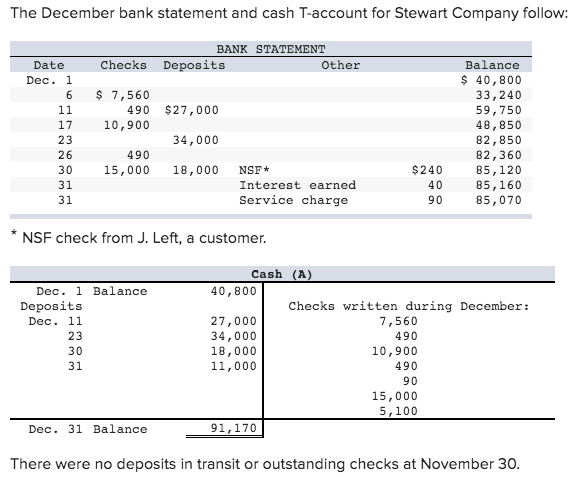

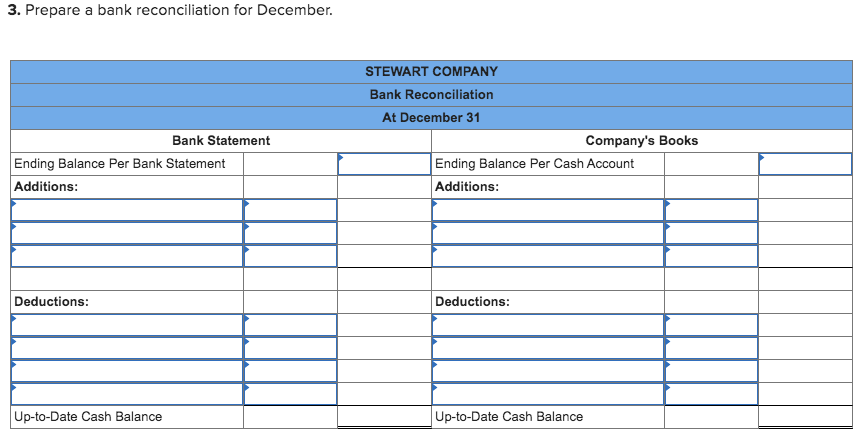

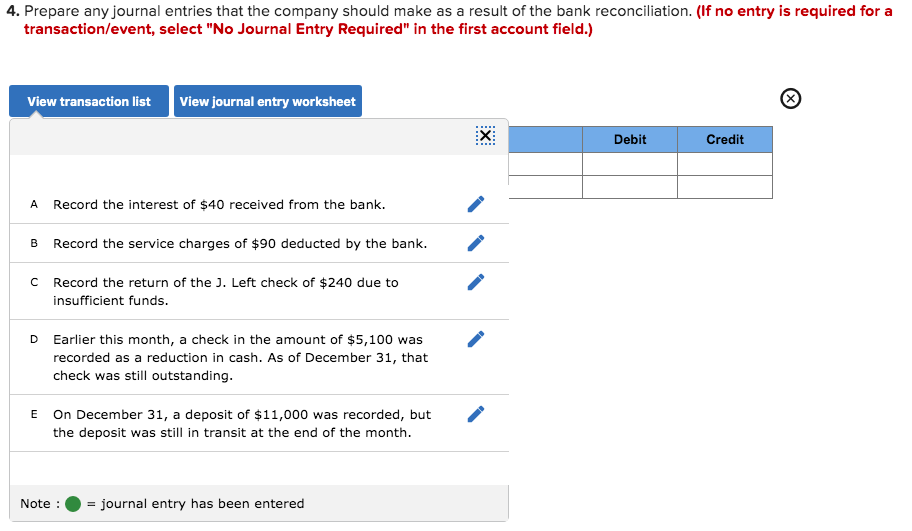

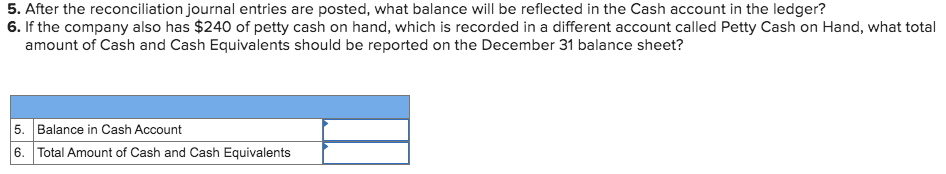

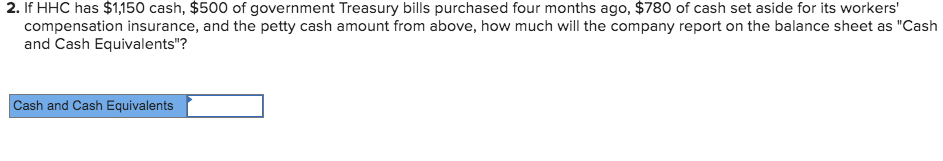

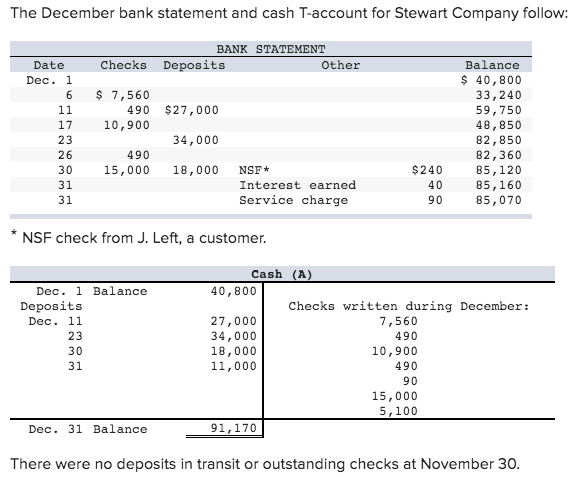

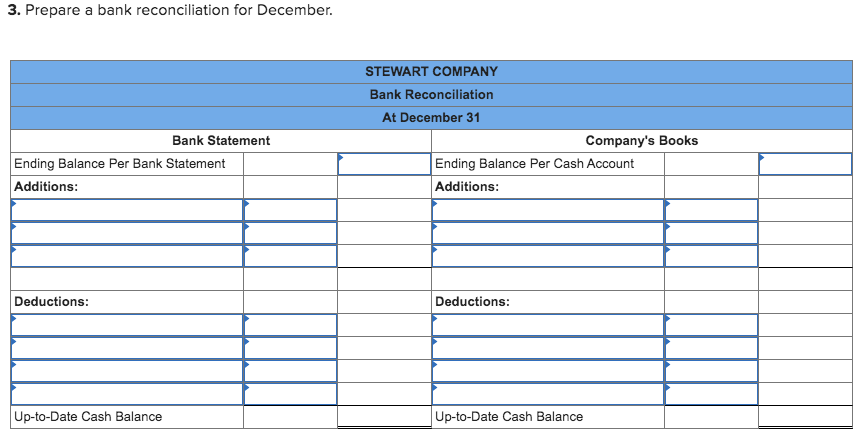

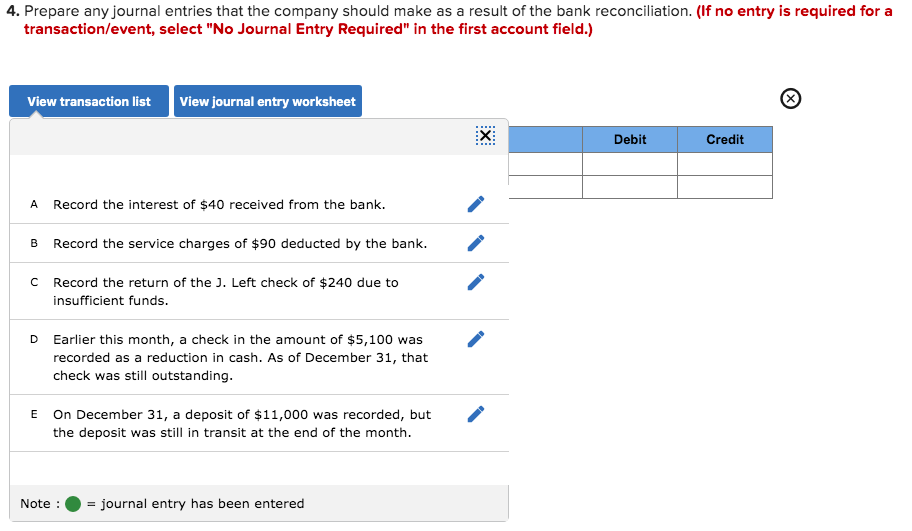

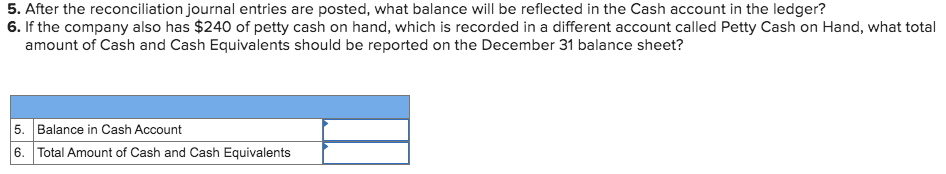

The December bank statement and cash T-account for Stewart Company follow: BANK STATEMENT Checks Deposits Other Date Dec. 1 6 $ 7,560 490 10,900 $27,000 17 34,000 Balance $ 40,800 33,240 59,750 48,850 82,850 82,360 85,120 85,160 85,070 30 490 15,000 18,000 $ 240 NSF* Interest earned Service charge 40 90 *NSF check from J. Left, a customer. Dec. 1 Balance Deposits Dec. 11 Cash (A) 40, 800 Checks written during December: 27,000 7,560 34,000 490 18,000 10,900 11,000 490 90 15,000 5,100 91,170 Dec. 31 Balance There were no deposits in transit or outstanding checks at November 30. 3. Prepare a bank reconciliation for December. STEWART COMPANY Bank Reconciliation At December 31 Bank Statement Ending Balance Per Bank Statement Additions: Company's Books Ending Balance Per Cash Account Additions: Deductions: Deductions: Up-to-Date Cash Balance Up-to-Date Cash Balance 4. Prepare any journal entries that the company should make as a result of the bank reconciliation. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list View journal entry worksheet Debit Credit A Record the interest of $40 received from the bank. B Record the service charges of $90 deducted by the bank. C Record the return of the J. Left check of $240 due to insufficient funds. D Earlier this month, a check in the amount of $5,100 was recorded as a reduction in cash. As of December 31, that check was still outstanding. E on December 31, a deposit of $11,000 was recorded, but the deposit was still in transit at the end of the month. Note : = journal entry has been entered 5. After the reconciliation journal entries are posted, what balance will be reflected in the Cash account in the ledger? 6. If the company also has $240 of petty cash on hand, which is recorded in a different account called Petty Cash on Hand, what total amount of Cash and Cash Equivalents should be reported on the December 31 balance sheet? 5. Balance in Cash Account 6. Total Amount of Cash and Cash Equivalents 2. If HHC has $1,150 cash, $500 of government Treasury bills purchased four months ago, $780 of cash set aside for its workers' compensation insurance, and the petty cash amount from above, how much will the company report on the balance sheet as "Cash and Cash Equivalents"? Cash and Cash Equivalents