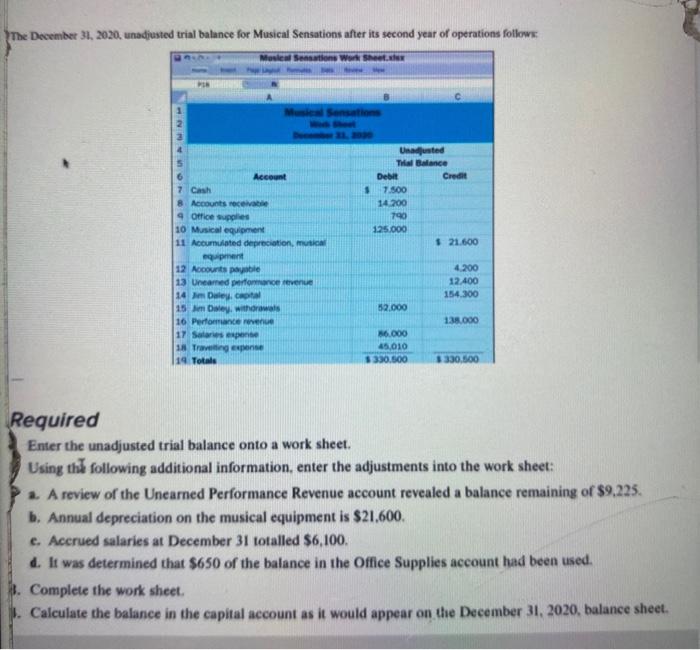

The December 31, 2020, unadjusted trial balance for Musical Sensations after its second year of operations follows: 27 Musical Sensations Work Sheet.xlsx PON Musical

The December 31, 2020, unadjusted trial balance for Musical Sensations after its second year of operations follows: 27 Musical Sensations Work Sheet.xlsx PON Musical Sensations Well Sheet December 31, 2030 C Unadjusted Trial Balance 6 7 Cash 8 Accounts receivable Account Debit Credit $ 7.500 14.200 4 Office supplies 10 Musical equipment 790 125.000 11 Accumulated depreciation, musical $21.600 equipment 12 Accounts payable 4.200 13 Uneamed performance revenue 12.400 14 Jm Daley, capital 154.300 15 Jim Daley, withdrawals 52.000 16 Performance revenue 138.000 17 Salaries expense 18 Travelling expense 19 Totals 86.000 45,010 $330.500 $330.500 Required Enter the unadjusted trial balance onto a work sheet. Using the following additional information, enter the adjustments into the work sheet: a. A review of the Unearned Performance Revenue account revealed a balance remaining of $9,225. b. Annual depreciation on the musical equipment is $21.600. e. Accrued salaries at December 31 totalled $6,100. d. It was determined that $650 of the balance in the Office Supplies account had been used. Complete the work sheet. Calculate the balance in the capital account as it would appear on the December 31, 2020, balance sheet.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started