Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Devon Motor Company produces automobiles. On April 1, the company had no beginning inventories, and it purchased 6,950 batteries at a cost of $125

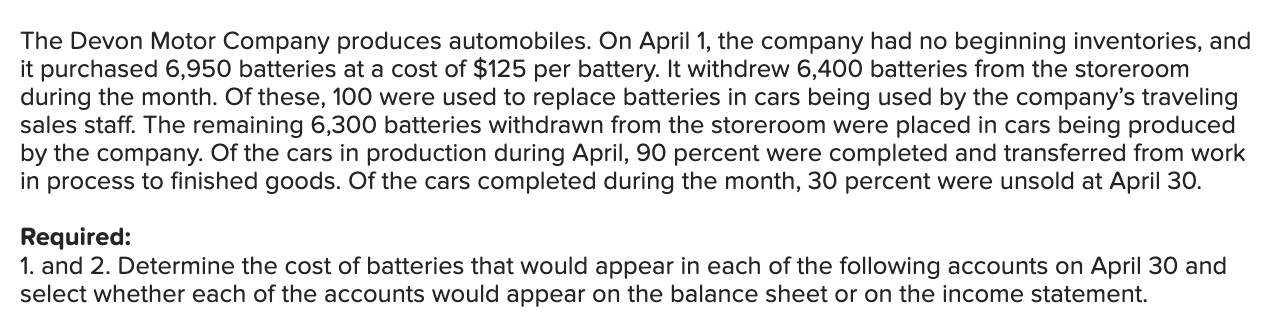

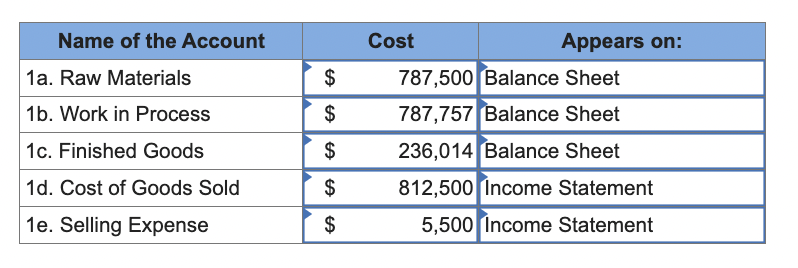

The Devon Motor Company produces automobiles. On April 1, the company had no beginning inventories, and it purchased 6,950 batteries at a cost of $125 per battery. It withdrew 6,400 batteries from the storeroom during the month. Of these, 100 were used to replace batteries in cars being used by the company's traveling sales staff. The remaining 6,300 batteries withdrawn from the storeroom were placed in cars being produced by the company. Of the cars in production during April, 90 percent were completed and transferred from work in process to finished goods. Of the cars completed during the month, 30 percent were unsold at April 30 . Required: 1. and 2. Determine the cost of batteries that would appear in each of the following accounts on April 30 and select whether each of the accounts would appear on the balance sheet or on the income statement. \begin{tabular}{|l|rr|l|} \hline \multicolumn{1}{|c|}{ Name of the Account } & \multicolumn{2}{c|}{ Cost } & \multicolumn{1}{c|}{ Appears on: } \\ \hline 1a. Raw Materials & $ & 787,500 & Balance Sheet \\ \hline 1b. Work in Process & $ & 787,757 & Balance Sheet \\ \hline 1c. Finished Goods & $ & 236,014 & Balance Sheet \\ \hline 1d. Cost of Goods Sold & $ & 812,500 & Income Statement \\ \hline 1e. Selling Expense & $ & 5,500 & Income Statement \\ \hline \end{tabular}

The Devon Motor Company produces automobiles. On April 1, the company had no beginning inventories, and it purchased 6,950 batteries at a cost of $125 per battery. It withdrew 6,400 batteries from the storeroom during the month. Of these, 100 were used to replace batteries in cars being used by the company's traveling sales staff. The remaining 6,300 batteries withdrawn from the storeroom were placed in cars being produced by the company. Of the cars in production during April, 90 percent were completed and transferred from work in process to finished goods. Of the cars completed during the month, 30 percent were unsold at April 30 . Required: 1. and 2. Determine the cost of batteries that would appear in each of the following accounts on April 30 and select whether each of the accounts would appear on the balance sheet or on the income statement. \begin{tabular}{|l|rr|l|} \hline \multicolumn{1}{|c|}{ Name of the Account } & \multicolumn{2}{c|}{ Cost } & \multicolumn{1}{c|}{ Appears on: } \\ \hline 1a. Raw Materials & $ & 787,500 & Balance Sheet \\ \hline 1b. Work in Process & $ & 787,757 & Balance Sheet \\ \hline 1c. Finished Goods & $ & 236,014 & Balance Sheet \\ \hline 1d. Cost of Goods Sold & $ & 812,500 & Income Statement \\ \hline 1e. Selling Expense & $ & 5,500 & Income Statement \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started