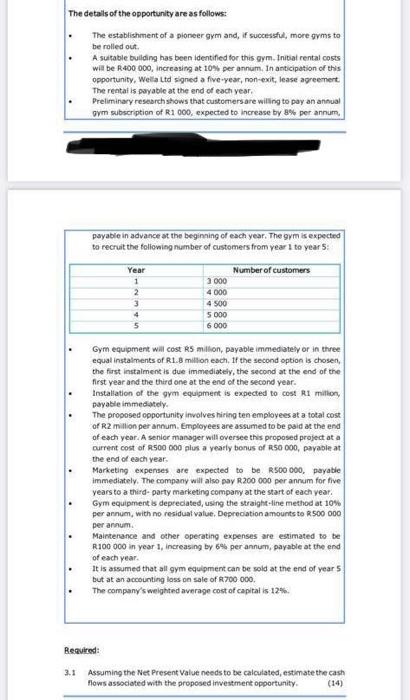

The details of the opportunity are as follows: The establishment of a pioneer gym and, if successful, more gyms to be rolled out A suitable building has been identified for this gym. Initial rental costs will be R400 000, increasing at 10% per annum. In anticipation of this opportunity, Wella Ltd signed a five-year, non-exit, lease agreement The rental is payable at the end of each year Preliminary research shows that customers are willing to pay an annual gym subscription of R1 000, expected to increase by 8% per annum, payable in advance at the beginning of each year. The gym is expected to recruit the following number of customers from year 1 to years Year 1 2 3 4 5 Number of customers 3 000 4 000 4 500 5 000 6 000 Gym equipment will cost RS million, payable immediately or in three equal instalments of R1.8 million each. If the second option is chosen the first instalment is due immediately, the second at the end of the first year and the third one at the end of the second year. Installation of the gym equipment is expected to cost R1 miliony payable immediately The proposed opportunity involves hiring ten employees at a total cost of R2 million per annum. Employees are assumed to be paid at the end of each year. A senior manager will oversee this proposed project at a Durrent cost of R500 000 plus a yearly bonus of R50 000, payable at the end of each year. Marketing expenses are expected to be R500 000, payable immediately. The company will also pay R200 000 per annum for five years to a third-party marketing company at the start of each year. Gym equipment is deprecated, using the straight-line method at 10% per annum, with no residual value. Depreciation amounts to R500 000 per annum Maintenance and other operating expenses are estimated to be R100 000 in year 1, increasing by 6% per annum, payable at the end of each year. It is assumed that all gym equipment can be sold at the end of years but at an accounting loss on sale of R200 000 The company's weighted average cost of capital is 12% Required: 3.1 Assuming the Net Present Value needs to be calculated, estimate the cash Pows associated with the proposed investment opportunity (14)