Question

The dollar-value LIFO method was adopted by Enya Corp. on January 1, 2014. Its inventory on that date was $393,900. On December 31, 2014, the

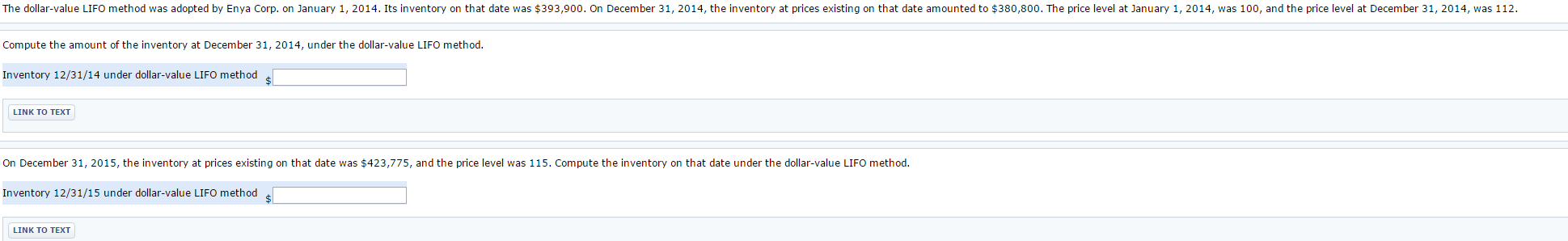

The dollar-value LIFO method was adopted by Enya Corp. on January 1, 2014. Its inventory on that date was $393,900. On December 31, 2014, the inventory at prices existing on that date amounted to $380,800. The price level at January 1, 2014, was 100, and the price level at December 31, 2014, was 112.

1: Compute the amount of the inventory at December 31, 2014, under the dollar-value LIFO method.

2: On December 31, 2015, the inventory at prices existing on that date was $423,775, and the price level was 115. Compute the inventory on that date under the dollar-value LIFO method.

**CLICK OPEN IMAGE IN NEW TAB TO SEE FULL SIZE

The dollar-value LIFO method was adopted by Enya Corp. on January 1, 2014. Its inventory on that date was $393,900. On December 31, 2014, the inventory at prices existing on that date amounted to $380,800. The price level at January 1, 2014, was 100, and the price level at December 31, 2014, was 112 on January 1, 20 Compute the amount of the inventory at December 31, 2014, under the dollar-value LIFO method ory at December 31,2014 at January 1, the invent Inventory 12/31/14 under dollar-value LIFO method 12/31/14 LINK TO TEXT On December 31, 2015, the inventory at prices existing on that date was $423,775, and the price level was 115. Compute the inventory on that date under the dollar-value LIFO method Inventory 12/31/15 under dollar-value LIFO method LINK TO TEXTStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started