862069 0.833333 1.859410 1.833393 1.808018 1783265 1759111 1735537 1.690051 1.646661 1.605232 1.527778 2.723248 2673012 2.624316 2.577097 2.531295 2.486852 2.401831 2.321632 2.245890 2.106481 3.545951 3.465106 3.387211 3.312127 3.239720 3.169865 3.0373492.913712 2.798181 2.588735 4.329477 4.212364 4.100197 3.992710 3.889651 3.790787 3.604776 3.433081 3.274294 2.990612 5.075692 4.917324 4.766540 4.622880 4.4859194355261 4.111407 3.888668 3.684736 3.325510 5.7863735.582381 5389289 5206370 5.032953 4.868419 4.563757 4.288305 4.038565 3.604592 6.463213 6.209794 5.971299 5.746639 5.534819 5.334926 4.967640 4.638864 4.343591 3.837160 7.107822 6.801692 6.515232 6.246888 5.995247 5.759024 5.328250 4.946372 4.606544 4.030967 7721735 7360087 7023582 6710081 6.417658 6144567 5650223 5.216116 4.833227 4.192472 8.306414 78868757498674 7138964 6,805191 6.495061 5.937699 5.452733 5.028644 4.327060 8.863252 8.383844 7942686 2536078 7160725 6.813692 6.194374 5.660292 5.197107 4.439217 9.393573 8.852683 8.357651 7.903776 7.486904 7103356 6.423548 5.842362 5.342334 4.532681 9.898641 9.294984 8.745468 8.244237 7.786150 7.366687 6.628168 6.002072 5.467529 4.610567 10.379658 9.712249 9.107914 8.5594798060688 7606080 6.810864 6.142168 5.575456 4.675473 10.837770 10.105895 9.446649 8.851369 8.312558 7823709 6.973986 6.265060 5.668497 4.729561 11.274066 10.477260 9.763223 9.121638 8.543631 8.021553 7119630 6.372859 5748704 4.774634 11689587 10.827603 10.059087 9.371887 8.755625 8.201412 7249670 6.467420 5.817848 4.812195 12.085321 11.158116 10.335595 9.6035998.905115 8.364920 7365777 6.550369 5.877455 4.843496 12.462210 11.469921 10.594014 9.818147 9.128546 8.513564 7469444 6.623131 5.928841 4.869580