Answered step by step

Verified Expert Solution

Question

1 Approved Answer

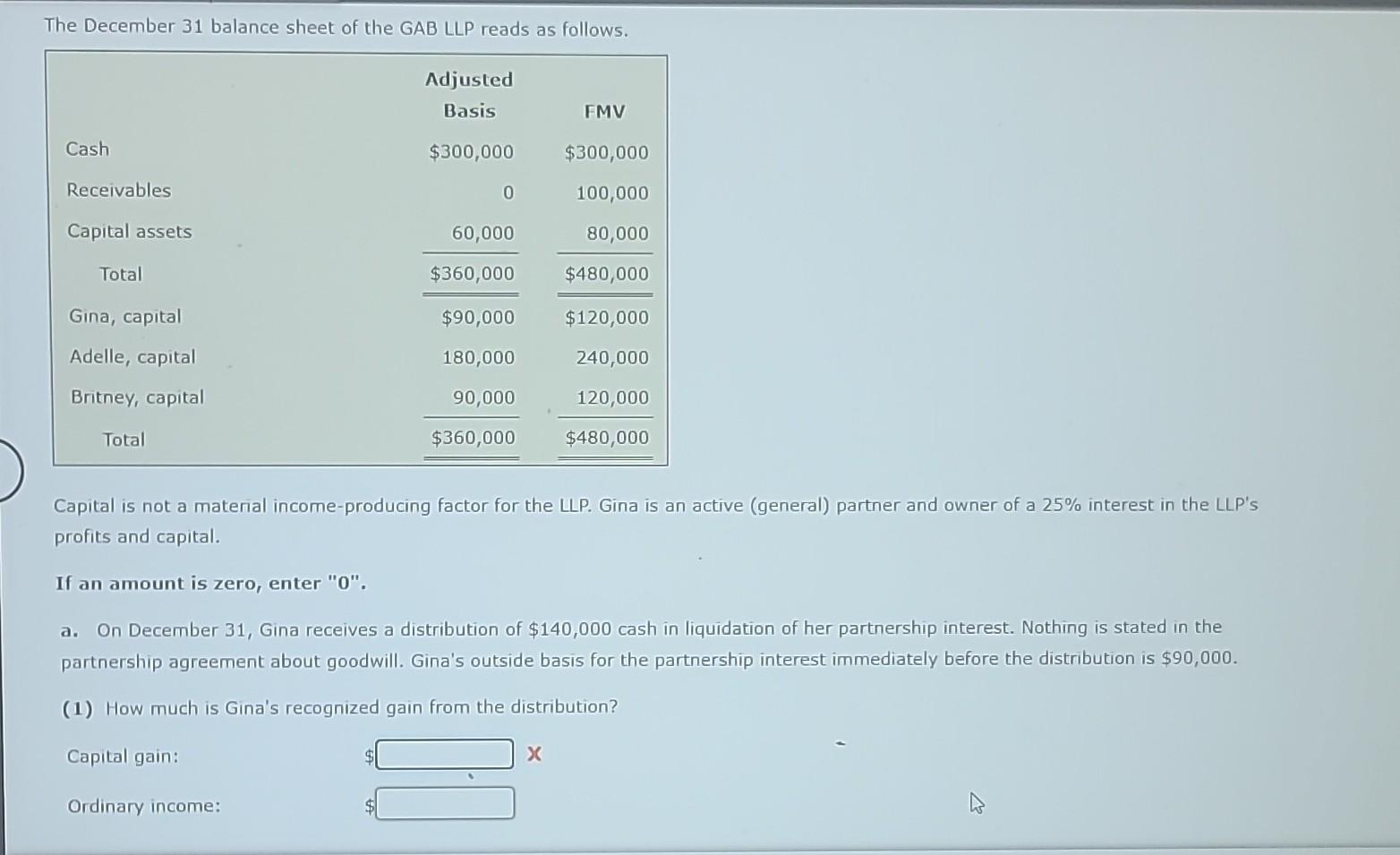

The December 31 balance sheet of the GAB LLP reads as follows. Adjusted Basis FMV Cash $300,000 $300,000 Receivables 0 100,000 Capital assets 60,000

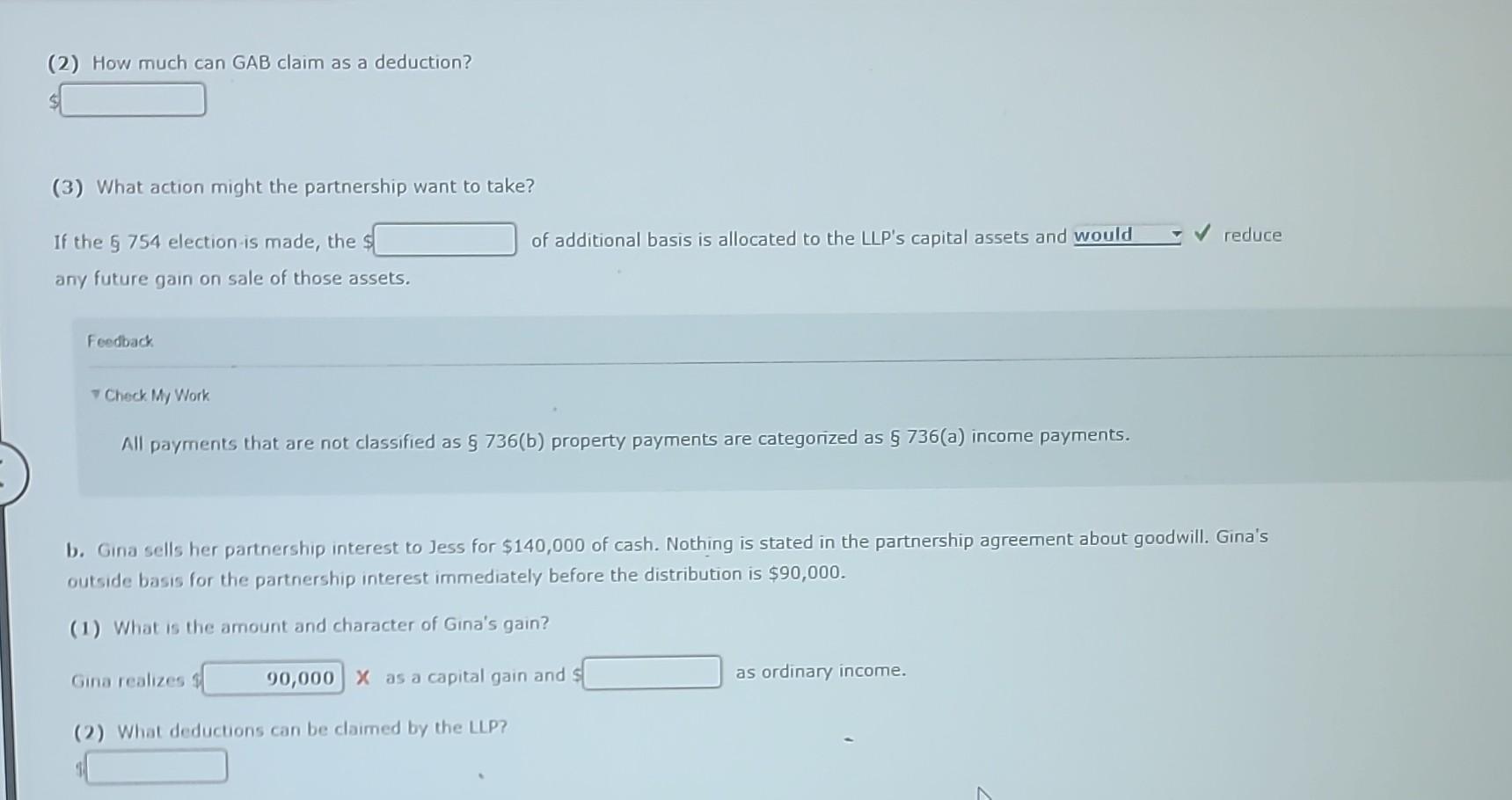

The December 31 balance sheet of the GAB LLP reads as follows. Adjusted Basis FMV Cash $300,000 $300,000 Receivables 0 100,000 Capital assets 60,000 80,000 Total $360,000 $480,000 Gina, capital $90,000 $120,000 Adelle, capital 180,000 240,000 Britney, capital 90,000 120,000 Total $360,000 $480,000 Capital is not a material income-producing factor for the LLP. Gina is an active (general) partner and owner of a 25% interest in the LLP's profits and capital. If an amount is zero, enter "0". a. On December 31, Gina receives a distribution of $140,000 cash in liquidation of her partnership interest. Nothing is stated in the partnership agreement about goodwill. Gina's outside basis for the partnership interest immediately before the distribution is $90,000. (1) How much is Gina's recognized gain from the distribution? Capital gain: Ordinary income: X (2) How much can GAB claim as a deduction? (3) What action might the partnership want to take? If the 754 election is made, the $ any future gain on sale of those assets. Feedback Check My Work of additional basis is allocated to the LLP's capital assets and would reduce All payments that are not classified as 736(b) property payments are categorized as 736(a) income payments. b. Gina sells her partnership interest to Jess for $140,000 of cash. Nothing is stated in the partnership agreement about goodwill. Gina's outside basis for the partnership interest immediately before the distribution is $90,000. (1) What is the amount and character of Gina's gain? Gina realizes 90,000 X as a capital gain and as ordinary income. (2) What deductions can be claimed by the LLP?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started