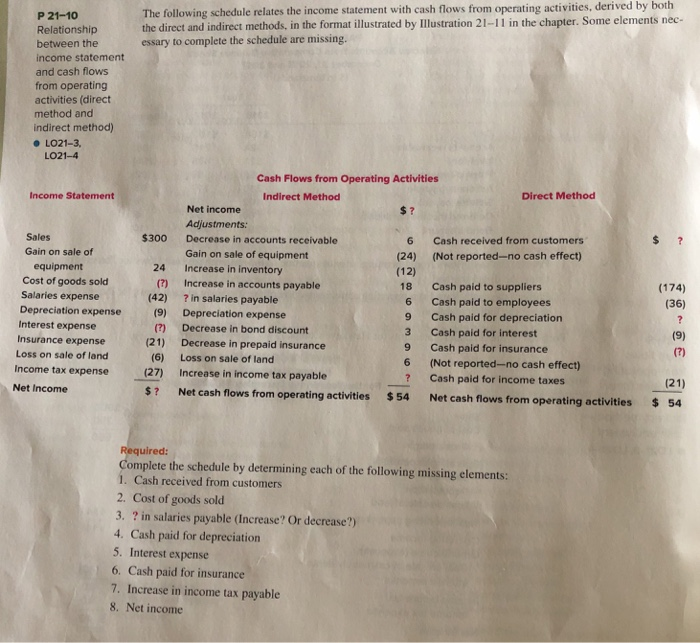

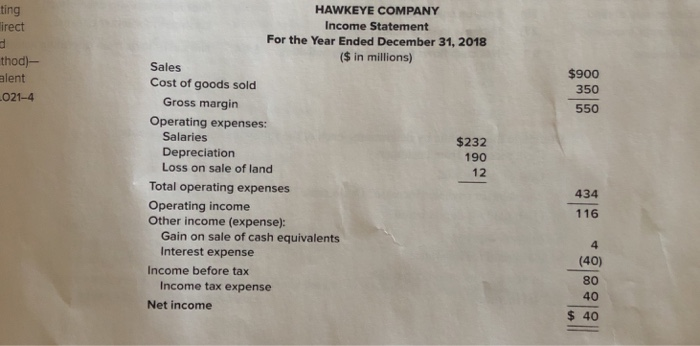

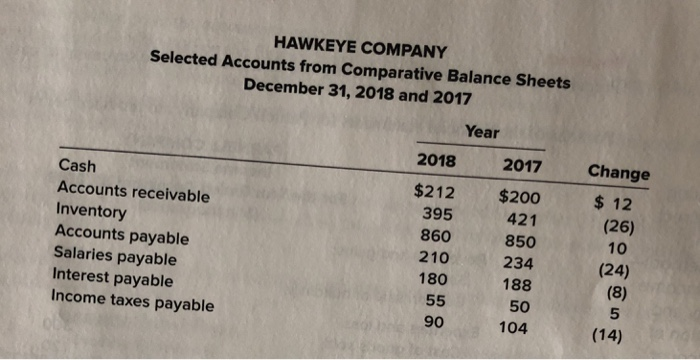

the direct and indirect methods, in the format illustrated by Ilustration 21-11 in the chapter. Some elements nee- essary to complete the schedule are missing. The following schedule relates the income statement with cash flows from operating activities, derived by both P 21-10 Relationship between the income statement and cash flows from operating activities (direct method and indirect method) L021-3, LO21-4 Cash Flows from Operating Activities Direct Method Indirect Method Income Statement Net income Adjustments: Decrease in accounts receivable Gain on sale of equipment Increase in inventory Increase in accounts payable ? in salaries payable Cash received from customers (Not reported-no cash effect) 6 (24) (12) 18 $300 Sales Gain on sale of equipment Cost of goods sold Salaries expense 24 (174) (36) (7) Cash paid to suppliers 6 Cash paid to employees 9 Cash paid for depreciation 3 Cash paid for interest 9 Cash paid for insurance 6 (Not reported-no cash effect) ? Cash paid for income taxes (42) Interest expense Insurance expense Loss on sale of land Income tax expense Depreciation expense (9) Depreciation expense (21) (27) (?) Decrease in bond discount Decrease in prepaid insurance Loss on sale of land Increase in income tax payable (6) (21) s 54 Net Income $? Net cash flows from operating activities $54 Net cash flows from operating activities Required: Complete the schedule by determining each of the following missing elements: Cash received from customers 2. Cost of goods sold 3. ? in salaries payable (Increase? Or decrease?) 4. Cash paid for depreciation 5. Interest expense 6. Cash paid for insurance 7. Increase in income tax payable 8. Net income HAWKEYE COMPANY Income Statement For the Year Ended December 31, 2018 ($ in millions) ting irect thod)-- alent 021-4 Sales Cost of goods sold $900 350 550 Gross margin Operating expenses: Salaries Depreciation Loss on sale of land $232 190 12 Total operating expenses 434 116 Operating income Other income (expense): Gain on sale of cash equivalents Interest expense 4 (40) 80 40 s 40 Income before tax Income tax expense Net income HAWKEYE COMPANY Selected Accounts from Comparative Balance Sheets December 31, 2018 and 2017 Year 2018 2017Change Cash Accounts receivable Inventory Accounts payable Salaries payable Interest payable Income taxes payable $212 395 860 210 180 $200 421 850 234 188 50 104 12 (26) 10 (24) 5 (14) 90