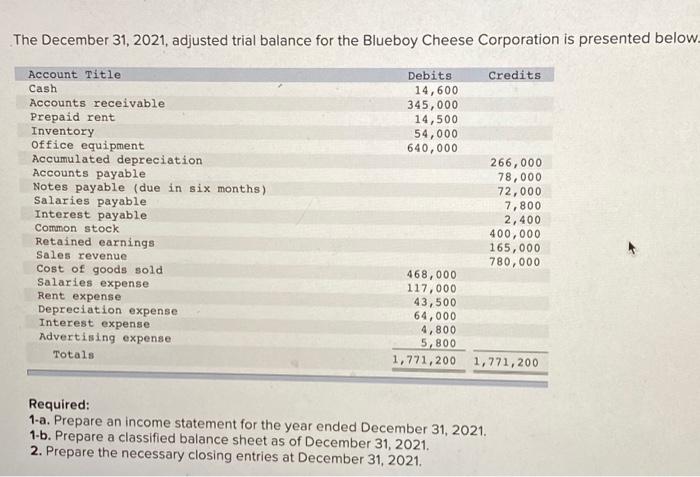

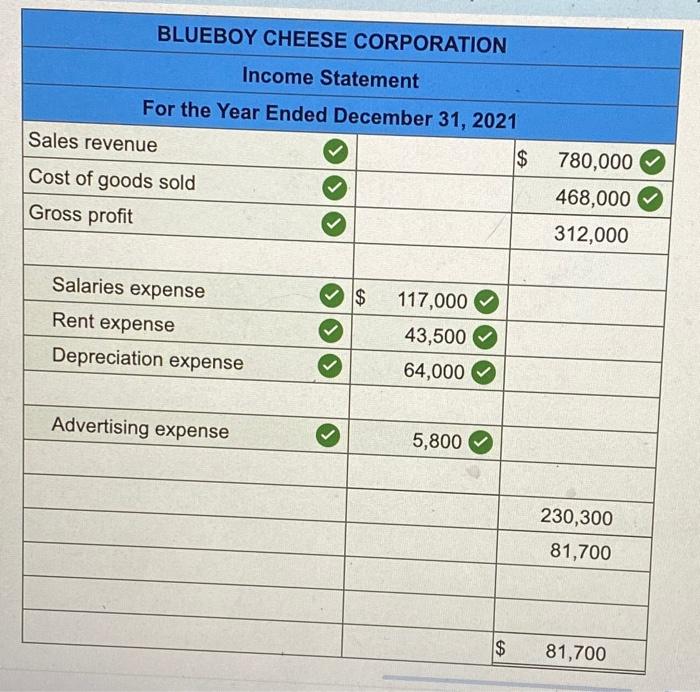

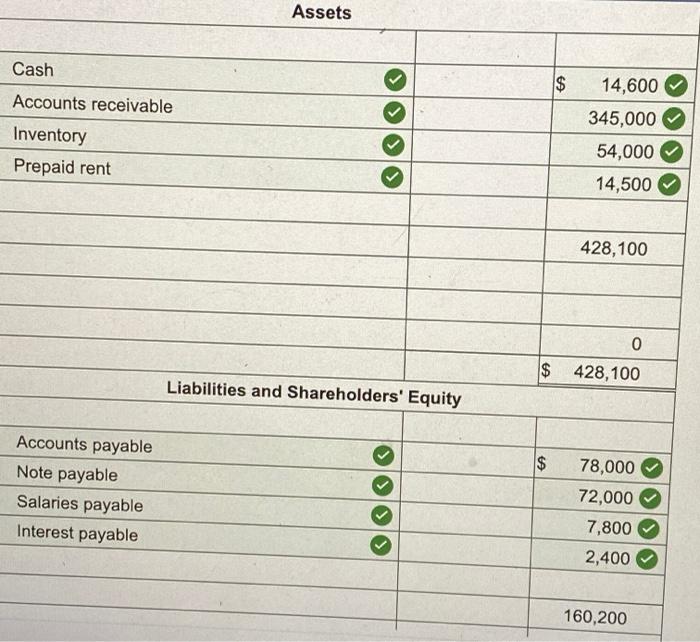

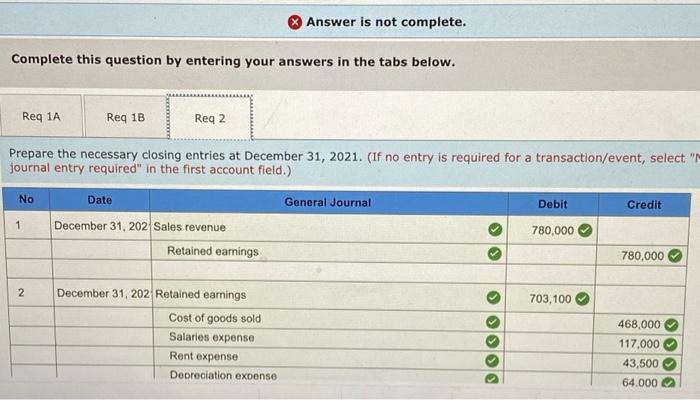

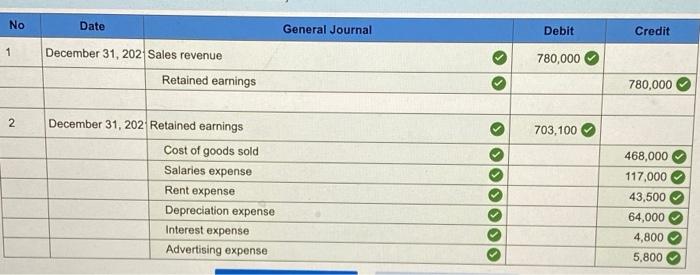

The December 31, 2021, adjusted trial balance for the Blueboy Cheese Corporation is presented below. Credits Debits 14,600 345,000 14,500 54,000 640,000 Account Title Cash Accounts receivable Prepaid rent Inventory Office equipment Accumulated depreciation Accounts payable Notes payable (due in six months) Salaries payable Interest payable Common stock Retained earnings Sales revenue Cost of goods sold Salaries expense Rent expense Depreciation expense Interest expense Advertising expense Totals 266,000 78,000 72,000 7,800 2,400 400,000 165,000 780,000 468,000 117,000 43,500 64,000 4,800 5,800 1,771,200 1,771,200 Required: 1-a. Prepare an income statement for the year ended December 31, 2021. 1-b. Prepare a classified balance sheet as of December 31, 2021. 2. Prepare the necessary closing entries at December 31, 2021. BLUEBOY CHEESE CORPORATION Income Statement For the Year Ended December 31, 2021 Sales revenue $ Cost of goods sold Gross profit 780,000 468,000 312,000 Salaries expense $ Rent expense Depreciation expense 117,000 43,500 64,000 Advertising expense 5,800 230,300 81,700 $ 81,700 Assets Cash $ 14,600 345,000 Accounts receivable Inventory Prepaid rent 54,000 14,500 428,100 0 $ 428,100 Liabilities and Shareholders' Equity $ Accounts payable Note payable Salaries payable Interest payable 78,000 72,000 7,800 2,400 160,200 Answer is not complete. Complete this question by entering your answers in the tabs below. Req 1A Reg 1B Req 2 Prepare the necessary closing entries at December 31, 2021. (If no entry is required for a transaction/event, select " journal entry required" in the first account field.) No General Journal Credit Date December 31, 202 Sales revenue Retained earnings Debit 780,000 1 780,000 2 703,100 December 31, 202 Retained earnings Cost of goods sold Salaries expense Rent expense Depreciation expense 468,000 117,000 43,500 64.000 NO Date General Journal Debit Credit 1 780,000 December 31, 202 Sales revenue Retained earnings 780,000 2 703,100 December 31, 202 Retained earnings Cost of goods sold Salaries expense Rent expense Depreciation expense Interest expense Advertising expense 468,000 117,000 43,500 64,000 4,800 5,800