Answered step by step

Verified Expert Solution

Question

1 Approved Answer

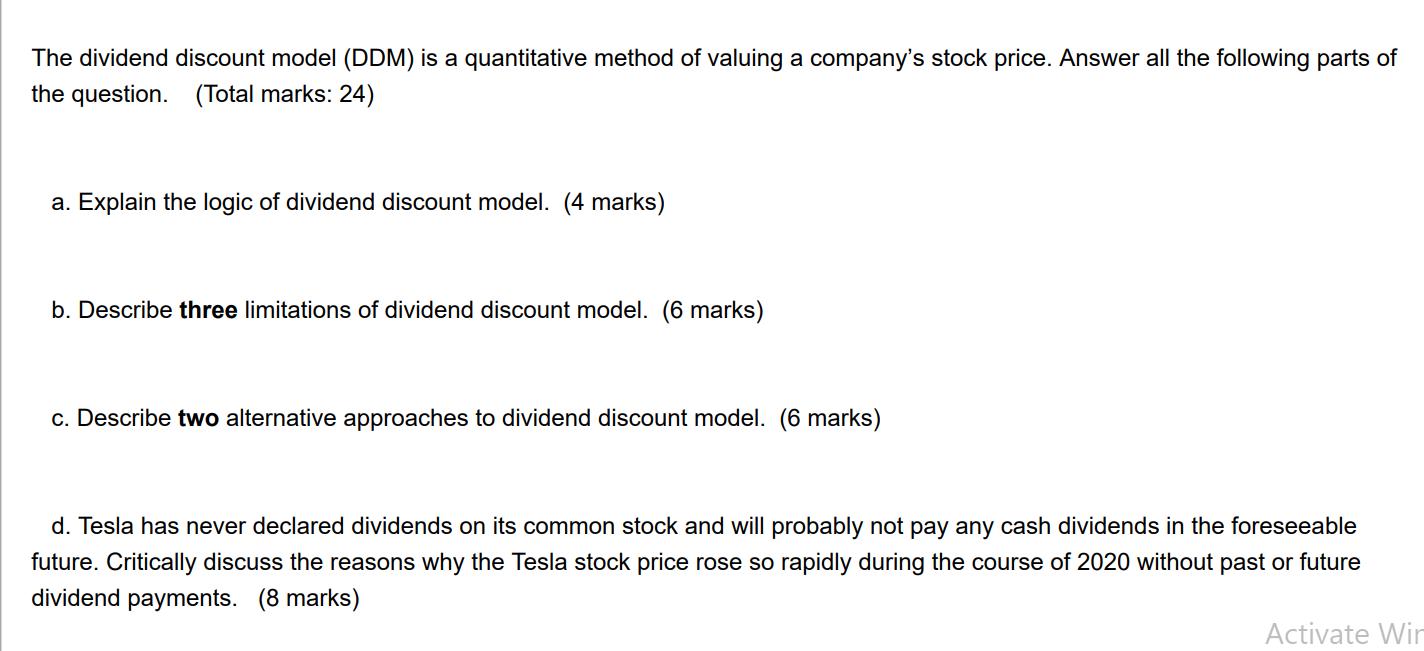

The dividend discount model (DDM) is a quantitative method of valuing a company's stock price. Answer all the following parts of the question. (Total

The dividend discount model (DDM) is a quantitative method of valuing a company's stock price. Answer all the following parts of the question. (Total marks: 24) a. Explain the logic of dividend discount model. (4 marks) b. Describe three limitations of dividend discount model. (6 marks) c. Describe two alternative approaches to dividend discount model. (6 marks) d. Tesla has never declared dividends on its common stock and will probably not pay any cash dividends in the foreseeable future. Critically discuss the reasons why the Tesla stock price rose so rapidly during the course of 2020 without past or future dividend payments. (8 marks) Activate Win

Step by Step Solution

★★★★★

3.44 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

a The logic of the dividend discount model DDM is based on the principle that the intrinsic value of a stock is the present value of its expected future dividends It assumes that the primary driver of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started