Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The directors of Hound Co are aware that it is the target of a possible takeover bid. The directors wish to protect their shareholders interests

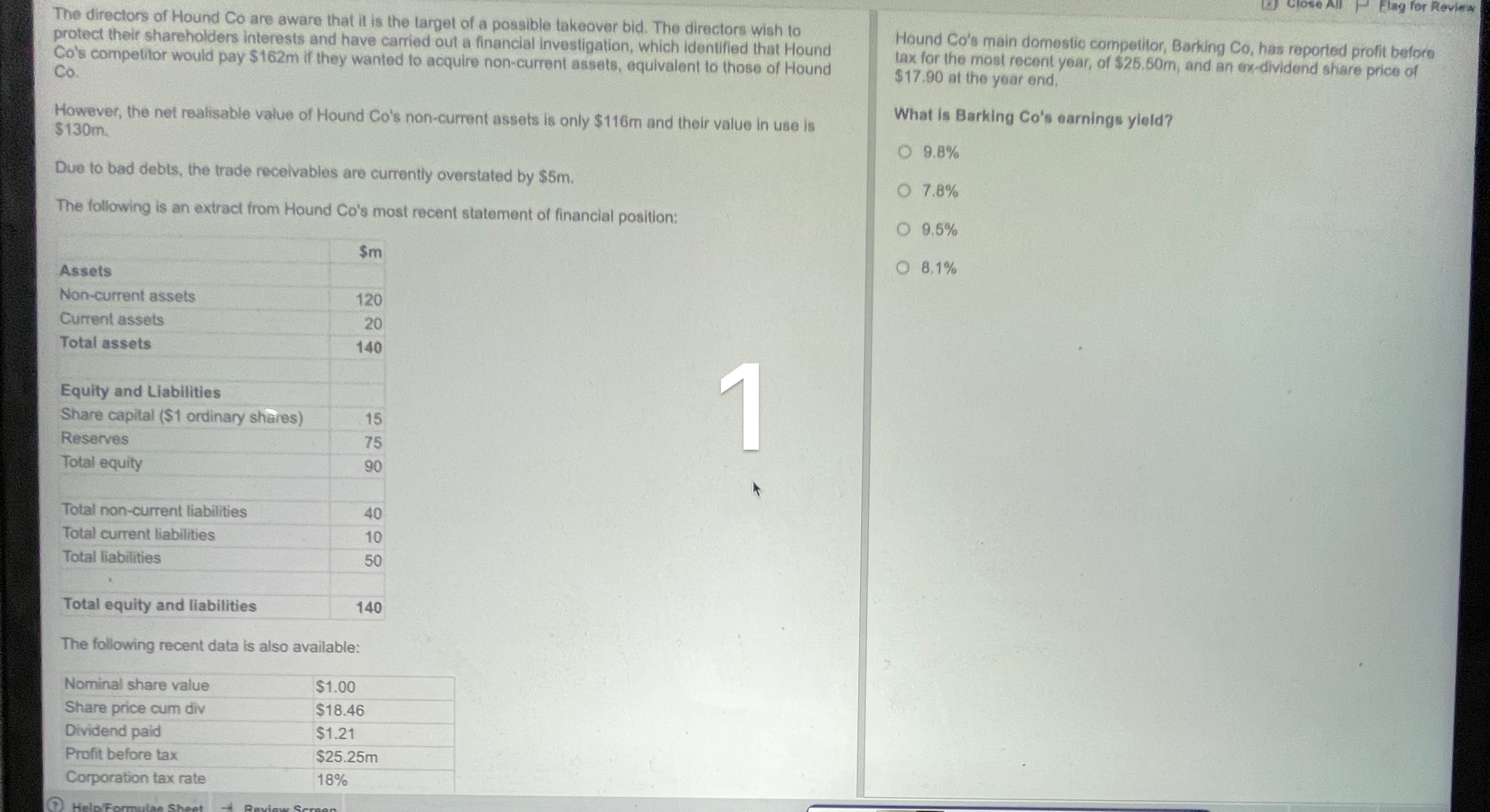

The directors of Hound Co are aware that it is the target of a possible takeover bid. The directors wish to protect their shareholders interests and have carried out a financial investigation, which identified that Hound Co's competitor would pay $162m if they wanted to acquire non-current assets, equivalent to those of Hound Co. However, the net realisable value of Hound Co's non-current assets is only $116m and their value in use is 5130mm Due to bad debts, the trade receivables are currently overstated by $5m. The following is an extract from Hound Co's most recent statement of financial position: Hound Co's main dornestio compelitor, Barking Co, has reported profit betore tax for the most recent year, of $25,60m, and an Gx-dividend share price of $17,90 at the year end. What is Barking Co's earnings yield? 9.8% 7.8% 9.5% 8,1% The following recent data is also available: The directors of Hound Co are aware that it is the target of a possible takeover bid. The directors wish to protect their shareholders interests and have carried out a financial investigation, which identified that Hound Co's competitor would pay $162m if they wanted to acquire non-current assets, equivalent to those of Hound Co. However, the net realisable value of Hound Co's non-current assets is only $116m and their value in use is 5130mm Due to bad debts, the trade receivables are currently overstated by $5m. The following is an extract from Hound Co's most recent statement of financial position: Hound Co's main dornestio compelitor, Barking Co, has reported profit betore tax for the most recent year, of $25,60m, and an Gx-dividend share price of $17,90 at the year end. What is Barking Co's earnings yield? 9.8% 7.8% 9.5% 8,1% The following recent data is also available

The directors of Hound Co are aware that it is the target of a possible takeover bid. The directors wish to protect their shareholders interests and have carried out a financial investigation, which identified that Hound Co's competitor would pay $162m if they wanted to acquire non-current assets, equivalent to those of Hound Co. However, the net realisable value of Hound Co's non-current assets is only $116m and their value in use is 5130mm Due to bad debts, the trade receivables are currently overstated by $5m. The following is an extract from Hound Co's most recent statement of financial position: Hound Co's main dornestio compelitor, Barking Co, has reported profit betore tax for the most recent year, of $25,60m, and an Gx-dividend share price of $17,90 at the year end. What is Barking Co's earnings yield? 9.8% 7.8% 9.5% 8,1% The following recent data is also available: The directors of Hound Co are aware that it is the target of a possible takeover bid. The directors wish to protect their shareholders interests and have carried out a financial investigation, which identified that Hound Co's competitor would pay $162m if they wanted to acquire non-current assets, equivalent to those of Hound Co. However, the net realisable value of Hound Co's non-current assets is only $116m and their value in use is 5130mm Due to bad debts, the trade receivables are currently overstated by $5m. The following is an extract from Hound Co's most recent statement of financial position: Hound Co's main dornestio compelitor, Barking Co, has reported profit betore tax for the most recent year, of $25,60m, and an Gx-dividend share price of $17,90 at the year end. What is Barking Co's earnings yield? 9.8% 7.8% 9.5% 8,1% The following recent data is also available Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started