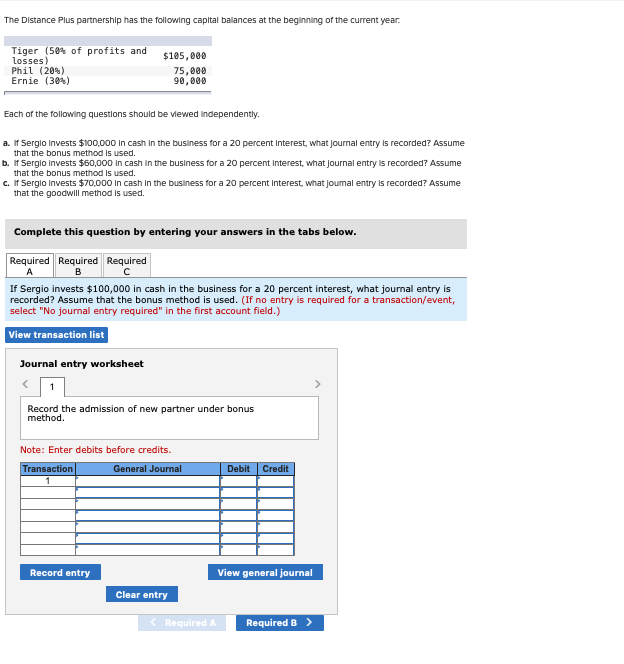

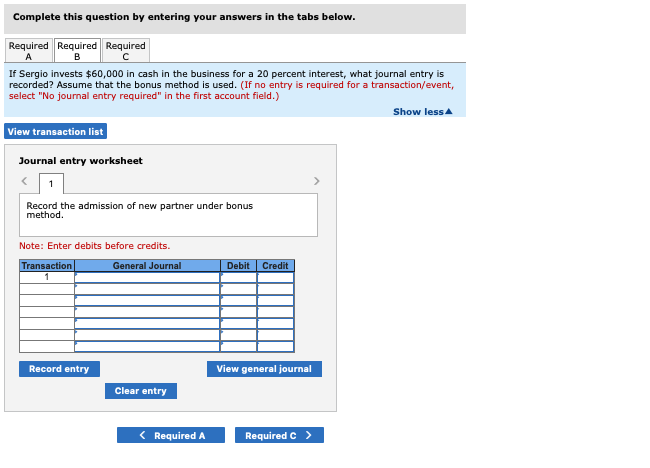

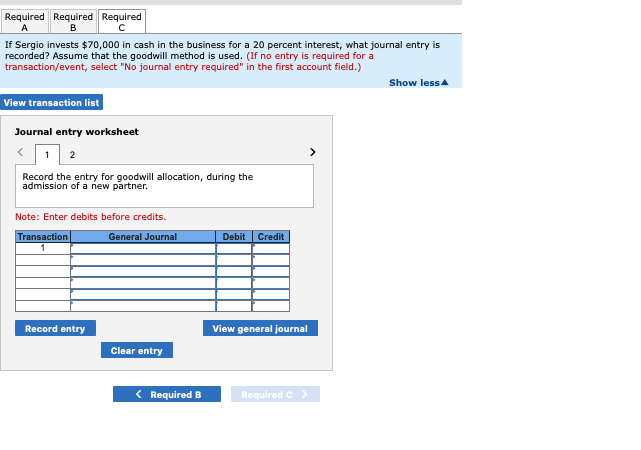

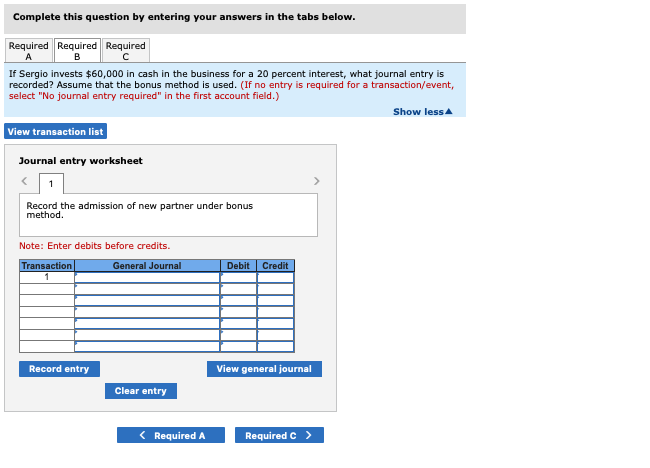

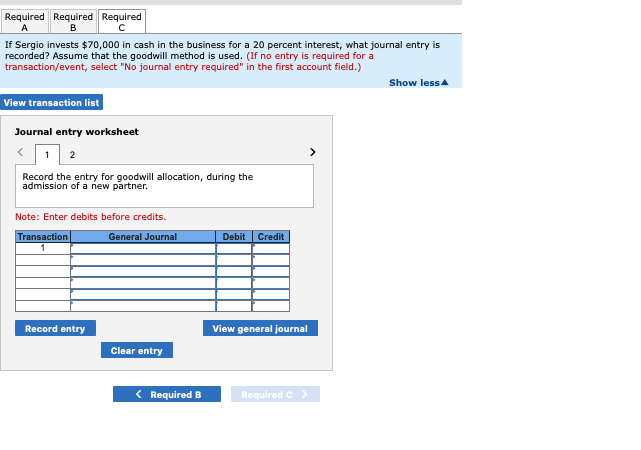

The Distance Plus partnership has the following capital balances at the beginning of the current year. Tiger (50% of profits and Losses) Phil (204) Ernie (304) $105,000 75,000 90,000 Each of the following questions should be viewed independently. a. If Sergio invests $100,000 In cash in the business for a 20 percent Interest, what journal entry is recorded? Assume that the bonus method is used. b. If Sergio invests $60,000 in cash in the business for a 20 percent interest, what journal entry is recorded? Assume that the bonus method is used. c. If Sergio invests $70,000 in cash in the business for a 20 percent Interest, what joumal entry is recorded? Assume that the goodwill method is used. Complete this question by entering your answers in the tabs below. Required Required Required B If Sergio invests $100,000 in cash in the business for a 20 percent interest, what journal entry is recorded? Assume that the bonus method is used. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet Record the admission of new partner under bonus method. Note: Enter debits before credits. Transaction General Journal Debit Credit Record entry View general journal Clear entry Required A Required B > Complete this question by entering your answers in the tabs below. Required Required Required B If Sergio invests $60,000 in cash in the business for a 20 percent interest, what journal entry is recorded? Assume that the bonus method is used. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Show less View transaction list Journal entry worksheet Record the admission of new partner under bonus method. Note: Enter debits before credits. Transaction General Journal Debit Credit Record entry View general journal Clear entry Required Required Required B If Sergio invests $70,000 in cash in the business for a 20 percent interest, what journal entry is recorded? Assume that the goodwill method is used. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Show less View transaction list Journal entry worksheet 1 2 Record the entry for goodwill allocation, during the admission of a new partner. Note: Enter debits before credits. Transaction General Journal Debit Credit 1 Record entry View general journal Clear entry