Answered step by step

Verified Expert Solution

Question

1 Approved Answer

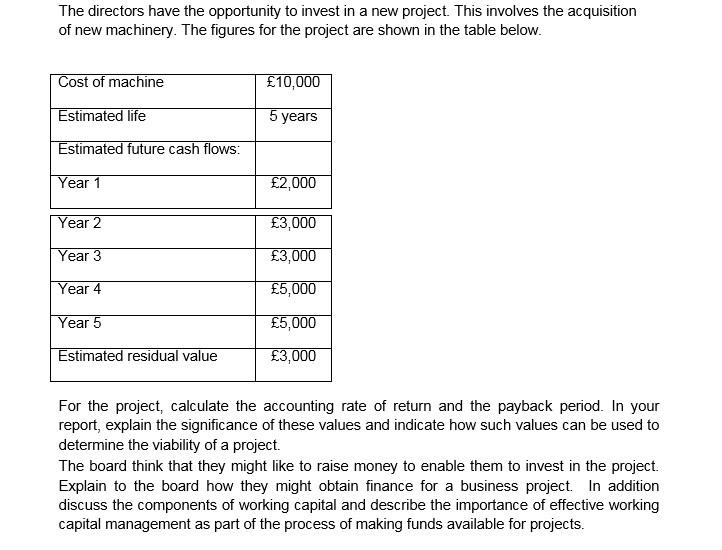

The directors have the opportunity to invest in a new project. This involves the acquisition of new machinery. The figures for the project are

The directors have the opportunity to invest in a new project. This involves the acquisition of new machinery. The figures for the project are shown in the table below. Cost of machine Estimated life Estimated future cash flows: Year 1 Year 2 Year 3 Year 4 Year 5 Estimated residual value 10,000 5 years 2,000 3,000 3,000 5,000 5,000 3,000 For the project, calculate the accounting rate of return and the payback period. In your report, explain the significance of these values and indicate how such values can be used to determine the viability of a project. The board think that they might like to raise money to enable them to invest in the project. Explain to the board how they might obtain finance for a business project. In addition discuss the components of working capital and describe the importance of effective working capital management as part of the process of making funds available for projects.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Calculation of Accounting Rate of Return Step 1 Annual Depreciation Initial Invest...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started