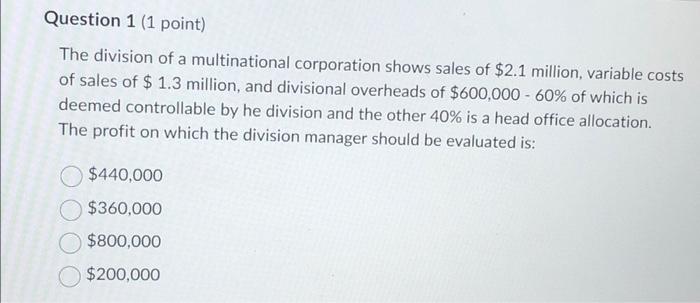

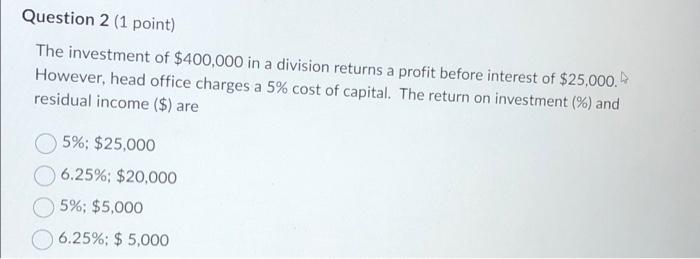

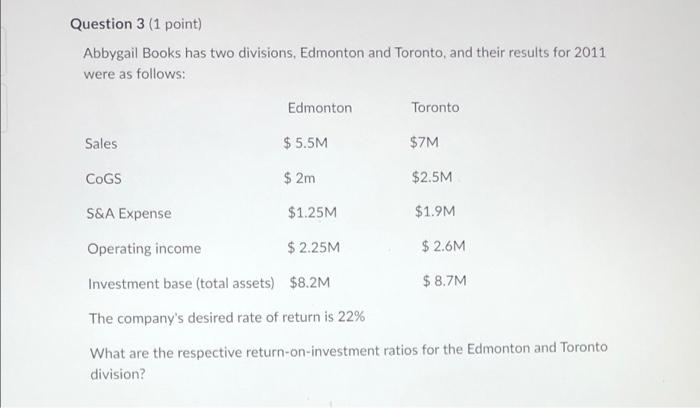

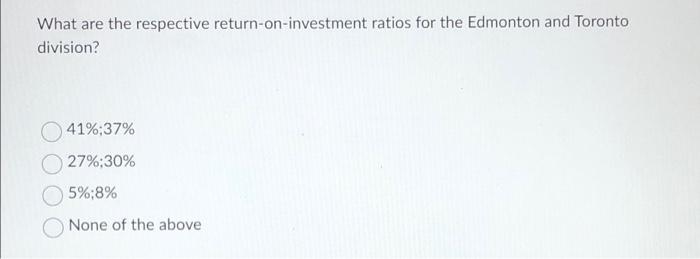

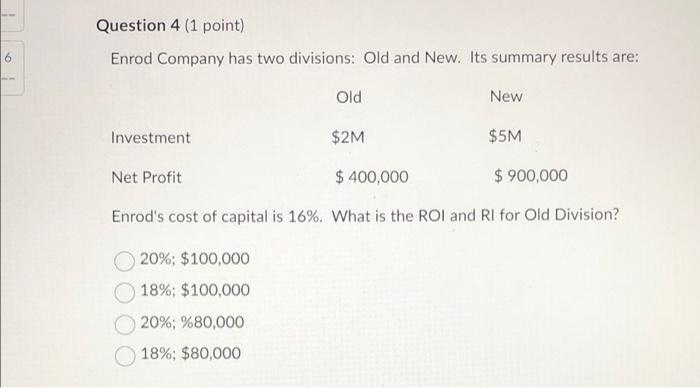

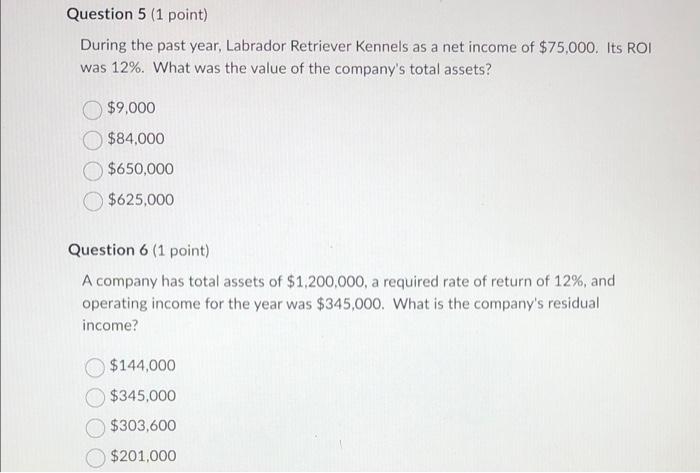

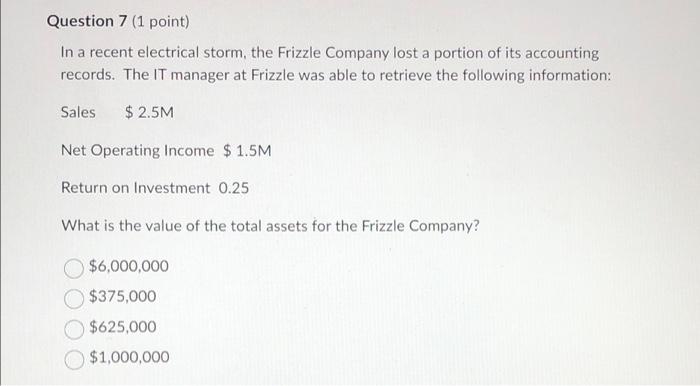

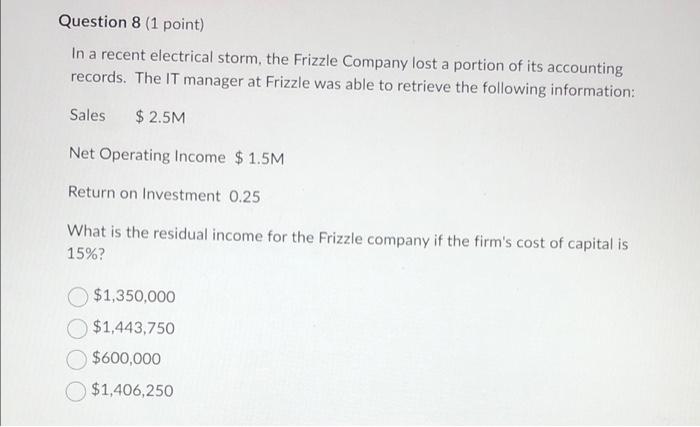

The division of a multinational corporation shows sales of $2.1 million, variable costs of sales of $1.3 million, and divisional overheads of $600,00060% of which is deemed controllable by he division and the other 40% is a head office allocation. The profit on which the division manager should be evaluated is: \begin{tabular}{|l|} \hline$440,000 \\ \hline$360,000 \\ \hline$800,000 \\ \hline$200,000 \\ \hline \end{tabular} The investment of $400,000 in a division returns a profit before interest of $25,000. However, head office charges a 5% cost of capital. The return on investment (%) and residual income ($) are \begin{tabular}{|l|} \hline 5%;$25,000 \\ \hline 6.25%;$20,000 \\ \hline 5%;$5,000 \\ \hline 6.25%;$5,000 \end{tabular} Abbygail Books has two divisions, Edmonton and Toronto, and their results for 2011 were as follows: The company's desired rate of return is 22% What are the respective return-on-investment ratios for the Edmonton and Toronto division? What are the respective return-on-investment ratios for the Edmonton and Toronto division? 41%;37% 27\%;30\% 5\%;8\% None of the above Enrod Company has two divisions: Old and New. Its summary results are: Enrod's cost of capital is 16%. What is the ROI and RI for Old Division? 20%;$100,00018%;$100,00020%;%80,00018%;$80,000 During the past year, Labrador Retriever Kennels as a net income of $75,000. Its ROI was 12%. What was the value of the company's total assets? $9,000$84,000$650,000$625,000 Question 6 (1 point) A company has total assets of $1,200,000, a required rate of return of 12%, and operating income for the year was $345,000. What is the company's residual income? $144,000$345,000$303,600$201,000 In a recent electrical storm, the Frizzle Company lost a portion of its accounting records. The IT manager at Frizzle was able to retrieve the following information: Sales $2.5M Net Operating Income $1.5M Return on Investment 0.25 What is the value of the total assets for the Frizzle Company? $6,000,000$375,000$625,000$1,000,000 In a recent electrical storm, the Frizzle Company lost a portion of its accounting records. The IT manager at Frizzle was able to retrieve the following information: Sales $2.5M Net Operating Income $1.5M Return on Investment 0.25 What is the residual income for the Frizzle company if the firm's cost of capital is 15%? $1,350,000$1,443,750$600,000$1,406,250