Question

The director of cost management for Portland Instrument Corporation compares each months actual results with a monthly plan. The standard direct-labor rates for the year

The director of cost management for Portland Instrument Corporation compares each months actual results with a monthly plan. The standard direct-labor rates for the year just ended and the standard hours allowed, given the actual output in April, are shown in the following schedule.

Standard Direct-Labor Rate per HourStandard Direct-Labor Hours Allowed, Given April OutputLabor class III$ 24.401,400Labor class II21.401,400Labor class I15.401,400A new union contract negotiated in March resulted in actual wage rates that differed from the standard rates. The actual direct-labor hours worked and the actual direct-labor rates per hour experienced for the month of April were as follows:

Actual Direct-Labor Rate per HourActual Direct- Labor HoursLabor class III$ 26.201,500Labor class II22.901,700Labor class I16.601,150Required:

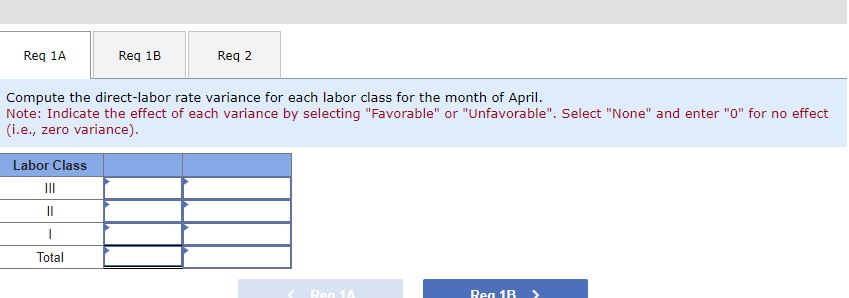

1-a. Compute the direct-labor rate variance for each labor class for the month of April.

1-b. Compute the direct-labor efficiency variance for each labor class for the month of April.

2. Which of the following could be considered an advantage of using a standard-costing system in which the standard direct-labor rates are not changed during the year to reflect such events as a new labor contract?

Compute the direct-labor rate variance for each labor class for the month of April. Note: Indicate the effect of each variance by selecting "Favorable" or "Unfavorable". Select "None" and enter "0" for no effect (i.e., zero variance)

Compute the direct-labor rate variance for each labor class for the month of April. Note: Indicate the effect of each variance by selecting "Favorable" or "Unfavorable". Select "None" and enter "0" for no effect (i.e., zero variance) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started