Answered step by step

Verified Expert Solution

Question

1 Approved Answer

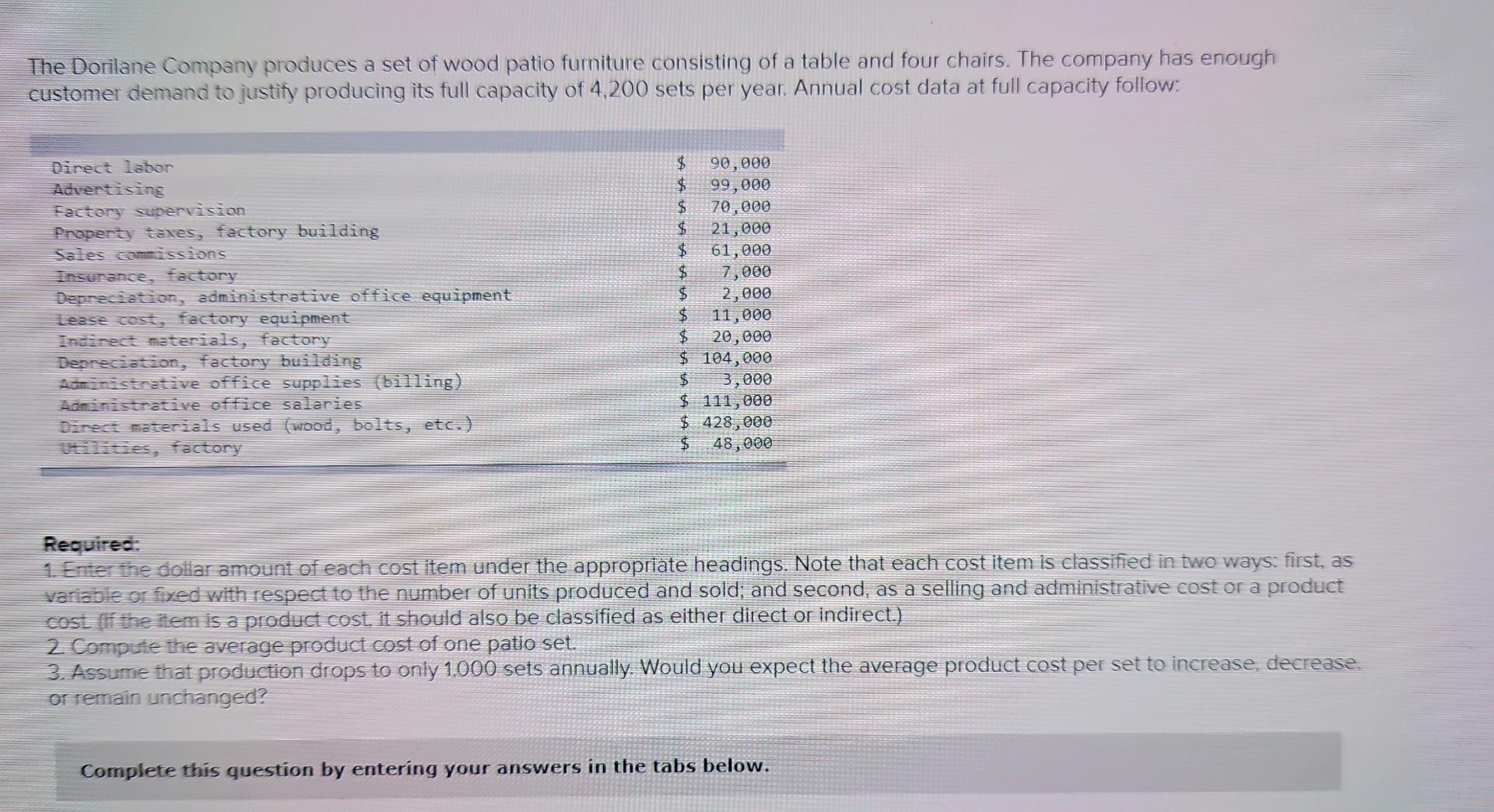

The Dorilane Company produces a set of wood patio furniture consisting of a table and four chairs. The company has enough customer demand to justify

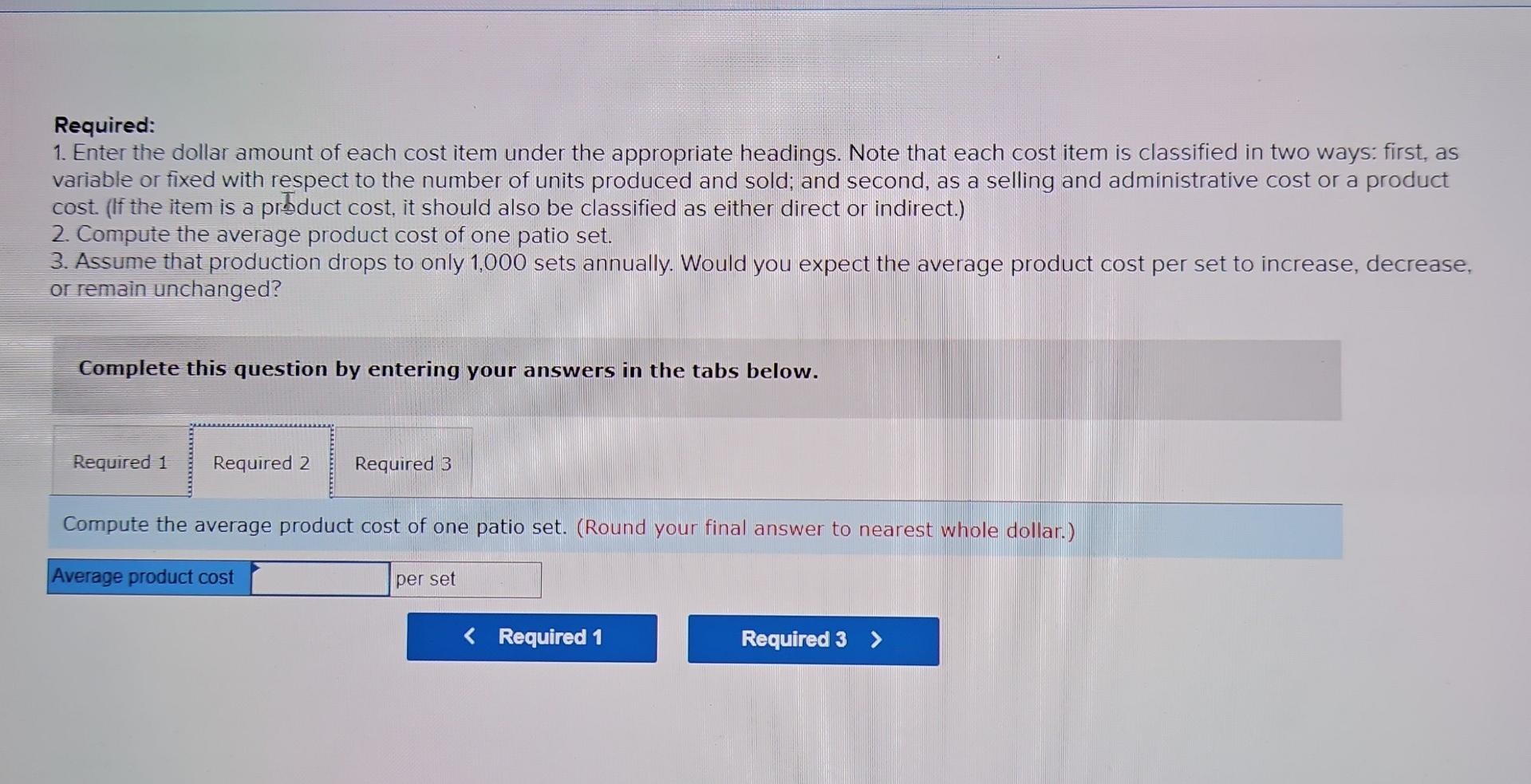

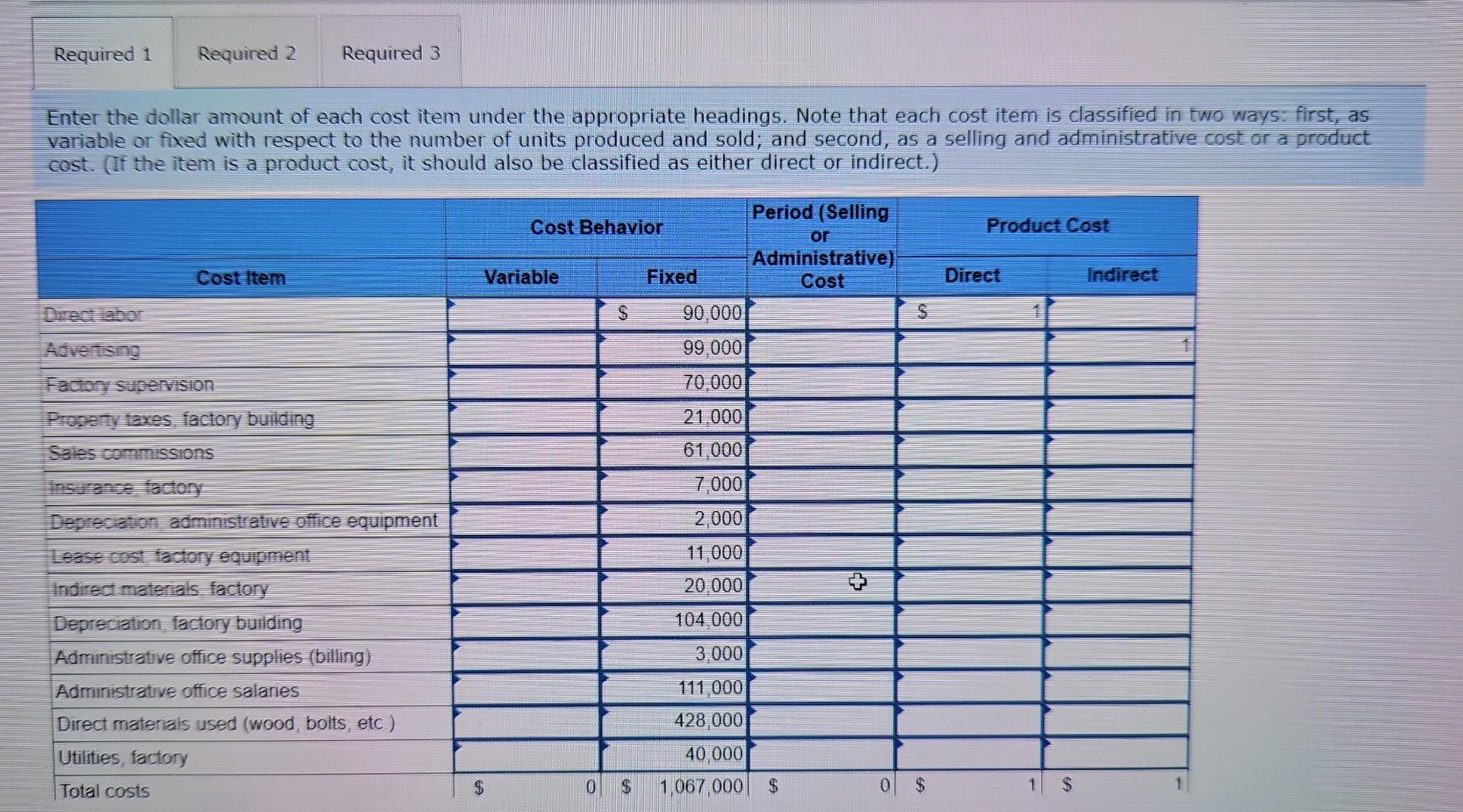

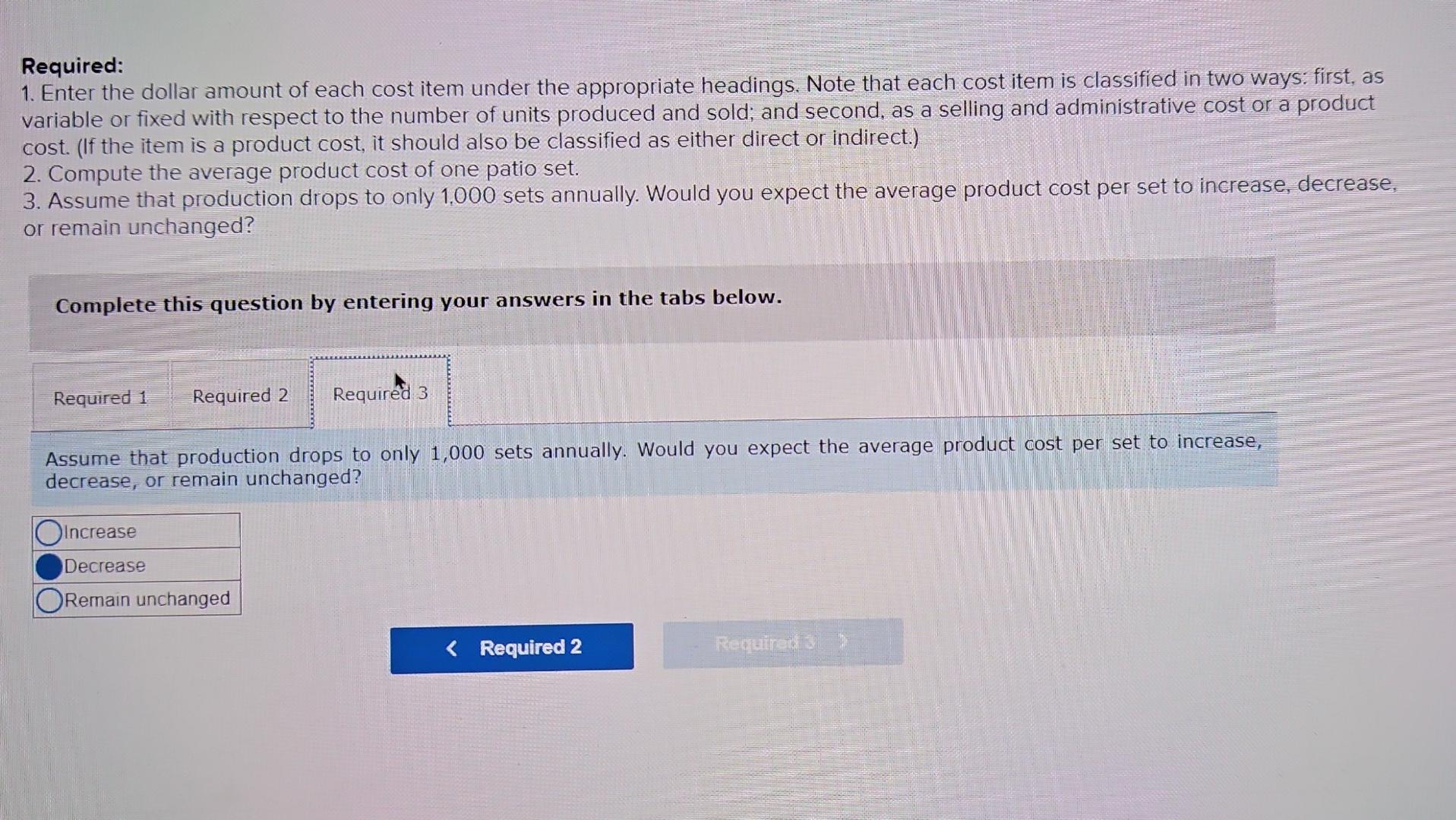

The Dorilane Company produces a set of wood patio furniture consisting of a table and four chairs. The company has enough customer demand to justify producing its full capacity of 4,200 sets per year. Annual cost data at full capacity follow: Required: 1. Enter the dollar amount of each cost item under the appropriate headings. Note that each cost item is classified in two ways: first, as variable or fixed with respect to the number of units produced and sold; and second, as a selling and administrative cost or a product cost. (ff the item is a product cost, it should also be classified as either direct or indirect.) 2. Compute the average product cost of one patio set. 3. Assume that production drops to only 1.000 sets annually. Would you expect the average product cost per set to increase, decrease. or remain unchanged? Required: 1. Enter the dollar amount of each cost item under the appropriate headings. Note that each cost item is classified in two ways: first, as variable or fixed with respect to the number of units produced and sold; and second, as a selling and administrative cost or a product cost. (If the item is a prduct cost, it should also be classified as either direct or indirect.) 2. Compute the average product cost of one patio set. 3. Assume that production drops to only 1,000 sets annually. Would you expect the average product cost per set to increase, decrease, or remain unchanged? Complete this question by entering your answers in the tabs below. Compute the average product cost of one patio set. (Round your final answer to nearest whole dollar.) Enter the dollar amount of each cost item under the appropriate headings. Note that each cost item is classified in two ways: first, as variable or fixed with respect to the number of units produced and sold; and second, as a selling and administrative cost or a product cost. (If the item is a product cost, it should also be classified as either direct or indirect.) Required: 1. Enter the dollar amount of each cost item under the appropriate headings. Note that each cost item is classified in two ways: first, as variable or fixed with respect to the number of units produced and sold; and second, as a selling and administrative cost or a product cost. (If the item is a product cost, it should also be classified as either direct or indirect.) 2. Compute the average product cost of one patio set. 3. Assume that production drops to only 1.000 sets annually. Would you expect the average product cost per set to increase, decrease, or remain unchanged? Complete this question by entering your answers in the tabs below. Assume that production drops to only 1,000 sets annually. Would you expect the average product cost per set to increase, decrease, or remain unchanged? \begin{tabular}{|l|} \hline ncrease \\ \hline Decrease \\ \hline Remain unchanged \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started