Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The December 31, 20X8, balance sheets for Pint Corporation and its 70 percent-owned subsidiary Saloon Company contained the following summarized amounts: PINT CORPORATION AND

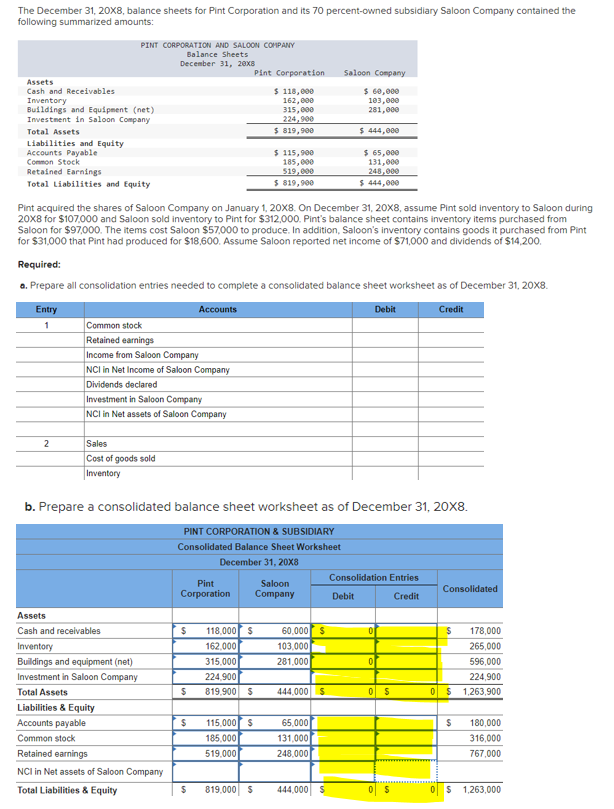

The December 31, 20X8, balance sheets for Pint Corporation and its 70 percent-owned subsidiary Saloon Company contained the following summarized amounts: PINT CORPORATION AND SALOON COMPANY Balance Sheets December 31, 20x8 Pint Corporation Saloon Company Assets Cash and Receivables Inventory Buildings and Equipment (net) Investment in Saloon Company Total Assets Liabilities and Equity Accounts Payable Common Stock Retained Earnings Total Liabilities and Equity $ 118,000 162,000 315,000 224,900 $ 819,900 $ 115,900 185,000 519,000 $ 819,900 $ 60,000 103,000 281,000 $ 444,000 $ 65,000 131,000 248,000 $ 444,000 Pint acquired the shares of Saloon Company on January 1, 20X8. On December 31, 20X8, assume Pint sold inventory to Saloon during 20X8 for $107,000 and Saloon sold inventory to Pint for $312,000. Pint's balance sheet contains inventory items purchased from Saloon for $97,000. The items cost Saloon $57,000 to produce. In addition, Saloon's inventory contains goods it purchased from Pint for $31,000 that Pint had produced for $18,600. Assume Saloon reported net income of $71,000 and dividends of $14,200. Required: a. Prepare all consolidation entries needed to complete a consolidated balance sheet worksheet as of December 31, 20X8. Accounts Debit Credit Entry 1 Common stock Retained earnings Income from Saloon Company NCI in Net Income of Saloon Company Dividends declared Investment in Saloon Company NCI in Net assets of Saloon Company 2 Sales Cost of goods sold Inventory b. Prepare a consolidated balance sheet worksheet as of December 31, 20X8. PINT CORPORATION & SUBSIDIARY Consolidated Balance Sheet Worksheet December 31, 20X8 Consolidation Entries Pint Corporation Saloon Consolidated Company Debit Credit Assets Cash and receivables $ 118,000 $ Inventory 162,000 Buildings and equipment (net) 315,000 60,000 $ 103,000 281,000 0 $ 178,000 265,000 596,000 Investment in Saloon Company 224,900 224,900 Total Assets $ 819,900 $ 444,000 $ 0 $ 0 $1,263,900 Liabilities & Equity Accounts payable Common stock Retained earnings $ 115,000 $ 65,000 185,000 519,000 131,000 248,000 $ 180,000 316,000 767,000 NCI in Net assets of Saloon Company Total Liabilities & Equity $ 819,000 $ 444,000 $ $ $ 1,263,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Consolidation Entries 1 Common stock Pint Corporation 185000 Retained earnings Pint Corporation 51...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started