Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The directors of a company are considering two mutually exclusive projects, which both require an investment of K1.2 million. The cash flows of the

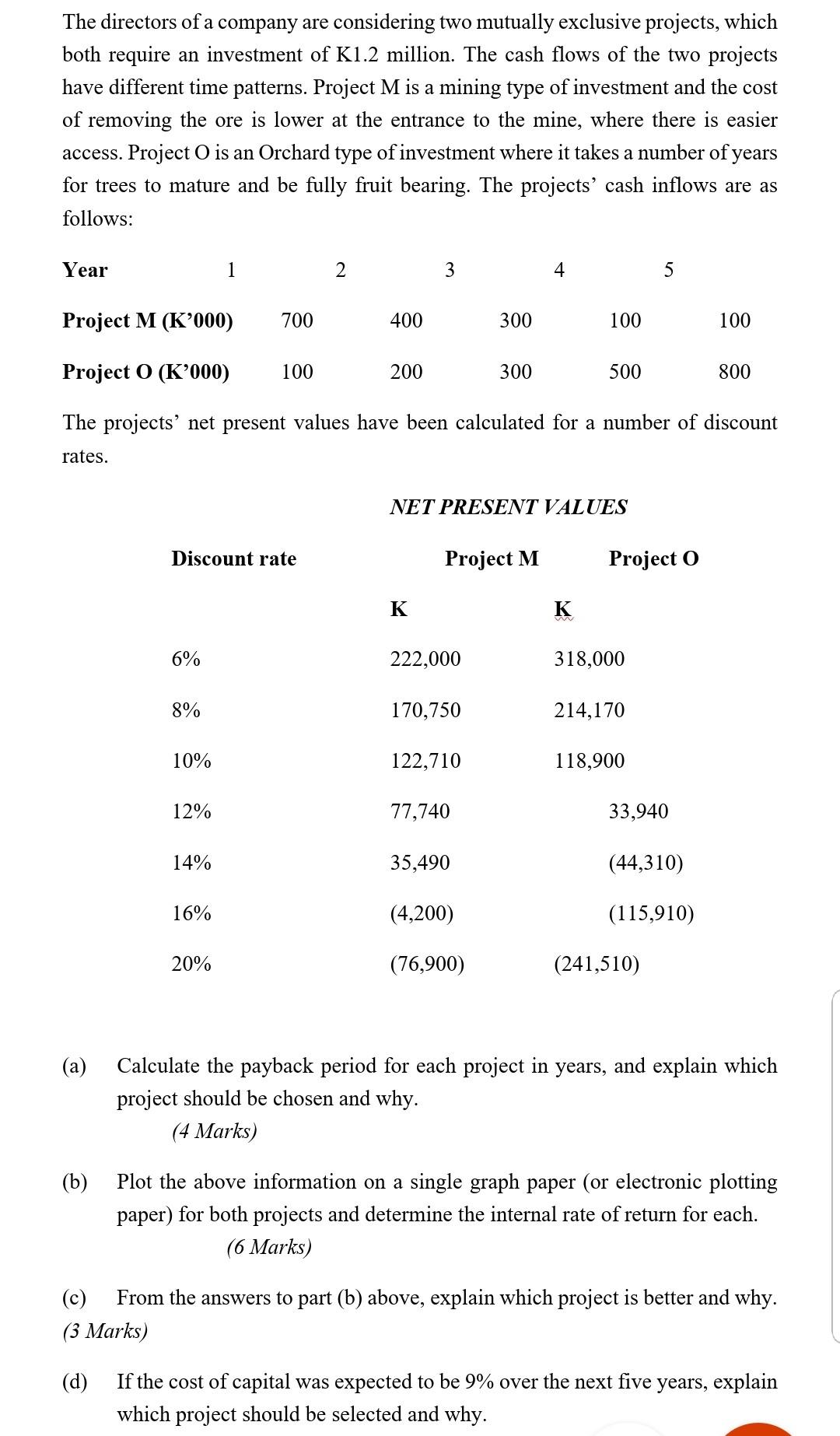

The directors of a company are considering two mutually exclusive projects, which both require an investment of K1.2 million. The cash flows of the two projects have different time patterns. Project M is a mining type of investment and the cost of removing the ore is lower at the entrance to the mine, where there is easier access. Project O is an Orchard type of investment where it takes a number of years for trees to mature and be fully fruit bearing. The projects' cash inflows are as follows: Year (a) 6% 8% Project M (K'000) Project O (K'000) The projects' net present values have been calculated for a number of discount rates. Discount rate 10% 12% 14% 1 16% 20% 700 100 2 400 200 3 K 222,000 Project M 170,750 NET PRESENT VALUES 122,710 77,740 300 35,490 300 (4,200) (76,900) 4 100 K 500 Project O 318,000 214,170 5 118,900 33,940 (44,310) (115,910) (241,510) 100 800 Calculate the payback period for each project in years, and explain which project should be chosen and why. (4 Marks) (b) Plot the above information on a single graph paper (or electronic plotting paper) for both projects and determine the internal rate of return for each. (6 Marks) (c) From the answers to part (b) above, explain which project is better and why. (3 Marks) (d) If the cost of capital was expected to be 9% over the next five years, explain which project should be selected and why.

Step by Step Solution

★★★★★

3.32 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

a Payback Period For Project MYear 1 K700000Year 3 K1100000 K700000 K400000Year 4 K1400000 K1100000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started