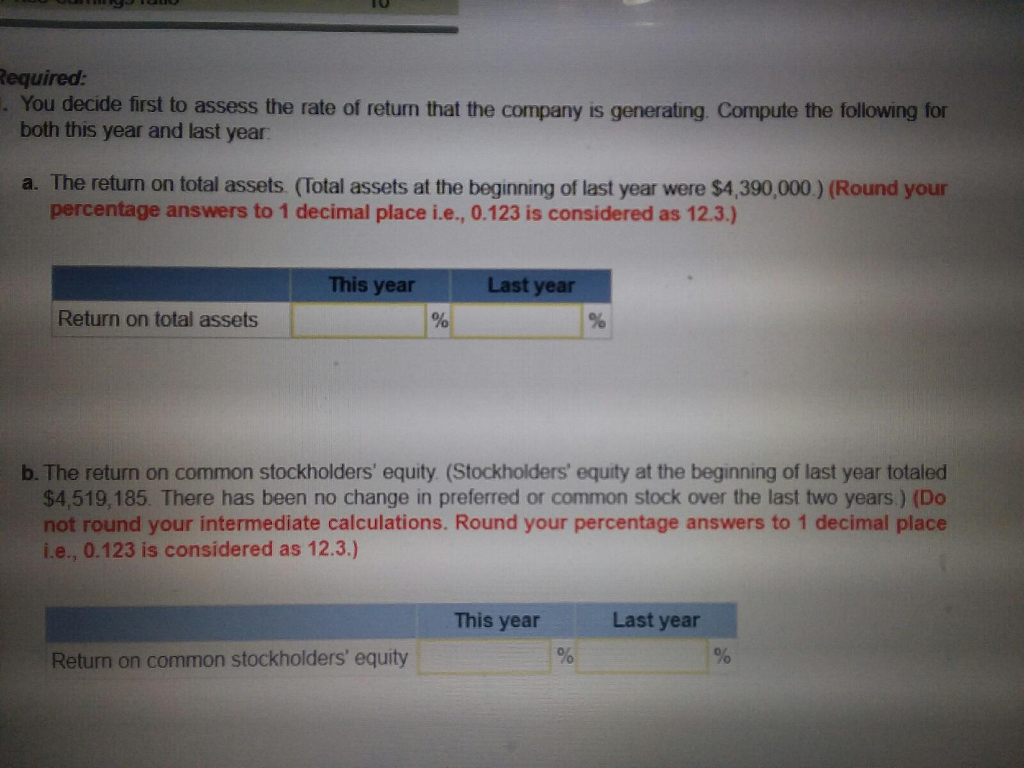

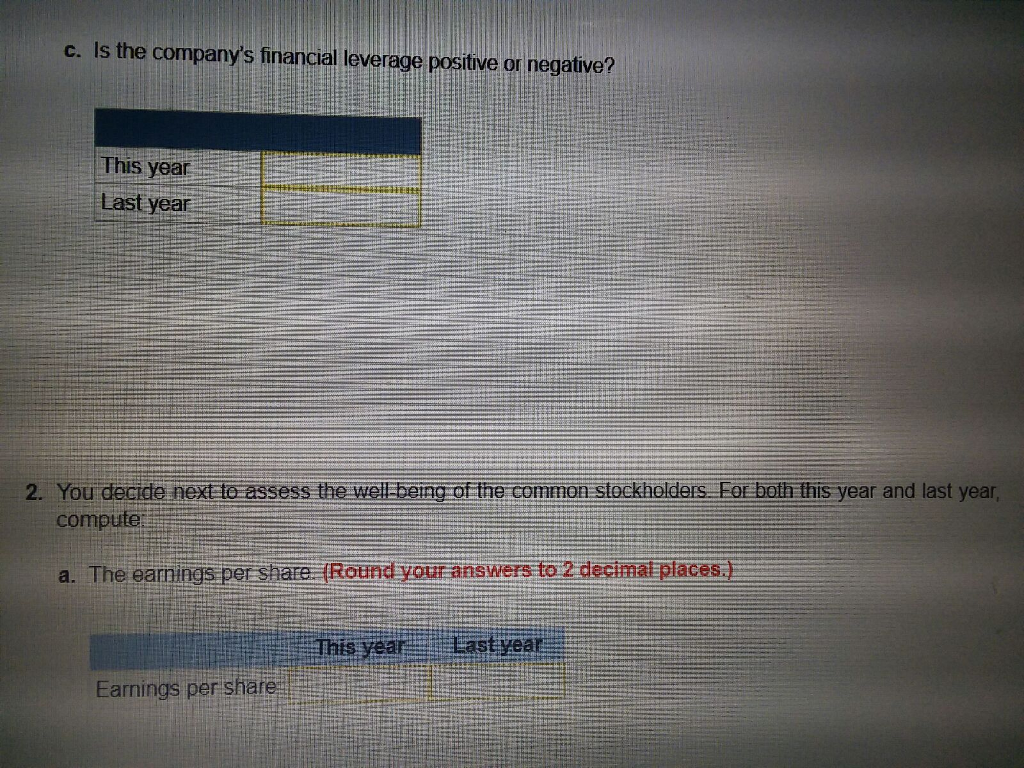

| | The dividend yield ratio for common stock.This year and last year The dividend payout ratio for common stock.This year and last year The price-earnings ratio.This year and last year The book value per share of common stock. This year and last year The gross margin percentage.This year and last year 3. | | You decide, finally, to assess creditor ratios to determine both short-term and long-term debt paying ability. For both this year and last year, compute: | | a. | Working capital.This year and last year. b. The current ratio.This year and last year. c. The acid-test ratio. This year and last year. d. The average collection period. (The accounts receivable at the beginning of last year totaled $520,000.) (Use 365 days in a year. Do not round intermediate calculations. Round your final answers to the nearest whole number.)This year and last year. e. The average sale period. (The inventory at the beginning of last year totaled $650,000.This year and last year. f. The debt-to-equity ratio.This year and last year. g.The times interest earned.This year and last year. | |

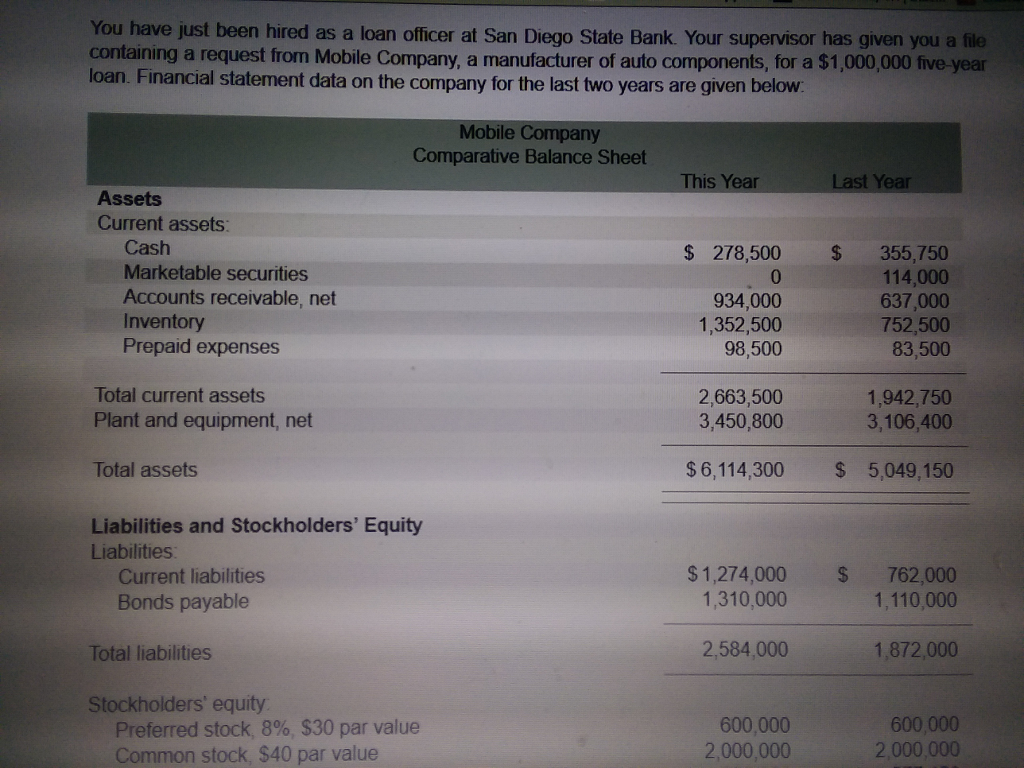

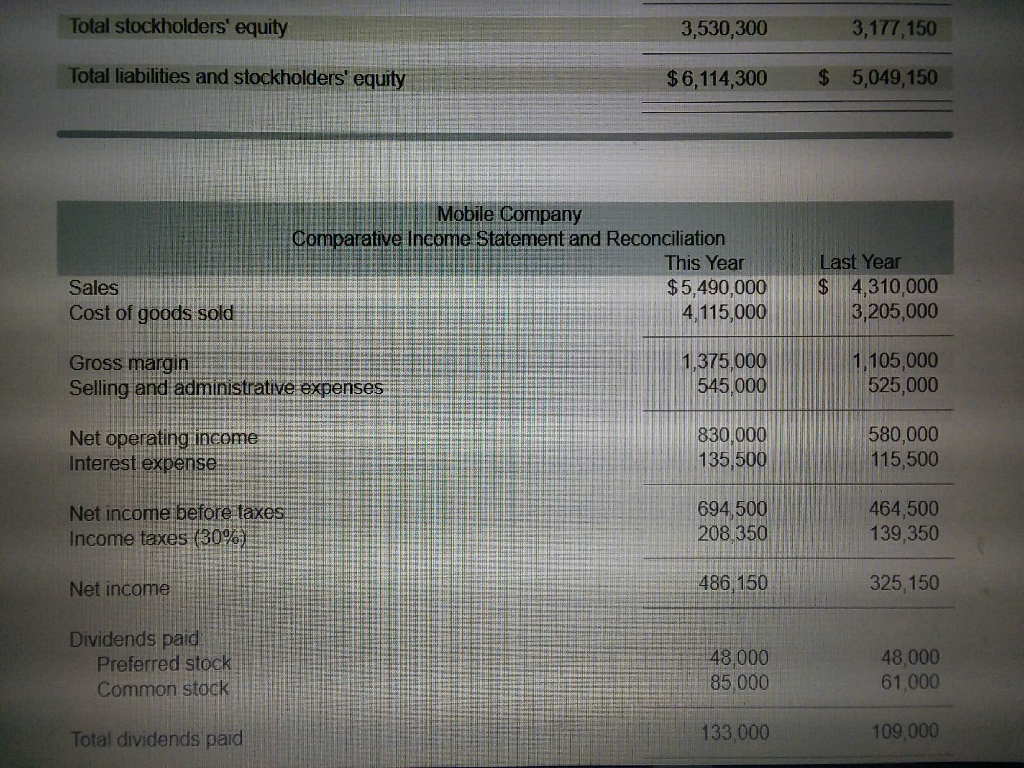

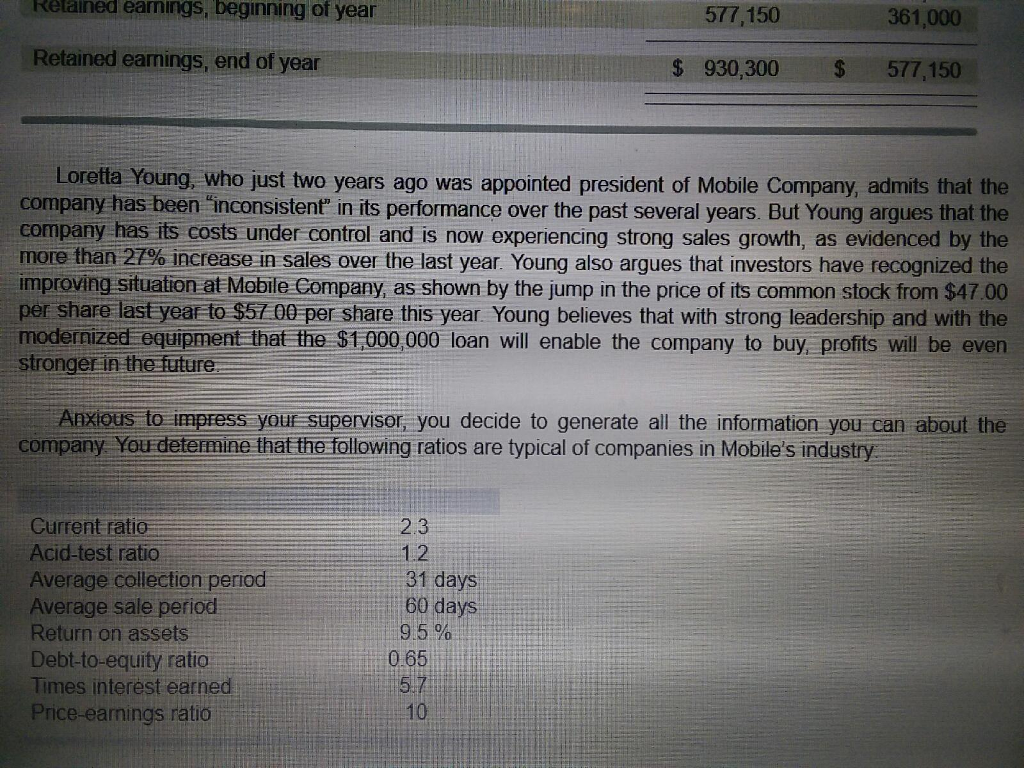

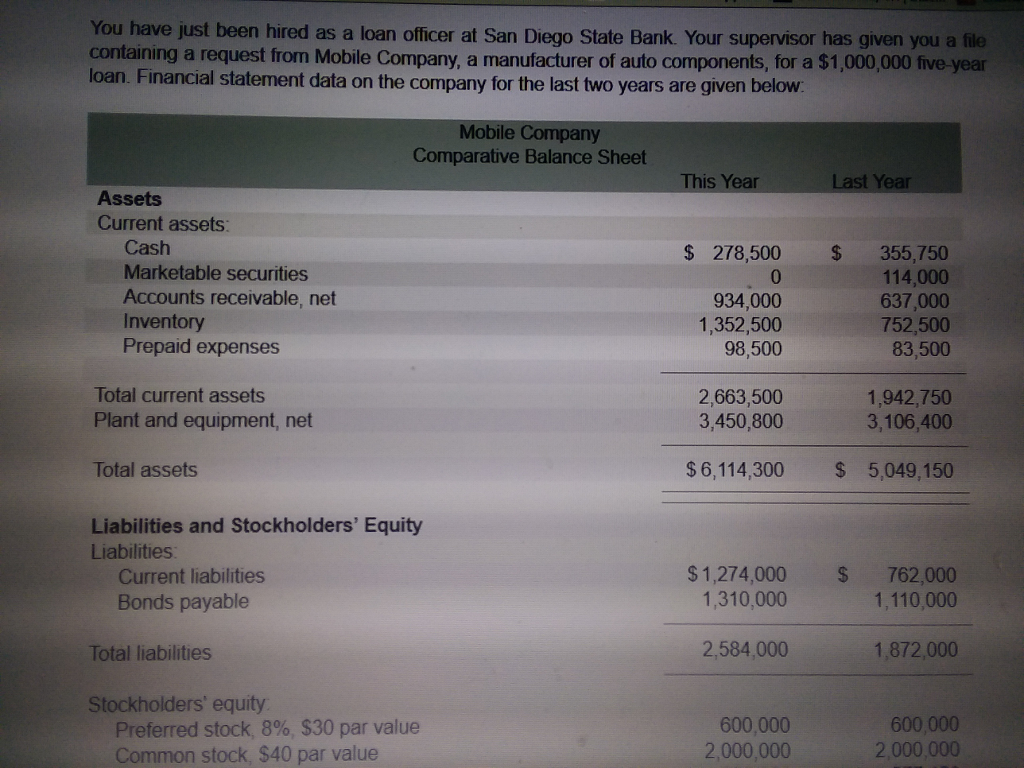

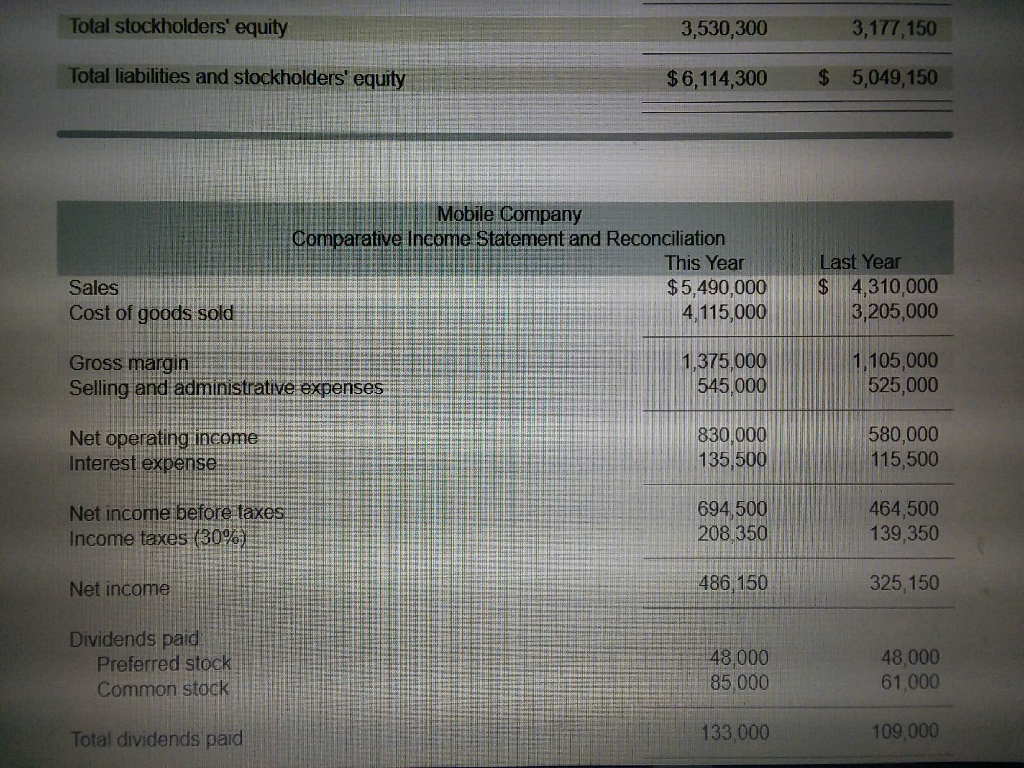

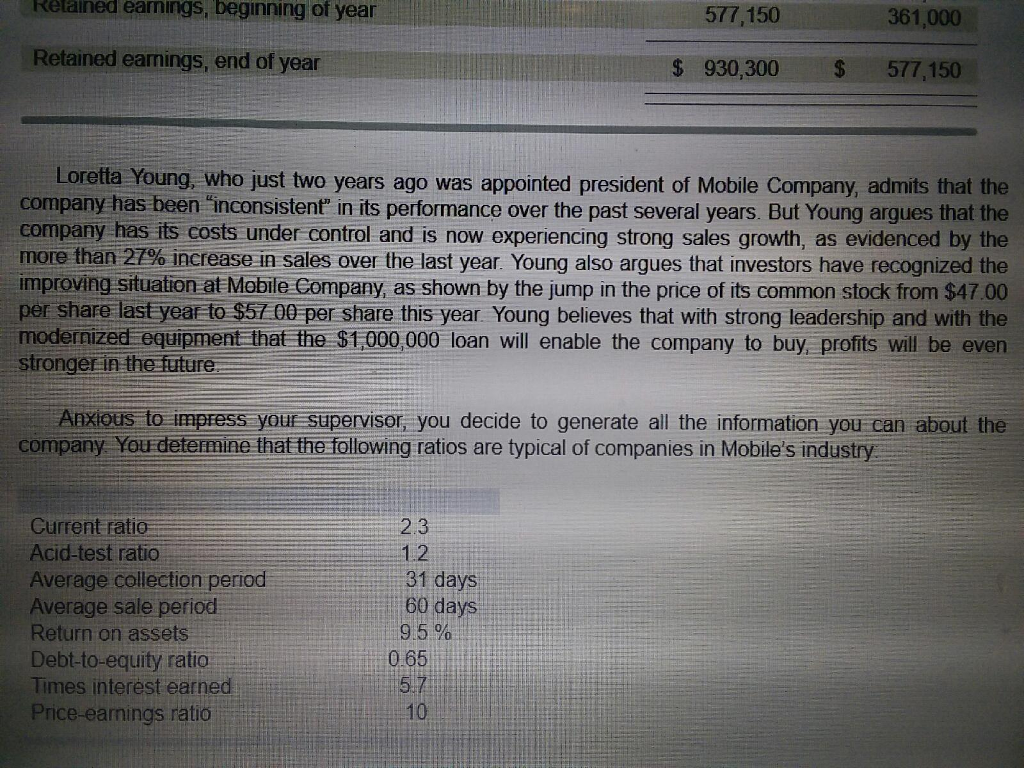

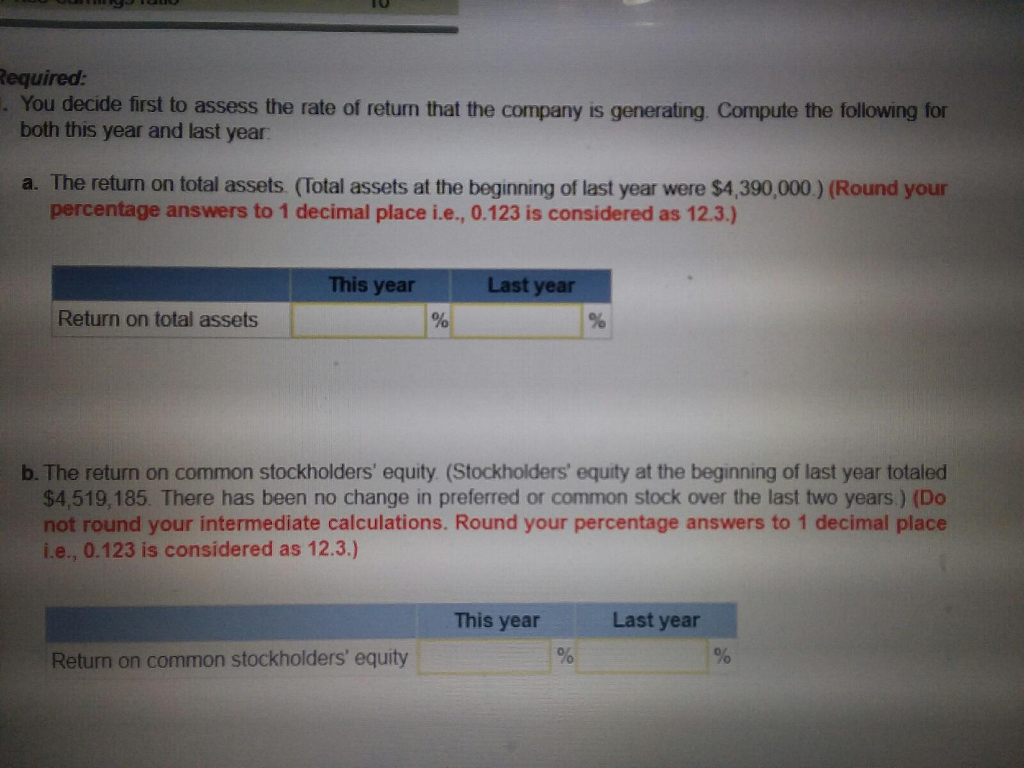

You have just been hired as a loan officer at San Diego State Bank. Your supervisor has given you a file containing a request from Mobile Company, a manufacturer of auto components, for a $1,000,000 five-year loan. Financial statement data on the company for the last two years are given below Mobile Company Comparative Balance Sheet This Year Assets Current assets: Cash 278,500 355,750 Marketable securities 114,000 Accounts receivable, net 934,000 637,000 Inventory 1,352,500 752,500 Prepaid expenses 98,500 83,500 Total current assets 2,663,500 1,942,750 3,450,800 Plant and equipment, net 3,106,400 Total assets 6,114,300 5,049,150 Liabilities and Stockholders' Equity Liabilities 1,274,000 762,000 Current liabilities 1,310,000 1,110,000 Bonds payable 1,872,000 2,584,000 Total liabilities Stockholders' equity 600 000 Preferred stock, 8%, $30 par value 600,000 Common stock, $40 par value 2,000,000 2,000,000