Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The directors of a small production company have the opportunity to invest in one of two new projects. Both projects involve the acquisition of new

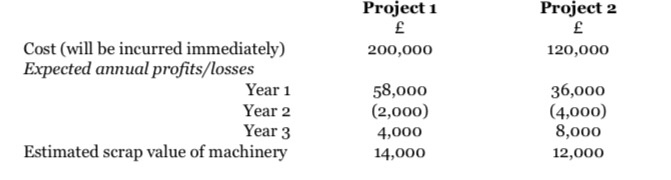

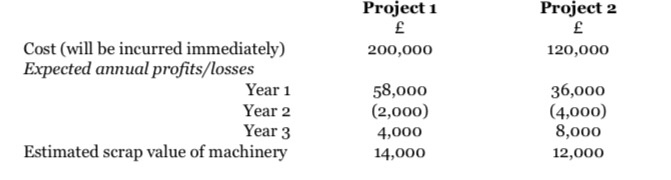

The directors of a small production company have the opportunity to invest in one of two new projects. Both projects involve the acquisition of new machinery. The figures for the projects are as follows:

Project 1 Project 2 200,000 120,000 Cost (will be incurred immediately) Expected annual profits/losses Year 1 Year 2 Year 3 Estimated scrap value of machinery 58,000 (2,000) 4,000 14,000 36,000 (4,000) 8,000 12,000

The business has an estimated cost of capital of 10%. They use a straight-line method of depreciation for non-current assets to calculate operating profit. The business has sufficient funds to meet the capital expenditure requirements.

You must demonstrate the main methods of project appraisal. Produce a document setting out your findings and the assumptions on which calculations are based. Evaluate each method of project appraisal and make a recommendation to the board as to which project they should invest in.

For each project, calculate:

- accounting rate of return

- payback

- net present value

- internal rate of return

An alternative way of determining depreciation is to use the reducing balance method.

- Use a theoretical rate of depreciation value of 40% to determine the annual net book values of assets costing 200,000 and 120,000 respectively for a four-year period.

- Discuss what allowances should be made for the effects of inflation in project appraisal.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started