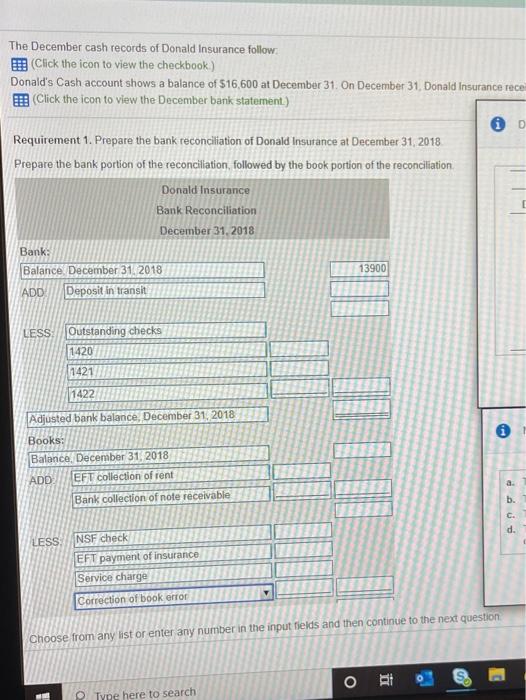

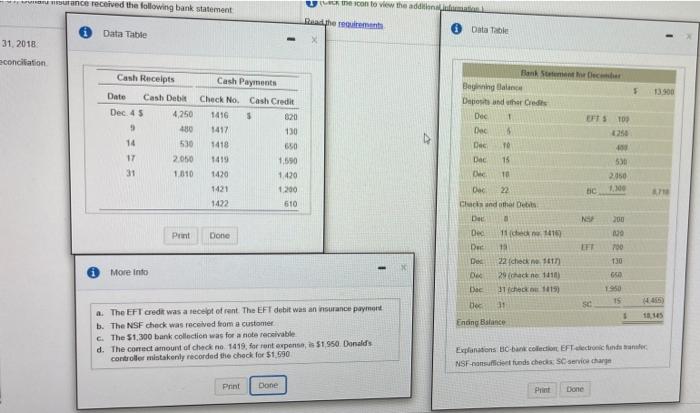

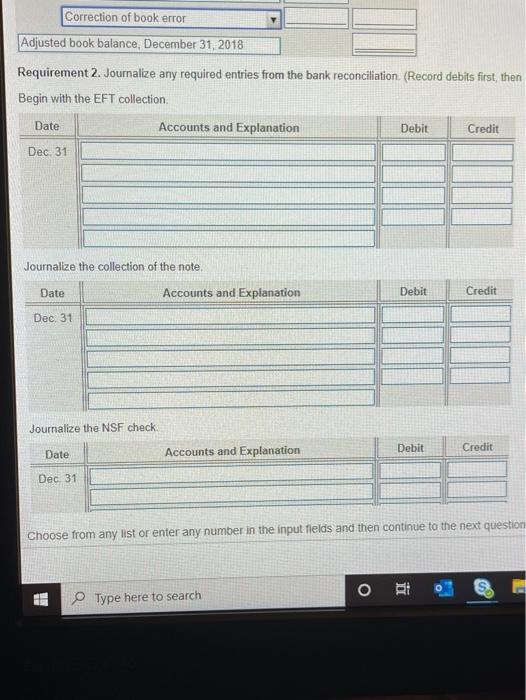

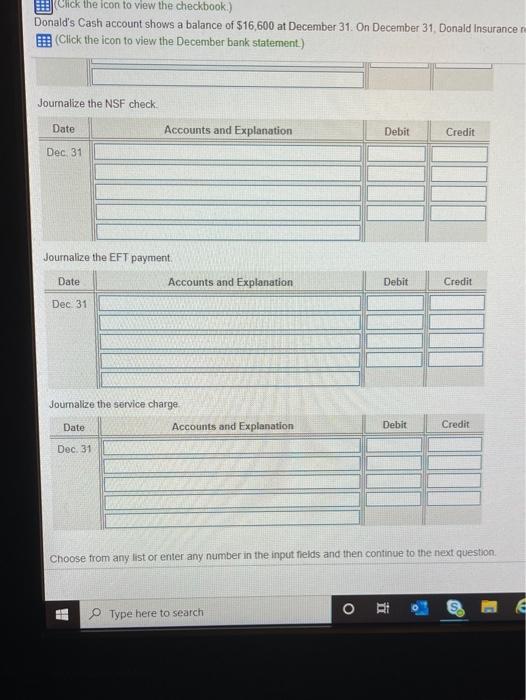

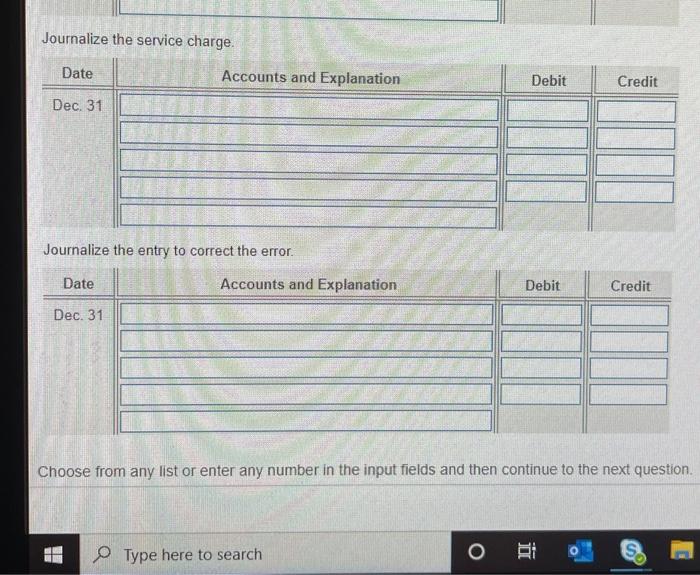

The December cash records of Donald Insurance follow Click the icon to view the checkbook) Donald's Cash account shows a balance of 516,600 at December 31. On December 31, Donald Insurance rece (Click the icon to view the December bank statement) 0 0 Requirement 1. Prepare the bank reconciliation of Donald Insutance at December 31, 2018 Prepare the bank portion of the reconciliation, followed by the book portion of the reconciliation Donald Insurance Bank Reconciliation December 31, 2018 13900 Bank: Balance December 31, 2018 ADD Deposit in transit LESS Outstanding checks 1420 1421 1422 Adjusted bank balance, December 31, 2018 Books: Balance, December 31, 2018 ADD EFT collection of rent Bank collection of note receivable C. d. LESS NSF check EFT payment of insurance Service charge Correction of book error Choose from any list or enter any number in the input fields and then continue to the next question O DI Type here to search - stance received the following bank statement e con to view the additional Reader Data Table Data Table 31, 2018 econciliation Cash Receipts F 13.00 Date Cash Debit Dec. 45 4250 9 180 14 530 17 2050 31 1.610 Cash Payments Check No Cash Credit 1416 3 820 1417 130 1418 60 1419 1,590 1420 1.420 1421 1200 1422 610 Bank Sec Beginning Bali Deposits and there Dec 1 EFTS TO Dec 8 Dec TO Dac 15 550 10 2.050 tic N Print Done Dac 22 Chantal Detits Da Dec 11 den 1419 Det 18 De 22 checkna 10 De 29 rack ne 101 Dee 11 c1819 Dec 11 200 wo 700 EFT T30 More info 10 15 10.15 Enong Balance a. The EFT credit was a recept of rent The EFT debit was an insurance payment b. The NSF check was received from a customer The $1,300 bank collection was for a not receivable d. The correct amount of check no 1419, for rent expenses $1950. Donalds controller mistakenly recorded the check for $1.590 Explanations can collection Electronic NSF ontsliefunds checks: SC service charge Print Done Print Done Correction of book error Adjusted book balance, December 31, 2018 Requirement 2. Journalize any required entries from the bank reconciliation (Record debits first, then Begin with the EFT collection Date Accounts and Explanation Debit Credit Dec. 31 Journalize the collection of the note Date Accounts and Explanation Debit Credit Dec. 31 Journalize the NSF check. Debit Accounts and Explanation Date Credit Dec 31 Choose from any list or enter any number in the input fields and then continue to the next question Type here to search ORI Click the icon to view the checkbook.) Donald's Cash account shows a balance of $16,600 at December 31. On December 31. Donald Insurance Click the icon to view the December bank statement) Journalize the NSF check Date Accounts and Explanation Debit Credit Dec 31 Journalize the EFT payment Date Accounts and Explanation Debit Credit Dec 31 Journalize the service charge Date Accounts and Explanation Debit Credit Dec. 31 Choose from any list or enter any number in the input fields and then continue to the next question, Type here to search O Journalize the service charge. Date Accounts and Explanation Debit Credit Dec. 31 Journalize the entry to correct the error. Date Accounts and Explanation Debit Credit Dec. 31 Choose from any list or enter any number in the input fields and then continue to the next question. O Type here to search O RI