Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The December bank statement and cash T-account for Stewart Company follow BANK STATEMENT Date Checks Deposits Other December 1 December 6 $ 7,540 December 11

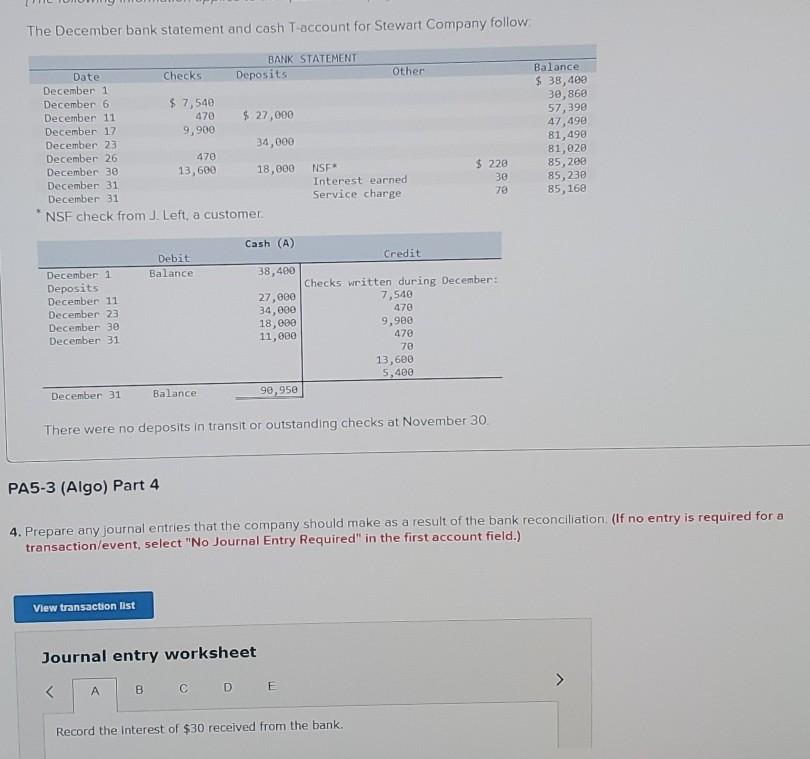

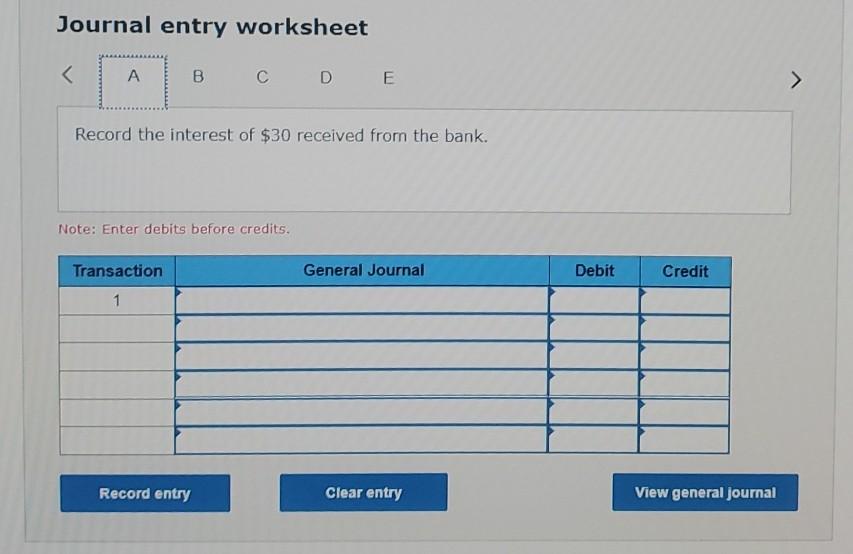

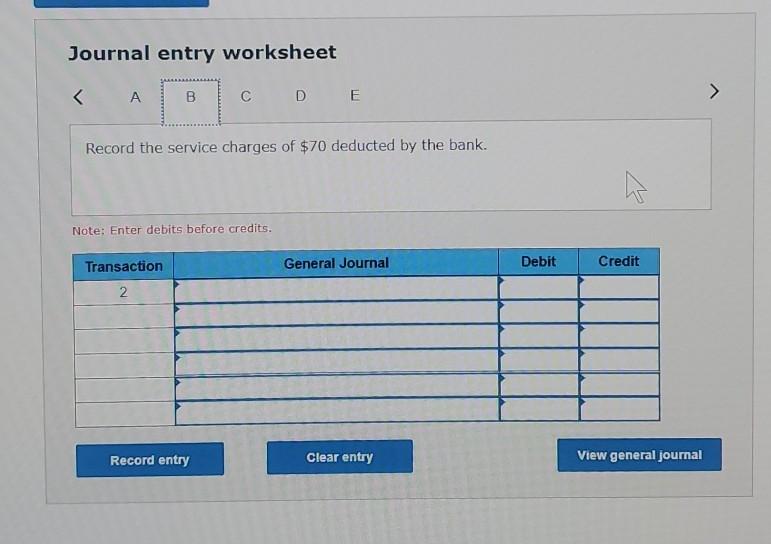

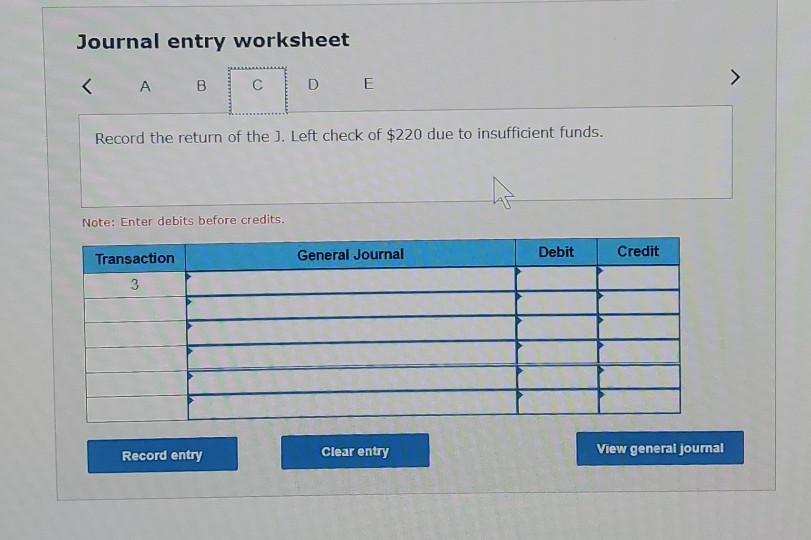

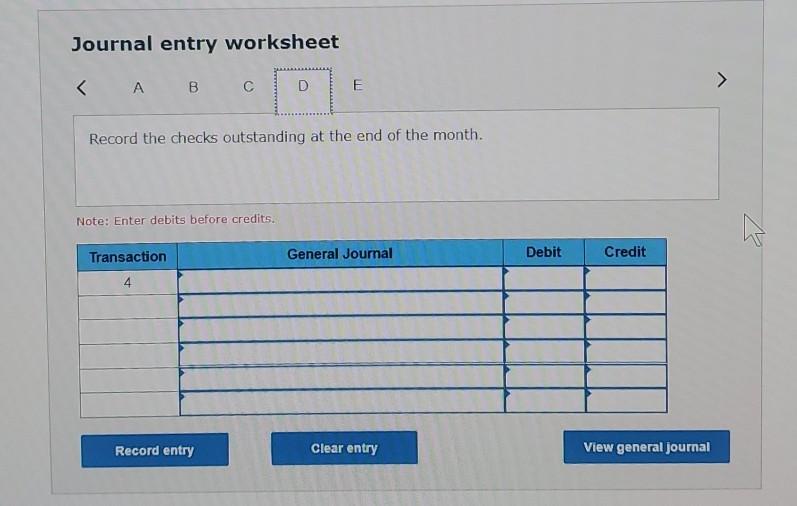

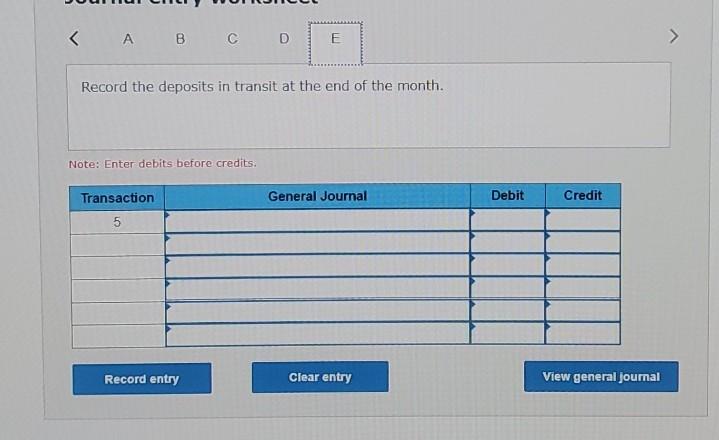

The December bank statement and cash T-account for Stewart Company follow BANK STATEMENT Date Checks Deposits Other December 1 December 6 $ 7,540 December 11 470 $ 27,000 December 17 9,900 December 23 34,000 December 26 470 December 30 13,600 18,000 NSF December 31 Interest earned December 31 Service charge NSF check from J. Left, a customer Balance $ 38,400 39,868 57, 398 47,490 81,490 81,020 85,280 85,230 85,168 $ 220 30 70 Debit Balance December 1 Deposits December 11 December 23 December 3e December 31 Cash (A) Credit 38,480 Checks written during December: 27,000 7,540 34,000 470 18,080 9,900 11,000 470 70 13,600 5,400 90,950 December 31 Balance There were no deposits in transit or outstanding checks at November 30 PA5-3 (Algo) Part 4 4. Prepare any journal entries that the company should make as a result of the bank reconciliation (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet > Record the interest of $30 received from the bank. Note: Enter debits before credits. General Journal Debit Credit Transaction 1 Record entry Clear entry View general journal Journal entry worksheet Record the service charges of $70 deducted by the bank. Note: Enter debits before credits. Transaction General Journal Debit Credit 2 Record entry Clear entry View general journal Journal entry worksheet > Record the deposits in transit at the end of the month. Note: Enter debits before credits. Transaction General Journal Debit Credit 5 Record entry Clear entry View general journal

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started