Answered step by step

Verified Expert Solution

Question

1 Approved Answer

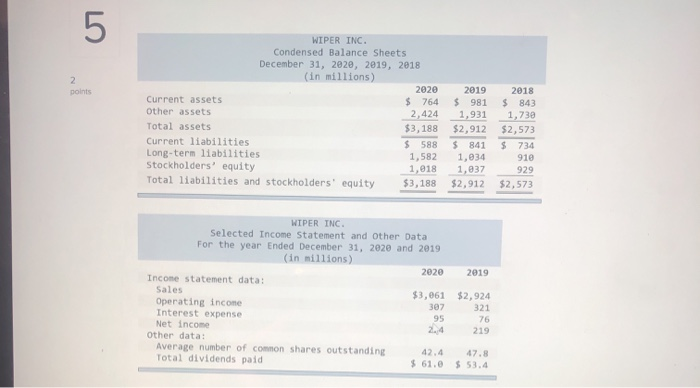

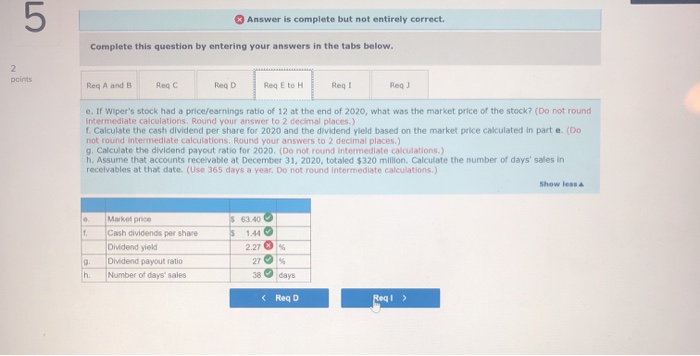

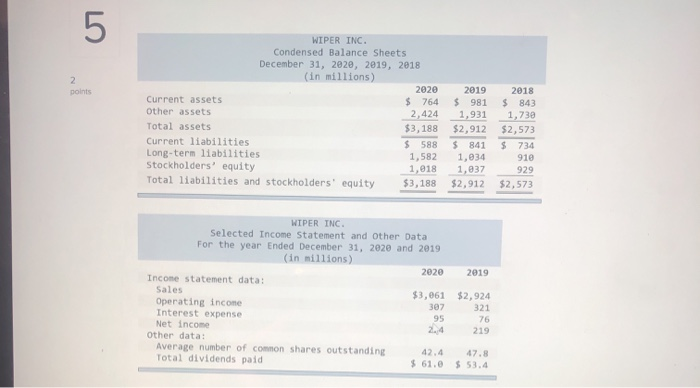

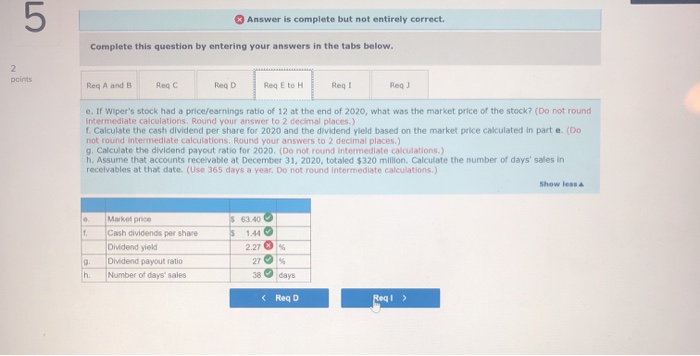

the dividend yield it is not 8.33, 0.02 or 2.27 5 WIPER INC. Condensed Balance Sheets December 31, 2020, 2019, 2018 (in millions) 2 2020

the dividend yield it is not 8.33, 0.02 or 2.27

5 WIPER INC. Condensed Balance Sheets December 31, 2020, 2019, 2018 (in millions) 2 2020 2019 $ 981 1,931 $2,912 2018 843 1,730 points Current assets $ 764 2,424 Other assets Total assets $3,188 $2,573 Current liabilities Long-term liabilities Stockholders' equity Total liabilities and stockholders' equity $ 588 $ 841 1,034 1,037 $2,912 $ 734 1,582 910 1,018 $3,188 929 $2,573 WIPER INC Selected Income Statement and Other Data For the year Ended December 31, 2020 and 2019 (in millions) 2020 2019 Income statement data: Sales $3,061 $2,924 Operating income Interest expense Net income Other data: Average number of common shares outstanding Total dividends paid 307 321 95 76 24 219 42.4 47.8 $ 61.0 $ 53.4 LO Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. 2 points Req A and B Req C Req D Req E to H Req I Req J e. If Wiper's stock had a price/earnings ratio of 12 at the end of 2020, what was the market price of the stock? (Do not round intermediate calculations. Round your answer to 2 decimal places.) f. Calculate the cash dividend per share for 2020 and the dividend yleld based on the market price calculated in part e. (Do not round intermediate calculations. Round your answers to 2 decimal places.) g. Calculate the dividend payout ratio for 2020. (Do not round intermediate calculations.) h. Assume that accounts receivable at December 31, 2020, totaled $320 million. Calculate the number of days' sales in recelvables at that date. (Use 365 days a year. Do not round intermediate calculations.) Show less A Market price Cash dividends per share Dividend yield 63 40 1.44 2.27 % Dividend payout ratio 27 % Number of days' sales days h. 38 Req D Req LO

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started