Answered step by step

Verified Expert Solution

Question

1 Approved Answer

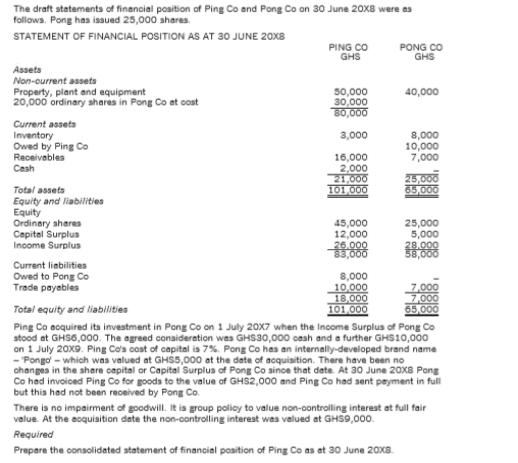

The draft statements of financial position of Ping Co and Pong Co on 30 June 20X8 were as follows. Pong has issued 25,000 shares.

The draft statements of financial position of Ping Co and Pong Co on 30 June 20X8 were as follows. Pong has issued 25,000 shares. STATEMENT OF FINANCIAL POSITION AS AT 30 JUNE 20x8 Assets Non-current assets Property, plant and equipment 20,000 ordinary shares in Pong Co at cost Current assets Inventory Owed by Ping Co Receivables Cash Total assets Equity and liabilities Equity Ordinary shares Capital Surplus Income Surplus Current liabilities Owed to Pong Co Trade payables Total equity and liabilities PING CO GHS PONG CO GHS 50,000 40,000 30,000 80,000 3,000 8,000 10,000 16,000 7,000 2,000 21,000 25,000 101,000 65,000 45,000 25,000 12,000 5,000 26.000 28.000 83,000 8,000 10,000 7,000 18,000 7,000 101,000 65,000 Ping Co acquired its investment in Pong Co on 1 July 20X7 when the Income Surplus of Pong Co stood at GHS6,000. The agreed consideration was GHS30,000 cash and a further GHS10,000 on 1 July 20x9. Ping Co's cost of capital is 7%. Pong Co has an internally-developed brand name -Pongo - which was valued at GHS5,000 at the date of acquisition. There have been no changes in the share capital or Capital Surplus of Pong Co since that date. At 30 June 20X8 Pong Co had invoiced Ping Co for goods to the value of GHS2,000 and Ping Co had sent payment in full but this had not been received by Pong Co. There is no impairment of goodwill. It is group policy to value non-controlling interest at full fair value. At the acquisition date the non-controlling interest was valued at GH59,000. Required Prepare the consolidated statement of financial position of Ping Co as at 30 June 20x8.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To prepare the consolidated statement of financial position for P...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started