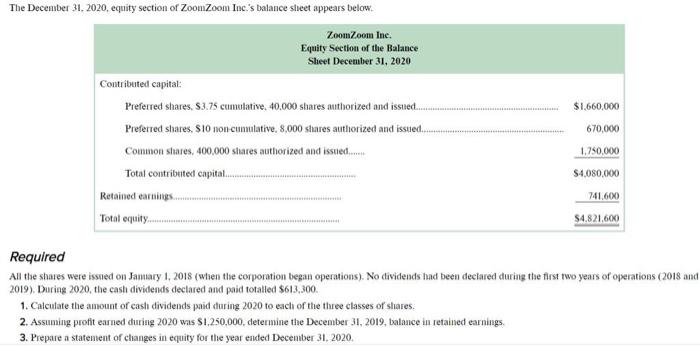

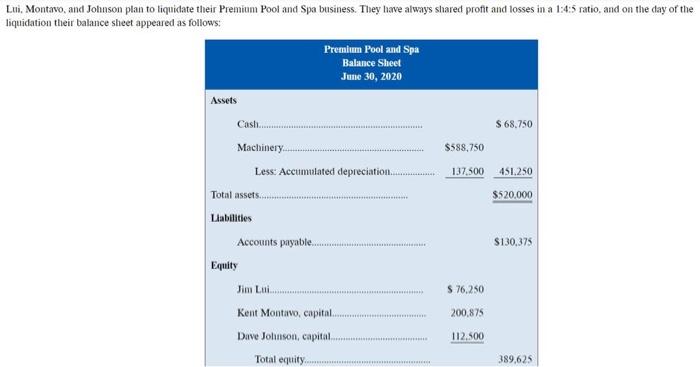

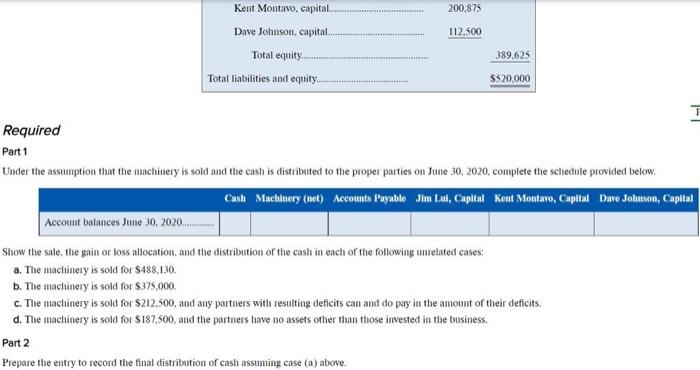

The December 31, 2020, equity section of Zoom Zoom Inc.'s balance sheet appears below. Zoom Zoom Inc. Equity Section of the Balance Sheet December 31, 2020 Contributed capital Preferred shares, 53.75 cumulative, 40.000 shares authorized and issued Preferred shares. Si non cumulative. 8,000 shares authorized and issted.. Common shares, 400,000 shares authorized and issued...... Total contributed capital Retained earnings Total equity......... $1,660,000 670,000 1.750,000 $4.080,000 741.600 $4.821,600 Required All the shares were issued on January 1, 2018 (when the corporation began operations). No dividends had been declared during the first two years of operations (2018 and 2019). During 2020, the cash dividends declared and paid totalled $613,300. 1. Calculate the amount of cash dividends paid during 2020 to each of the three classes of shares. 2. Assuming profit earned during 2020 was $1,250,000, determine the December 31, 2019, balance in retained earnings 3. Prepare a statement of changes in equity for the year ended December 31, 2020. Lui, Montavo, and Johnson plan to liquidate their Premium Pool and Spa business. They have always sharect profit and losses in a 1:4:5 ratio, and on the day of the liquidation their balance sheet appeared as follows: Premium Pool and Spa Balance Sheet June 30, 2020 Assets Cash $ 68.750 $588,750 137.500 451.250 $520.000 Machinery Less: Accumulated depreciation. Total assets. Liabilities Accounts payable. Equity $130,375 Jim Lui S 76.250 200,875 Kent Montalvo, capital. Dave Johnson, capital 112.500 Total equity... 389,625 Kent Montavo, capital. 200.875 Dave Johnson, capital 112.500 Total equity 389,625 $520,000 Total liabilities and equity 1 1 I Required Part 1 Under the assumption that the machinery is sold and the cash is distributed to the proper parties on June 30, 2020, complete the schedule provided below. Cash Machinery (net) Accounts Payable Jim Lul, Capital Kent Montavo, Capital Dave Johnson, Capital Account balances June 30, 2020... Show the sale, the gain or loss allocation, and the distribution of the cash in each of the following unrelated cases: a. The machinery is sold for $488,130. b. The machinery is sold for $375,000 c. The machinery is sold for $212.500, and any partners with resulting deficits can and do pay in the amount of their deficits. d. The machinery is sold for $187.500, and the partners have no assets other than those invested in the business. Part 2 Prepare the entry to record the final distribution of cash assuming case (a) above