Answered step by step

Verified Expert Solution

Question

1 Approved Answer

que fic The draft statements of financial position at 31 March 2021 and statements of profit or loss for the year ended 31 March

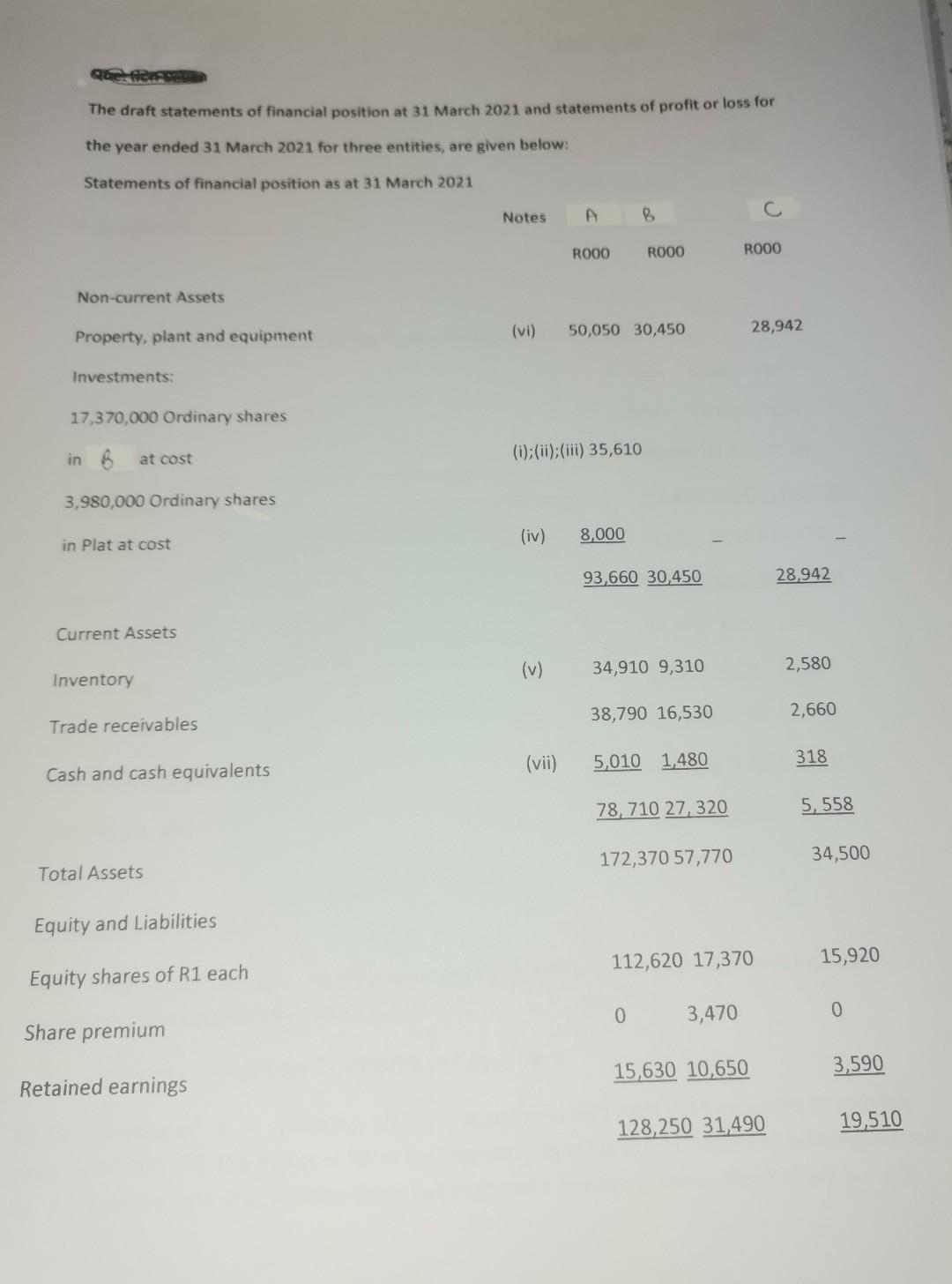

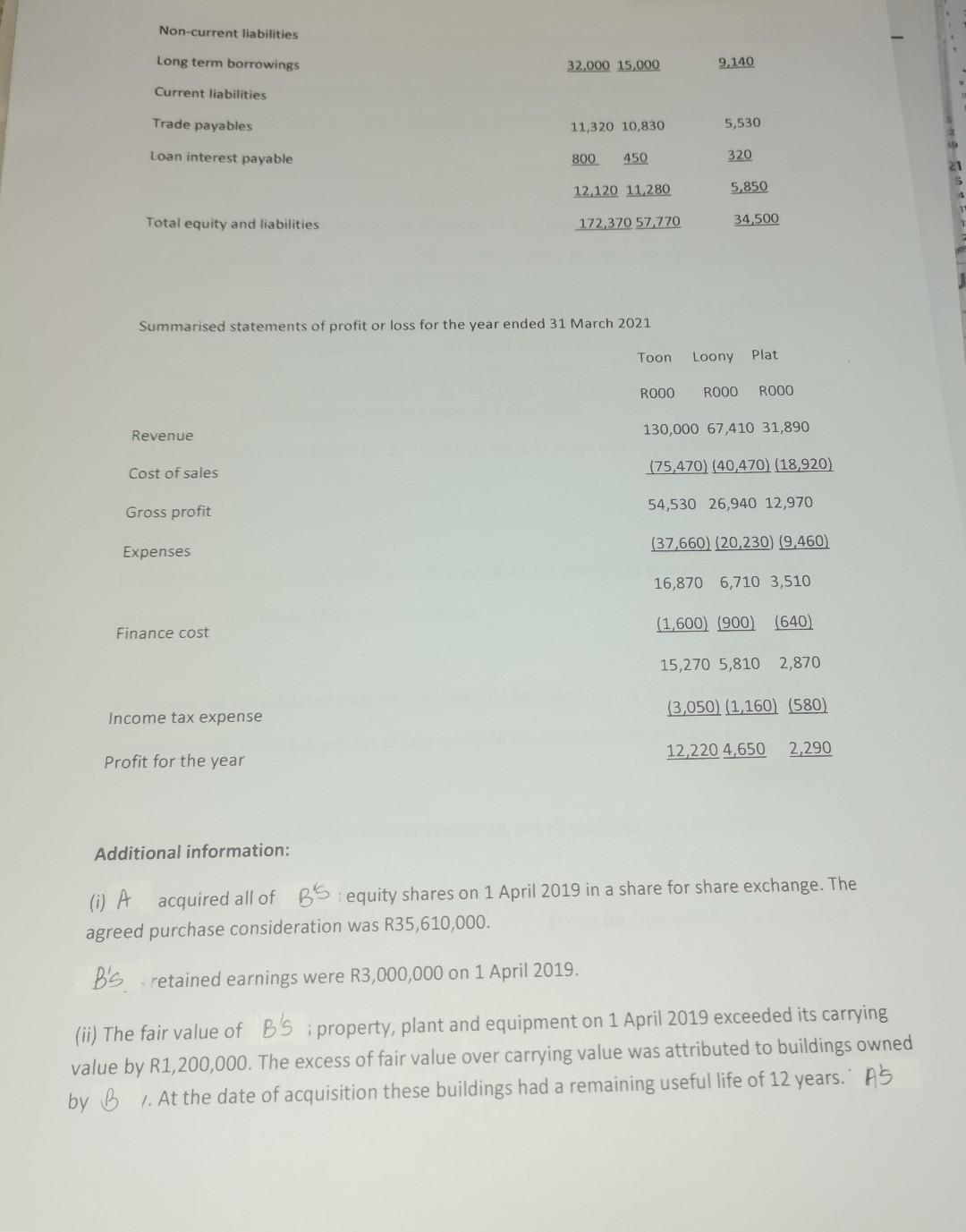

que fic The draft statements of financial position at 31 March 2021 and statements of profit or loss for the year ended 31 March 2021 for three entities, are given below: Statements of financial position as at 31 March 2021 Non-current Assets Property, plant and equipment Investments: 17,370,000 Ordinary shares in 8 3,980,000 Ordinary shares at cost in Plat at cost Current Assets Inventory Trade receivables Cash and cash equivalents Total Assets Equity and Liabilities Equity shares of R1 each Share premium Retained earnings Notes A ROOO (v) (vi) 50,050 30,450 (i); (ii); (iii) 35,610 (iv) 8,000 (vii) B ROOO 93,660 30,450 34,910 9,310 38,790 16,530 5,010 1,480 78,710 27, 320 172,370 57,770 0 ROOO 112,620 17,370 3,470 28,942 15,630 10,650 128,250 31,490 28,942 2,580 2,660 318 5,558 34,500 15,920 0 3,590 19,510 Non-current liabilities Long term borrowings Current liabilities Trade payables Loan interest payable Total equity and liabilities Revenue Cost of sales Gross profit Expenses Summarised statements of profit or loss for the year ended 31 March 2021 Finance cost Income tax expense 32,000 15,000 Profit for the year 11,320 10,830 800 450 12,120 11,280 172,370 57,770 Toon R000 9,140 5,530 320 5,850 34,500 Loony Plat ROOO ROOO 130,000 67,410 31,890 (75,470) (40,470) (18,920) 54,530 26,940 12,970 (37,660) (20,230) (9,460) 16,870 6,710 3,510 (1,600) (900) (640) 15,270 5,810 2,870 (3,050) (1,160) (580) 12,220 4,650 2,290 Additional information: (i) A acquired all of BS equity shares on 1 April 2019 in a share for share exchange. The agreed purchase consideration was R35,610,000. B's retained earnings were R3,000,000 on 1 April 2019. T (ii) The fair value of B's property, plant and equipment on 1 April 2019 exceeded its carrying value by R1,200,000. The excess of fair value over carrying value was attributed to buildings owned by B. At the date of acquisition these buildings had a remaining useful life of 12 years. AS accounting policy is to depreciate all property, plant and equipment using the straight line basis with no residual value. (iii) A carried out an impairment review of the goodwill arising on acquisition of Band found that as at 31 March 2021 the goodwill had NOT been impaired but had actually increased in value by R50,000. (iv) A purchased its shareholding in C on 1 April 2020 for R8,000,000. The fair value of C's net assets was the same as its carrying value at that date. A exercises significant influence over all aspects of ct financial and operating policies. (v) A occasionally trades with During February 2021 Asold goods for R960,000. B had not paid for the goods by 31 March 2021. A uses a mark-up of 331/3% on cost. 20% of the goods had been sold by (vi) Asold a piece of machinery to on 1 April 2020 for R115,000. The machinery had A property, plant and previously been used in A's business and had been included in equipment at a carrying value of R90,000. A had recognised the profit on disposal in revenue. The machinery had a remaining useful life of 5 years on 1 April 2020. transferred R115,000 to A on 31 March 2021 which was not recorded by (vii) B April 2021. Required: at 31 March 2021. shown. (b) Prepare the consolidated statement of financial position for A as at 31 March 2021, in accordance with the requirements of International Financial Reporting Standards. Notes to the financial statements are not required, but all workings must be clearly until (Total for Question Four = 25 marks)

Step by Step Solution

★★★★★

3.42 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

Consolidated Statement of Financial Position for A as at 31 March 2021 Assets Amount Noncurrent asse...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started