Answered step by step

Verified Expert Solution

Question

1 Approved Answer

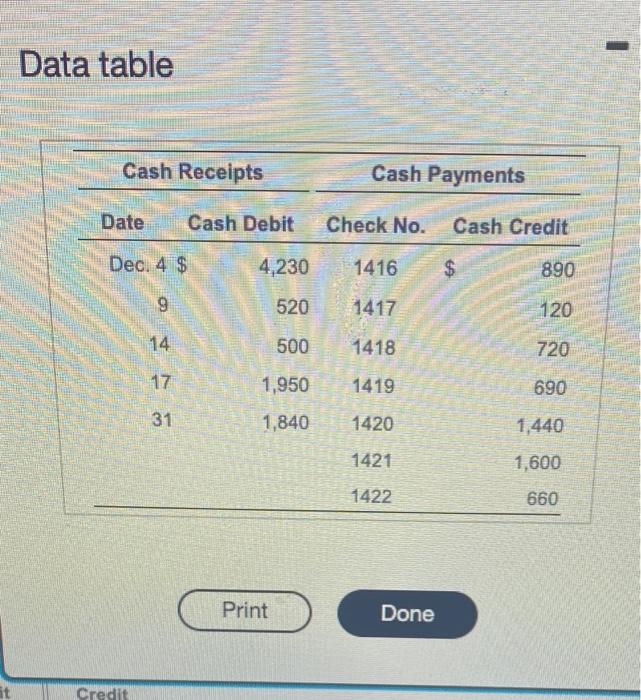

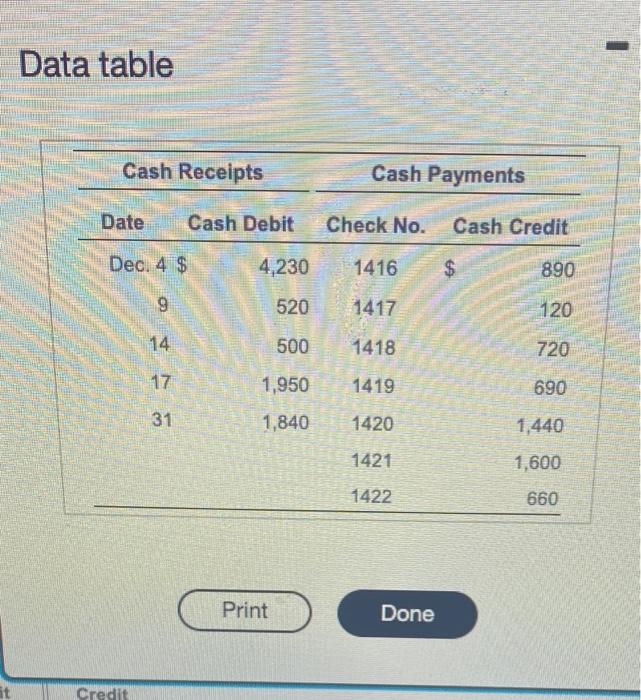

The December Cash records of Harry insurance follow: harry's cash account shows a balance of 16,520 at December 31. On December 31, Harry insurance received

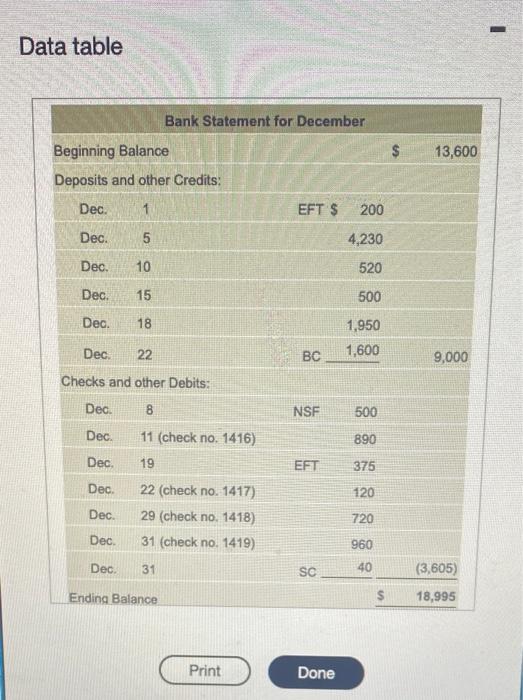

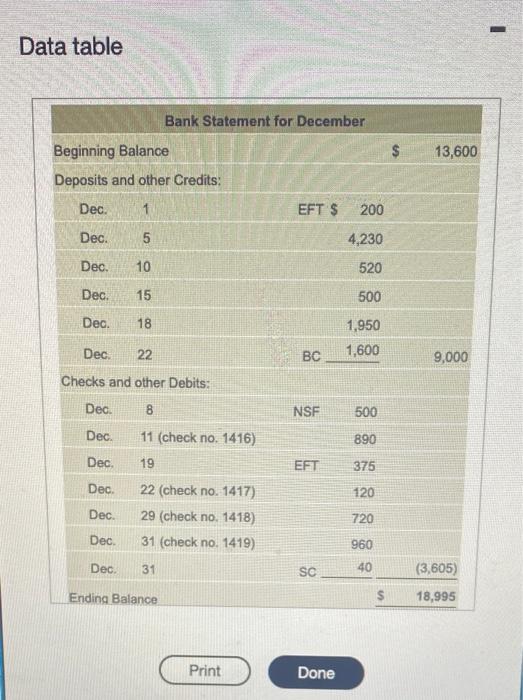

The December Cash records of Harry insurance follow: harry's cash account shows a balance of 16,520 at December 31. On December 31, Harry insurance received the following bank statement:

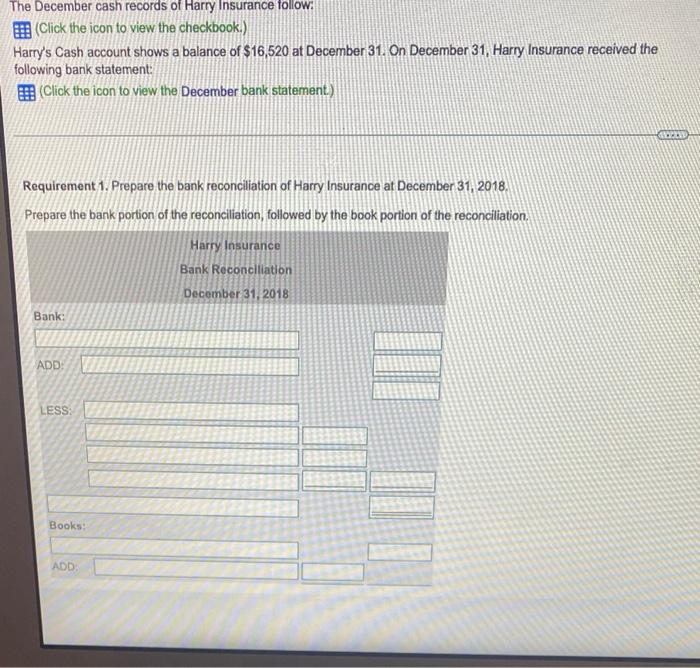

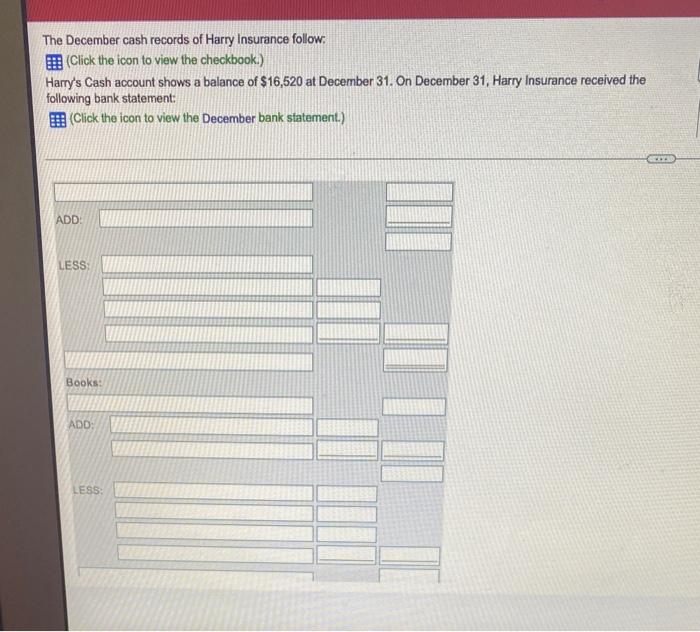

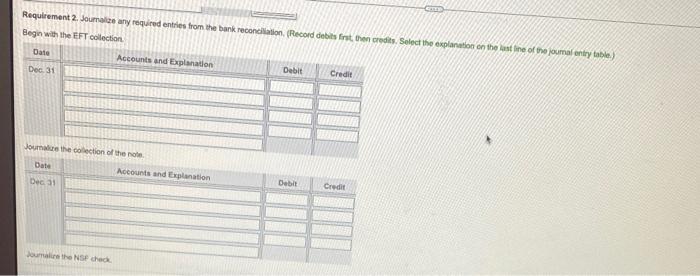

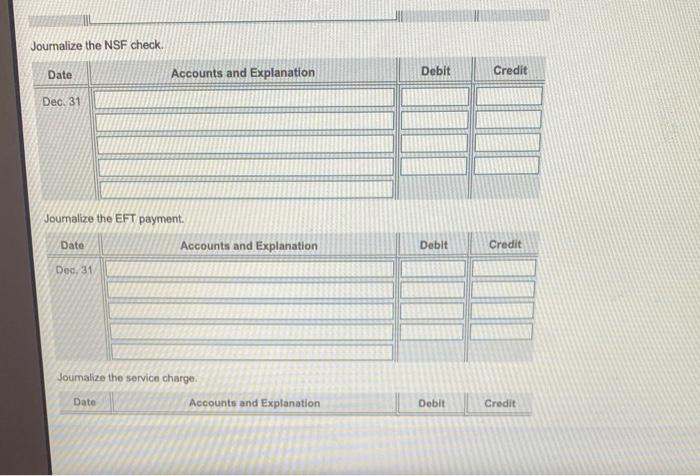

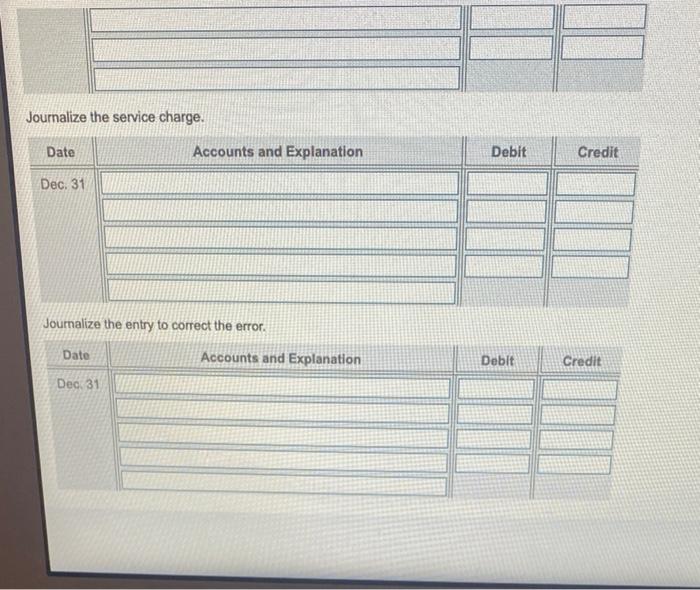

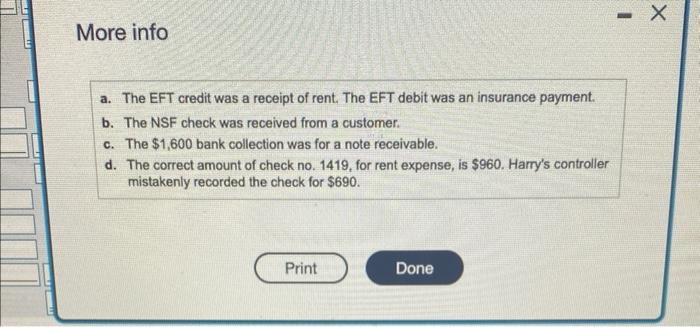

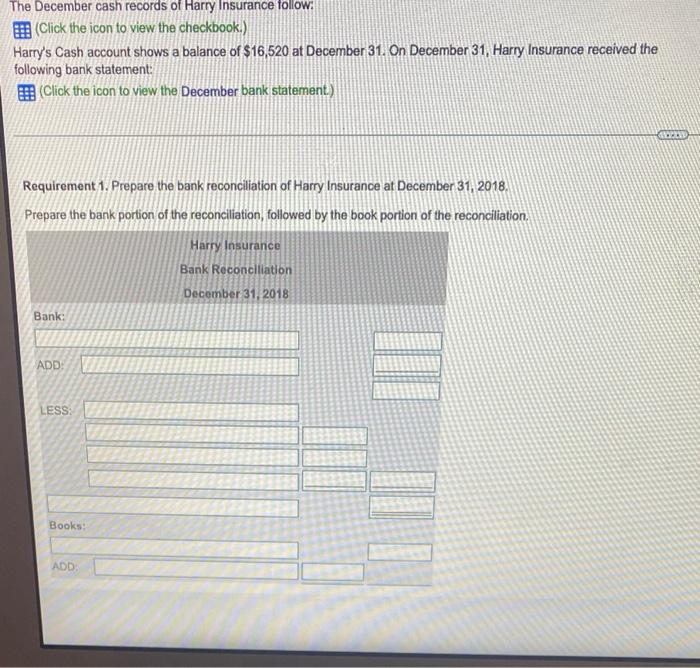

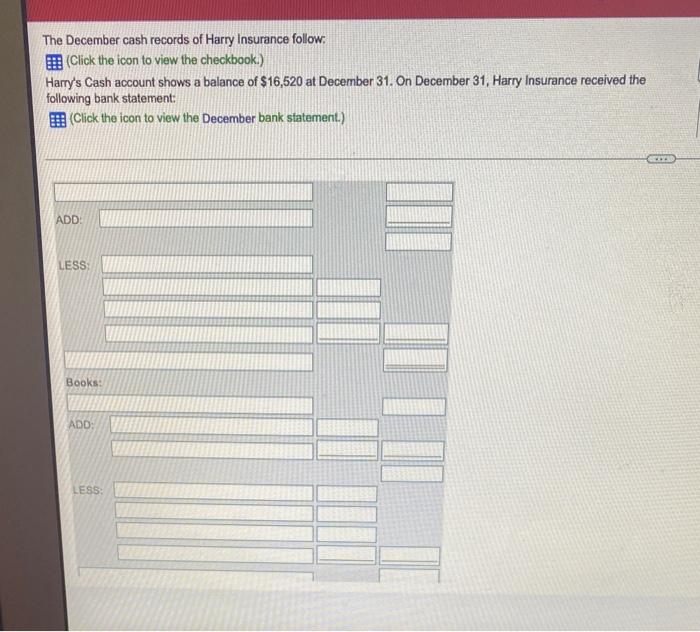

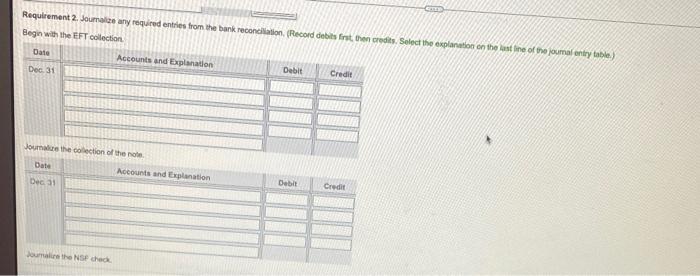

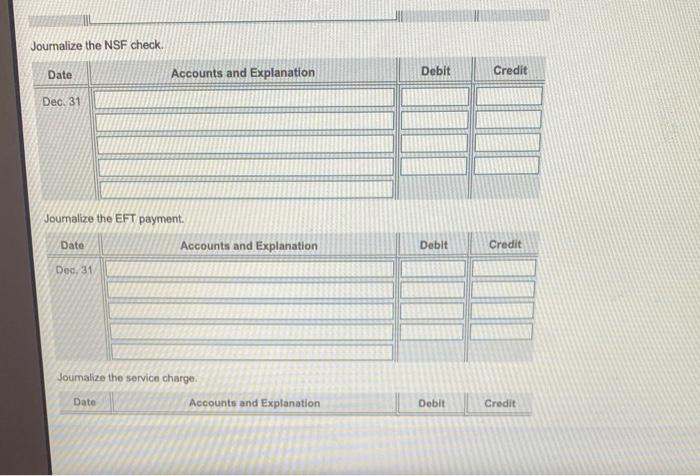

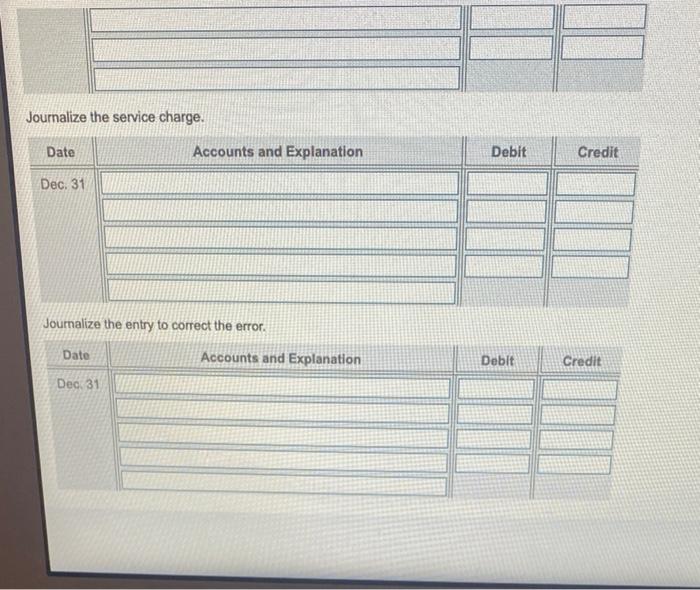

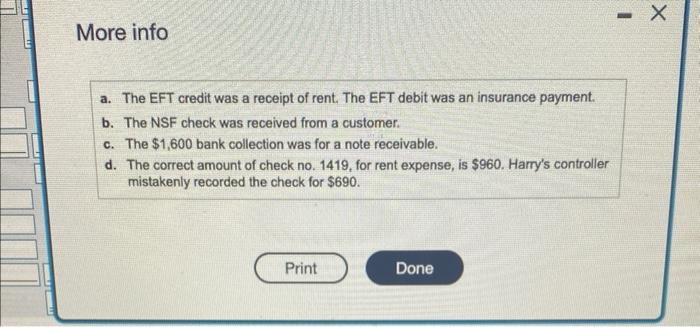

The December cash records of Harry Insurance follow: (Click the icon to view the checkbook.) Harry's Cash account shows a balance of $16,520 at December 31 . On December 31 , Harry Insurance received the following bank statement: (Click the icon to view the December bank statement.) Requirement 1. Prepare the bank reconciliation of Harry Insurance at December 31, 2018. Prepare the bank portion of the reconciliation, followed by the book portion of the reconciliation. The December cash records of Harry insurance follow: (Click the icon to view the checkbook.) Harry's Cash account shows a balance of $16,520 at December 31. On December 31 , Harry Insurance received the following bank statement: (Click the icon to view the December bank statement.) Requitement 2. Sournalize any required entries from the bank reconcilation, (Record debits frist, then crefits. Solect the explanation co the isst fine of the joumal entiy fable.) Gegin with the FFT collection Journalize the NSF check. Joumalize the EFT payment. Joumalize the service charge. Journalize the service charge. Journalize the entry to correct the error. Data table Data table More info a. The EFT credit was a receipt of rent. The EFT debit was an insurance payment. b. The NSF check was received from a customer. c. The $1,600 bank collection was for a note receivable. d. The correct amount of check no. 1419, for rent expense, is $960. Harry's controller mistakenly recorded the check for $690 requirement 1. Prepare the bank reconciliation of Harry insurance at December 31, 2018. Repair the Bank portion of the reconciliation, followed by the book portion of the reconciliation.

requirement 2. journalize any required entries from the bank reconciliation. ( Record debits first, then credits. Select the explanation on the last line of the journal entry table.)

the checkbook

the bank statement

additional data for the bank reconciliation follow

thank you in advance!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started