Answered step by step

Verified Expert Solution

Question

1 Approved Answer

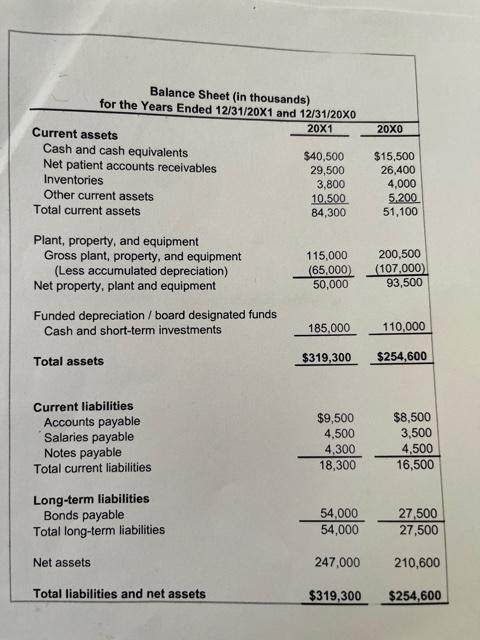

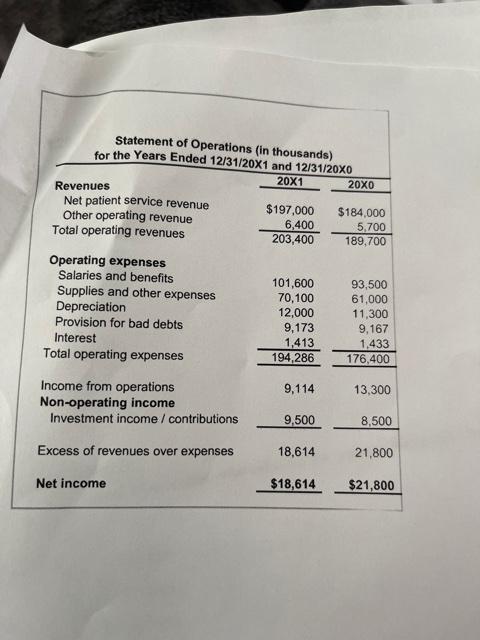

The debt principal payments each year are $5,500,000 ******** What is the Debt Service Coverage Ratio for 20X0 and 20X1? Balance Sheet (in thousands) for

The debt principal payments each year are $5,500,000 ********

What is the Debt Service Coverage Ratio for 20X0 and 20X1?

Balance Sheet (in thousands) for the Years Ended 12/31/20X1 and 12/31/20X0 20X1 20x0 Current assets Cash and cash equivalents Net patient accounts receivables Inventories Other current assets Total current assets $40,500 29,500 3,800 10.500 84,300 $15,500 26,400 4.000 5.200 51,100 Plant, property, and equipment Gross plant, property, and equipment (Less accumulated depreciation) Net property, plant and equipment Funded depreciation / board designated funds Cash and short-term investments 115,000 (65,000 50,000 200,500 (107.000) 93,500 185,000 110,000 Total assets $319,300 $254,600 Current liabilities Accounts payable Salaries payable Notes payable Total current liabilities $9,500 4,500 4,300 18,300 $8,500 3,500 4,500 16,500 Long-term liabilities Bonds payable Total long-term liabilities 54,000 54,000 27,500 27,500 Net assets 247,000 210,600 Total liabilities and net assets $319,300 $254,600 Statement of Operations (in thousands) for the Years Ended 12/31/20X1 and 12/31/20x0 20X1 20x0 Revenues Net patient service revenue Other operating revenue Total operating revenues $197,000 6,400 203,400 $184.000 5,700 189,700 Operating expenses Salaries and benefits Supplies and other expenses Depreciation Provision for bad debts Interest Total operating expenses 101,600 70,100 12,000 9,173 1,413 194,286 93,500 61,000 11,300 9,167 1,433 176,400 9,114 13,300 Income from operations Non-operating income Investment income / contributions 9,500 8,500 Excess of revenues over expenses 18,614 21,800 Net income $18,614 $21,800Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started