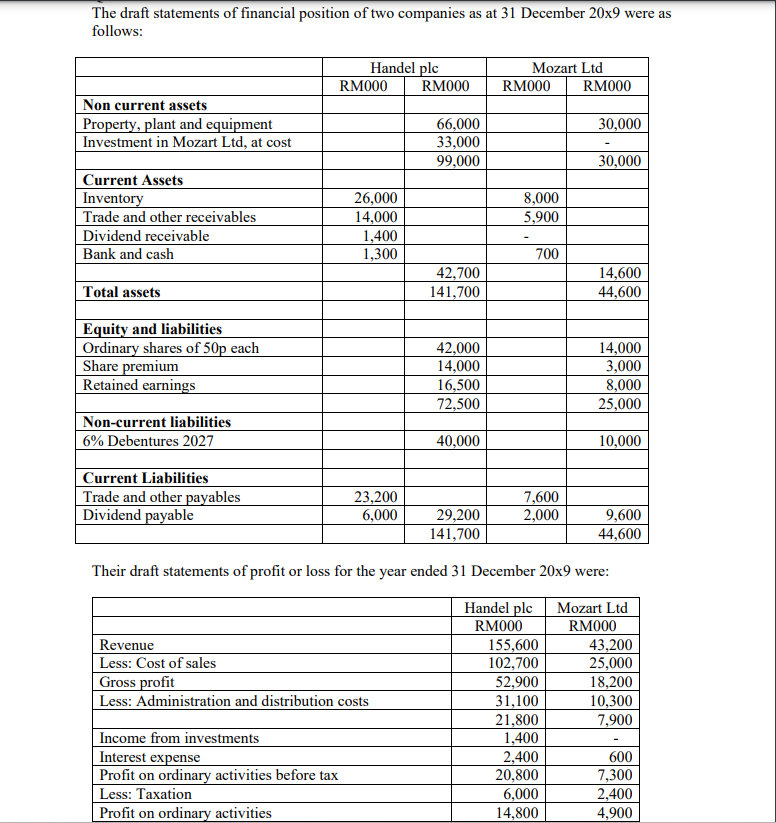

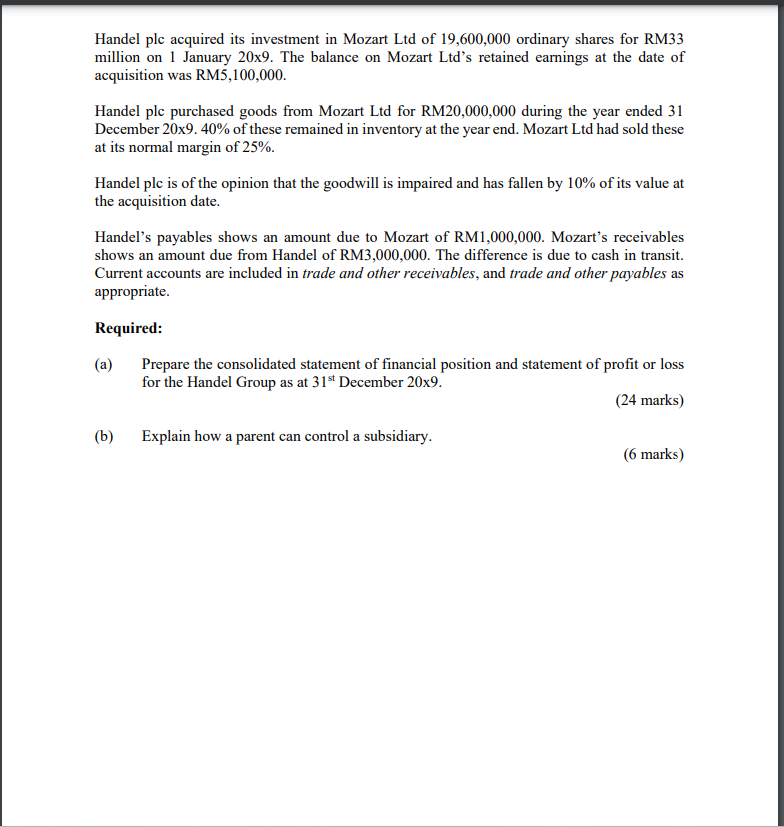

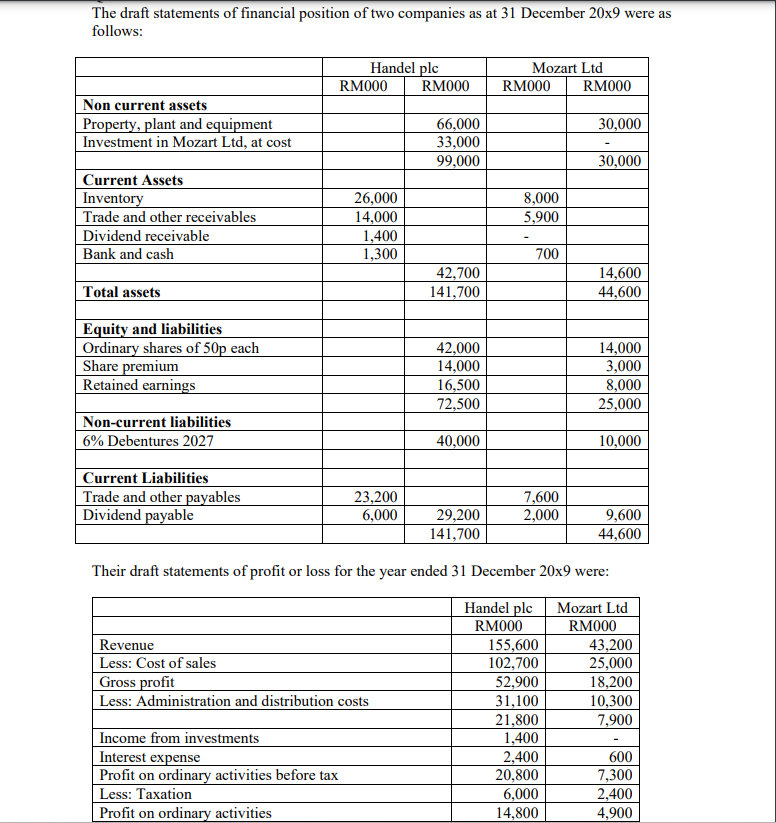

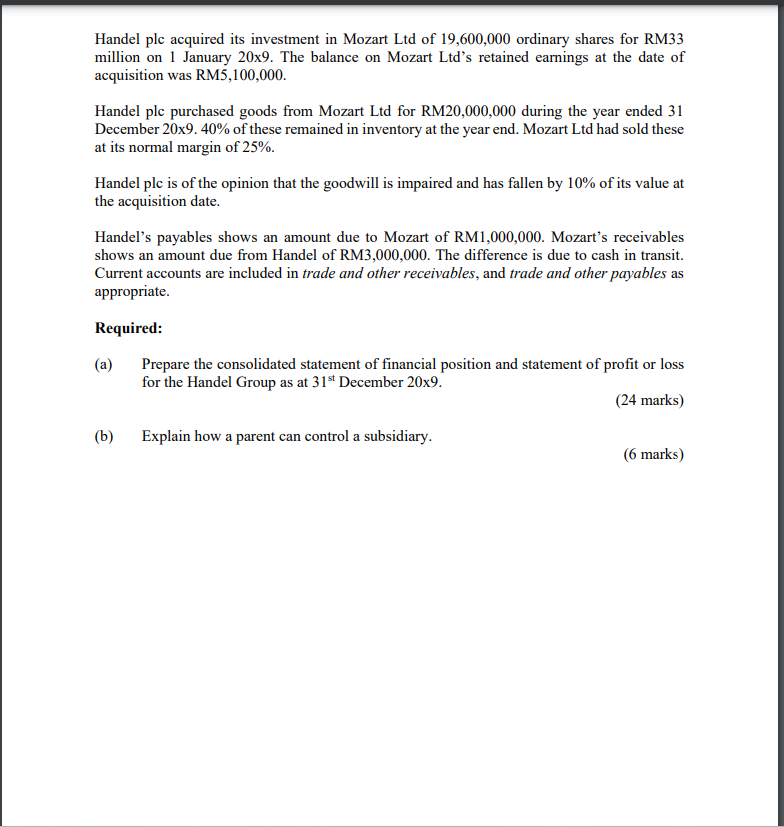

The draft statements of financial position of two companies as at 31 December 209 were as follows: Their draft statements of profit or loss for the year ended 31 December 20x9 were: Handel plc acquired its investment in Mozart Ltd of 19,600,000 ordinary shares for RM33 million on 1 January 209. The balance on Mozart Ltd's retained earnings at the date of acquisition was RM5,100,000. Handel plc purchased goods from Mozart Ltd for RM20,000,000 during the year ended 31 December 209.40% of these remained in inventory at the year end. Mozart Ltd had sold these at its normal margin of 25%. Handel plc is of the opinion that the goodwill is impaired and has fallen by 10% of its value at the acquisition date. Handel's payables shows an amount due to Mozart of RM1,000,000. Mozart's receivables shows an amount due from Handel of RM3,000,000. The difference is due to cash in transit. Current accounts are included in trade and other receivables, and trade and other payables as appropriate. Required: (a) Prepare the consolidated statement of financial position and statement of profit or loss for the Handel Group as at 31st December 209. (24 marks) (b) Explain how a parent can control a subsidiary. (6 marks) The draft statements of financial position of two companies as at 31 December 209 were as follows: Their draft statements of profit or loss for the year ended 31 December 20x9 were: Handel plc acquired its investment in Mozart Ltd of 19,600,000 ordinary shares for RM33 million on 1 January 209. The balance on Mozart Ltd's retained earnings at the date of acquisition was RM5,100,000. Handel plc purchased goods from Mozart Ltd for RM20,000,000 during the year ended 31 December 209.40% of these remained in inventory at the year end. Mozart Ltd had sold these at its normal margin of 25%. Handel plc is of the opinion that the goodwill is impaired and has fallen by 10% of its value at the acquisition date. Handel's payables shows an amount due to Mozart of RM1,000,000. Mozart's receivables shows an amount due from Handel of RM3,000,000. The difference is due to cash in transit. Current accounts are included in trade and other receivables, and trade and other payables as appropriate. Required: (a) Prepare the consolidated statement of financial position and statement of profit or loss for the Handel Group as at 31st December 209. (24 marks) (b) Explain how a parent can control a subsidiary. (6 marks)