Answered step by step

Verified Expert Solution

Question

1 Approved Answer

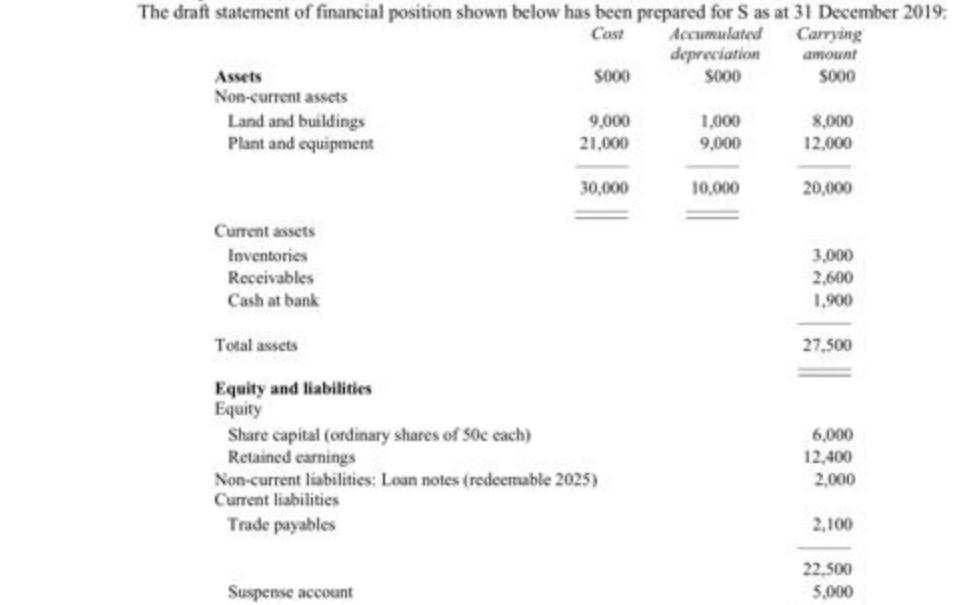

The draft statement of financial position shown below has been prepared for S as at 31 December 2019 Cost Accumulated depreciation 5000 Assets Non-current

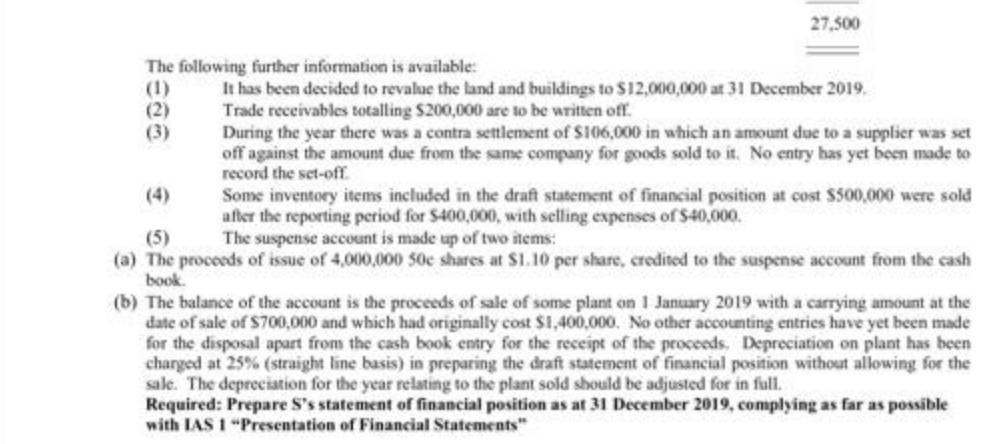

The draft statement of financial position shown below has been prepared for S as at 31 December 2019 Cost Accumulated depreciation 5000 Assets Non-current assets Land and buildings Plant and equipment Current assets Inventories Receivables Cash at bank Total assets Equity and liabilities Equity Current liabilities Trade payables 5000 Suspense account 9,000 21,000 Share capital (ordinary shares of 50c each) Retained earnings Non-current liabilities: Loan notes (redeemable 2025) 30,000 1,000 9,000 10,000 Carrying amount $000 8,000 12,000 20,000 3,000 2,600 1,900 27,500 6,000 12,400 2,000 2,100 22,500 5,000 The following further information is available: (2) 27,500 It has been decided to revalue the land and buildings to $12,000,000 at 31 December 2019. Trade receivables totalling $200,000 are to be written off. During the year there was a contra settlement of $106,000 in which an amount due to a supplier was set off against the amount due from the same company for goods sold to it. No entry has yet been made to record the set-off. Some inventory items included in the draft statement of financial position at cost $500,000 were sold after the reporting period for $400,000, with selling expenses of $40,000. The suspense account is made up of two items: (5) (a) The proceeds of issue of 4,000,000 50c shares at $1.10 per share, credited to the suspense account from the cash book. (b) The balance of the account is the proceeds of sale of some plant on 1 January 2019 with a carrying amount at the date of sale of $700,000 and which had originally cost $1,400,000. No other accounting entries have yet been made for the disposal apart from the cash book entry for the receipt of the proceeds. Depreciation on plant has been charged at 25% (straight line basis) in preparing the draft statement of financial position without allowing for the sale. The depreciation for the year relating to the plant sold should be adjusted for in full. Required: Prepare S's statement of financial position as at 31 December 2019, complying as far as possible with IAS 1 "Presentation of Financial Statements"

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To prepare Ss statement of financial position as at 31 December 2019 we need to make adjustments based on the additional information provided Lets go through the adjustments step by step Step 1 Revalu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started