Answered step by step

Verified Expert Solution

Question

1 Approved Answer

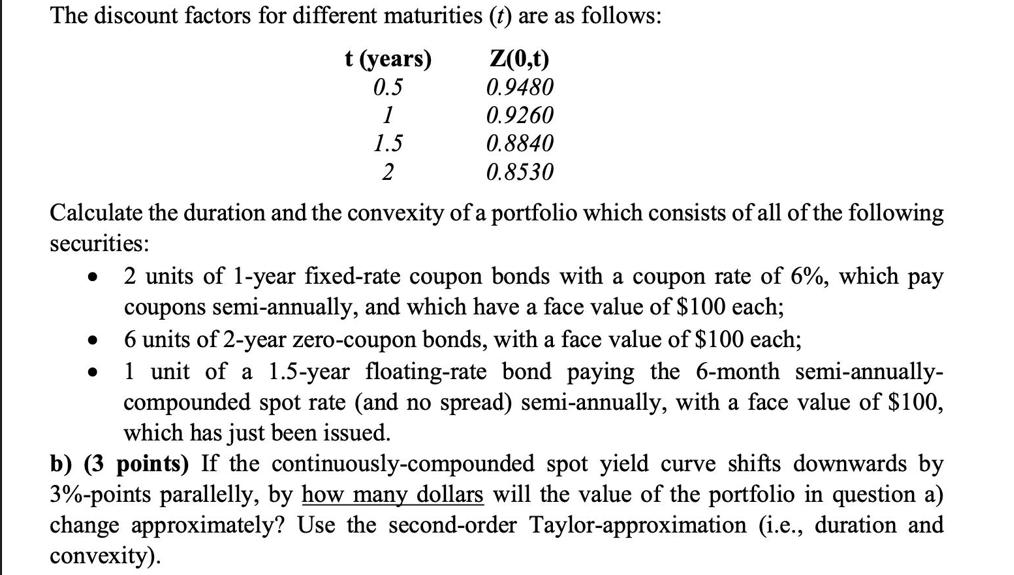

The discount factors for different maturities (t) are as follows: t (years) Z(0,t) 0.9480 0.5 1 0.9260 1.5 0.8840 2 0.8530 Calculate the duration

The discount factors for different maturities (t) are as follows: t (years) Z(0,t) 0.9480 0.5 1 0.9260 1.5 0.8840 2 0.8530 Calculate the duration and the convexity of a portfolio which consists of all of the following securities: 2 units of 1-year fixed-rate coupon bonds with a coupon rate of 6%, which pay coupons semi-annually, and which have a face value of $100 each; 6 units of 2-year zero-coupon bonds, with a face value of $100 each; 1 unit of a 1.5-year floating-rate bond paying the 6-month semi-annually- compounded spot rate (and no spread) semi-annually, with a face value of $100, which has just been issued. b) (3 points) the continuously-compounded spot yield curve shifts downwards by 3%-points parallelly, by how many dollars will the value of the portfolio in question a) change approximately? Use the second-order Taylor-approximation (i.e., duration and convexity).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the duration and convexity of the portfolio we need to consider the characteristics of each security in the portfolio Given Securities in ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started