Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Double Dip Co. is expecting their ice cream sales to decline due to the increased interest in healthy eating. Thus, the company has announced

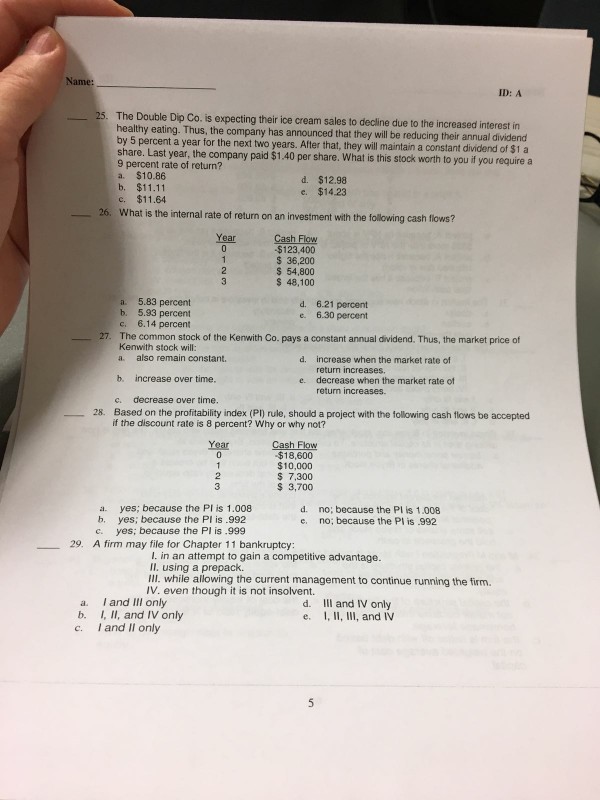

The Double Dip Co. is expecting their ice cream sales to decline due to the increased interest in healthy eating. Thus, the company has announced that they will be reducing their annual dividend by 5 percent a year for the next two years. After that, they will maintain a constant dividend a share. Last year, the company paid $1.40 per share. What is this stock worth to you if you require a 9 percent rate of return? a. $10.86 b, $11.11 c. $11.64 d. $12.98 e. $14.23 What is the internal rate of return on an investment with the following cash flows? a. 5.83 percent b. 5.93 percent c. 6.14 percent d. 6.21 percent e. 6.30 percent The common stock of the Kenwith Co. pays a constant annual dividend. Thus, the market price of Kenwith stock will: a. also remain constant. b. increase over time. c. decrease over time. d. increase when the market rate of return increases. e. decrease when the market rate of return increases. Based on the profitability index (PI) rule, should a project with the following cash flows be accepted if the discount rate is 8 percent? Why or why not? a. yes; because the PI is 1.008 b. yes, because the PI is .992 c. yes; because the PI is .999 d. no; because the PI is 1.008 e. no; because the PI is .992 A firm may file for Chapter 11 bankruptcy: I. in an attempt to gain a competitive advantage. II. using a prepack. III. while allowing the current management to continue running the firm. IV. even though it is not insolvent. a. I and III only b. I, II, and IV only c. I and II only d. III and IV only e. I, II, III, and IV

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started