Answered step by step

Verified Expert Solution

Question

1 Approved Answer

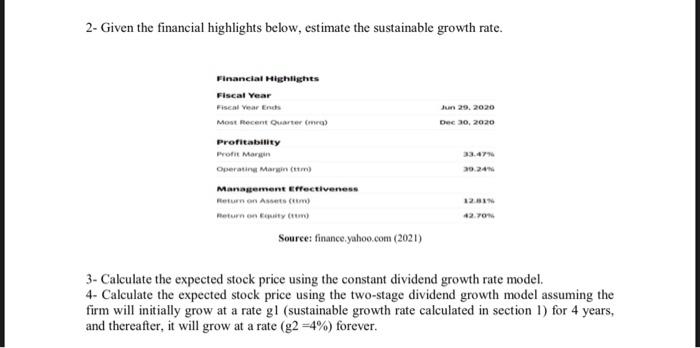

the discount rate is 18.20 2- Given the financial highlights below, estimate the sustainable growth rate. Financial Highlights Fiscal Year Fiscal Year Ends Most Recent

the discount rate is 18.20

2- Given the financial highlights below, estimate the sustainable growth rate. Financial Highlights Fiscal Year Fiscal Year Ends Most Recent water mo) Jun 29, 2020 Dec 30, 2020 33.47 Profitability Port Mar Operating Mar) Management effectiveness Return on Assets (m) Return on to Source: finance, yahoo.com (2021) 123 42. TON 3- Calculate the expected stock price using the constant dividend growth rate model. 4- Calculate the expected stock price using the two-stage dividend growth model assuming the firm will initially grow at a rate gl (sustainable growth rate calculated in section 1) for 4 years, and thereafter, it will grow at a rate (g2 -4%) forever. 2- Given the financial highlights below, estimate the sustainable growth rate. Financial Highlights Fiscal Year Fiscal Year Ends Most Recent water mo) Jun 29, 2020 Dec 30, 2020 33.47 Profitability Port Mar Operating Mar) Management effectiveness Return on Assets (m) Return on to Source: finance, yahoo.com (2021) 123 42. TON 3- Calculate the expected stock price using the constant dividend growth rate model. 4- Calculate the expected stock price using the two-stage dividend growth model assuming the firm will initially grow at a rate gl (sustainable growth rate calculated in section 1) for 4 years, and thereafter, it will grow at a rate (g2 -4%) forever Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started