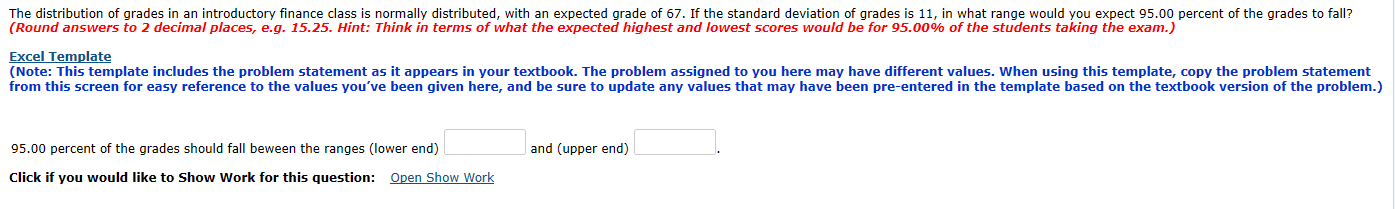

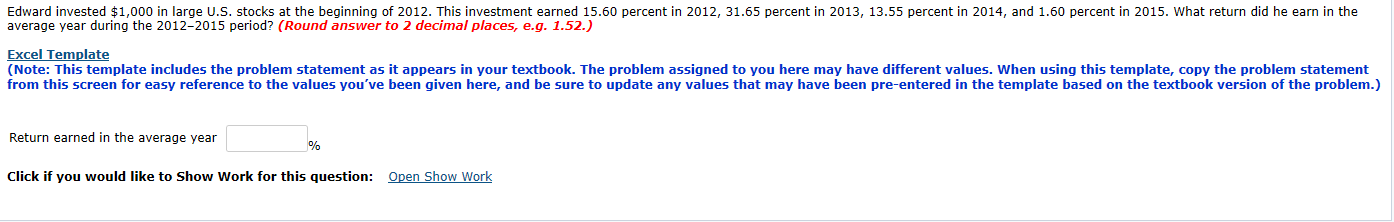

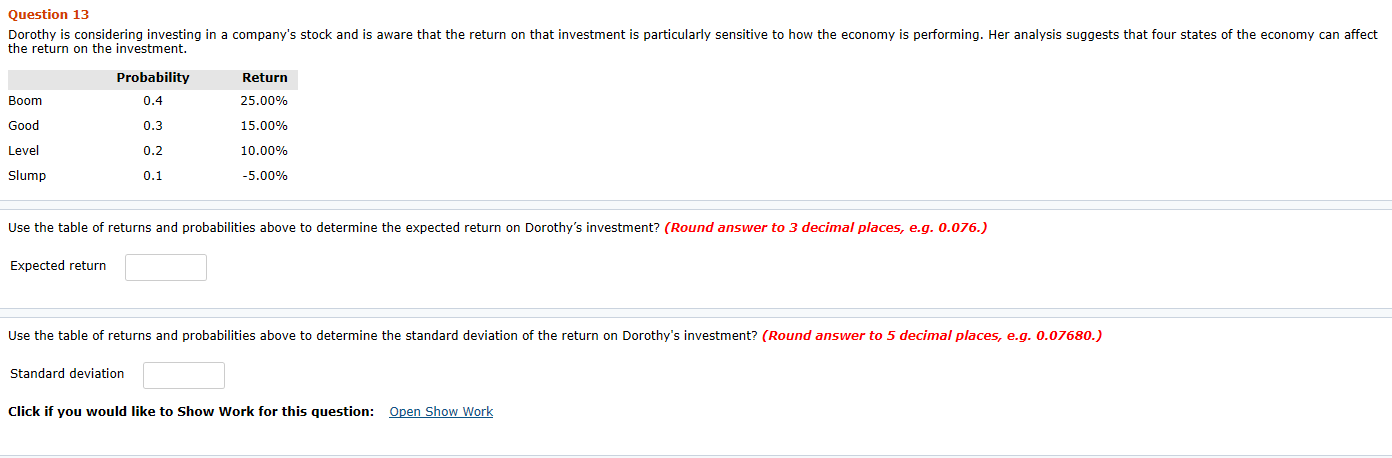

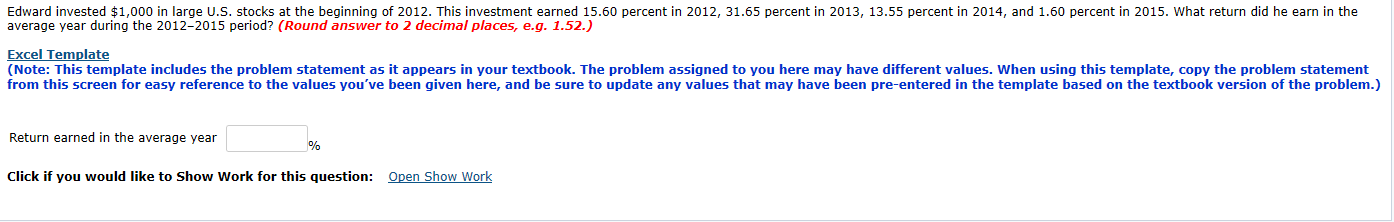

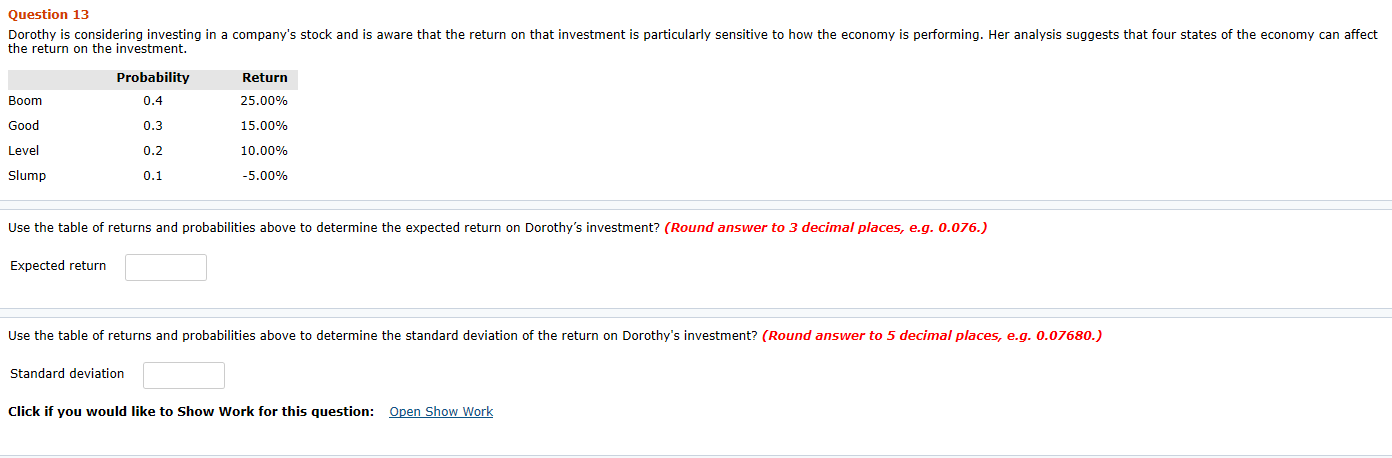

The distribution of grades in an introductory finance class is normally distributed, with an expected grade of 67. If the standard deviation of grades is 11, in what range would you expect 95.00 percent of the grades to fall? (Round answers to 2 decimal places, e.g. 15.25. Hint: Think in terms of what the expected highest and lowest scores would be for 95.00% of the students taking the exam.) Excel Template (Note: This template includes the problem statement as it appears in your textbook. The problem assigned to you here may have different values. When using this template, copy the problem statement from this screen for easy reference to the values you've been given here, and be sure to update any values that may have been pre-entered in the template based on the textbook version of the problem.) and (upper end) 95.00 percent of the grades should fall beween the ranges (lower end) Click if you would like to Show Work for this question: Open Show Work Edward invested $1,000 in large U.S. stocks at the beginning of 2012. This investment earned 15.60 percent in 2012, 31.65 percent in 2013, 13.55 percent in 2014, and 1.60 percent in 2015. What return did he earn in the average year during the 2012-2015 period? (Round answer to 2 decimal places, e.g. 1.52.) Excel Template (Note: This template includes the problem statement as it appears in your textbook. The problem assigned to you here may have different values. When using this template, copy the problem statement from this screen for easy reference to the values you've been given here, and be sure to update any values that may have been pre-entered in the template based on the textbook version of the problem.) Return earned in the average year Click if you would like to Show Work for this question: Open Show Work Question 13 Dorothy is considering investing in a company's stock and is aware that the return on that investment is particularly sensitive to how the economy is performing. Her analysis suggests that four states of the economy can affect the return on the investment. Probability Return 0.4 25.00% Boom Good 0.3 15.00% Level 0.2 10.00% Slump 0.1 -5.00% Use the table of returns and probabilities above to determine the expected return on Dorothy's investment? (Round answer to 3 decimal places, e.g. 0.076.) Expected return Use the table of returns and probabilities above to determine the standard deviation of the return on Dorothy's investment? (Round answer to 5 decimal places, e.g. 0.07680.) Standard deviation Click if you would like to Show Work for this question: Open Show Work