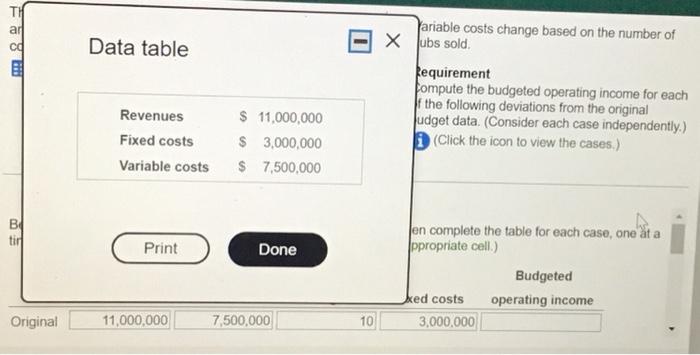

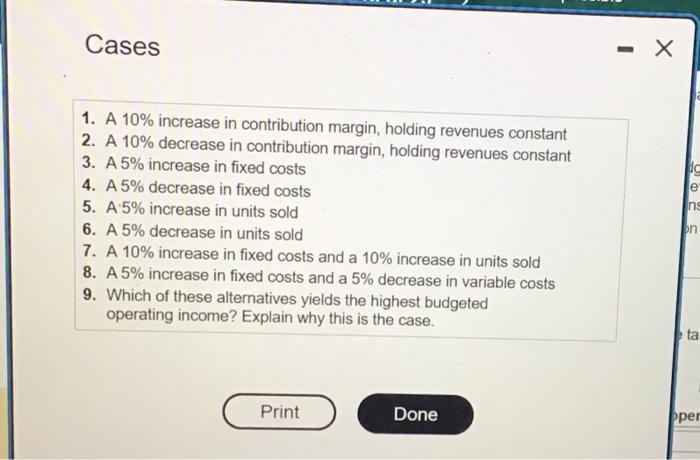

The Deli- Sub Shop owns and operates six stores in and around Minneapolis. You are given the following corporate budget data for next year: (Click the icon to view the corporate budget data.) Variable costs change based on the number of subs sold. Requirement Compute the budgeted operating income for each of the following deviations from the original budget data. (Consider each case independently.) (Click the icon to view the cases.) Begin by completing the table for the original information provided, then complete the table for each case, one at a time. (For amounts with a $0 balance, make sure to enter " 0 " in the appropriate cell.) The Deli- Sub Shop owns and operates six stores in and around Minneapolis. You are given the following corporate budget data for next year: (Click the icon to view the corporate budget data.) Variable costs change based on the number of subs sold. Requirement Compute the budgeted operating income for each of the following deviations from the original budget data. (Consider each case independently.) (Click the icon to view the cases.) Begin by completing the table for the original information provided, then complete the table for each case, one at a time. (For amounts with a $0 balance, make sure to enter " 0 " in the appropriate cell.) Data table ariable costs change based on the number of ubs sold. kequirement fompute the budgeted operating income for each f the following deviations from the original udget data. (Consider each case independently.) (Click the icon to view the cases.) en complete the table for each case, one at a ppropriate cell.) 1. A 10% increase in contribution margin, holding revenues constant 2. A 10% decrease in contribution margin, holding revenues constant 3. A 5% increase in fixed costs 4. A 5% decrease in fixed costs 5. A 5% increase in units sold 6. A 5% decrease in units sold 7. A 10% increase in fixed costs and a 10% increase in units sold 8. A 5% increase in fixed costs and a 5% decrease in variable costs 9. Which of these alternatives yields the highest budgeted operating income? Explain why this is the case