Answered step by step

Verified Expert Solution

Question

1 Approved Answer

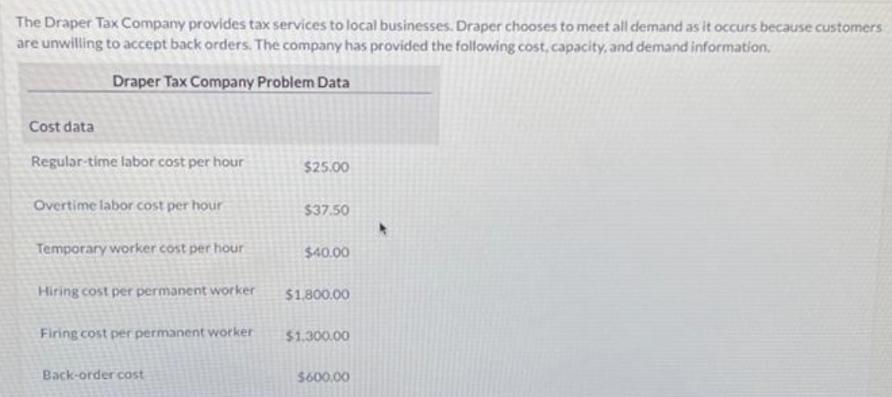

The Draper Tax Company provides tax services to local businesses. Draper chooses to meet all demand as it occurs because customers are unwilling to

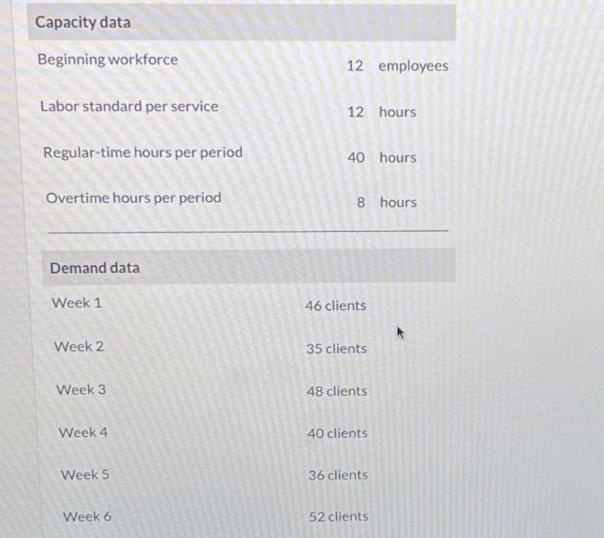

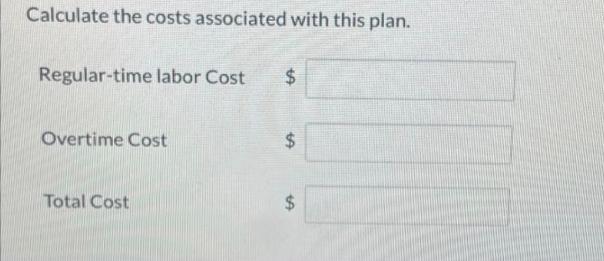

The Draper Tax Company provides tax services to local businesses. Draper chooses to meet all demand as it occurs because customers are unwilling to accept back orders. The company has provided the following cost, capacity, and demand information. Draper Tax Company Problem Data Cost data Regular-time labor cost per hour Overtime labor cost per hour Temporary worker cost per hour Hiring cost per permanent worker Firing cost per permanent worker Back-order cost $25.00 $37.50 $40.00 $1,800.00 $1.300.00 $600.00 Capacity data Beginning workforce Labor standard per service Regular-time hours per period Overtime hours per period Demand data Week 1 Week 2 Week 3 Week 4 Week 5 Week 6 12 employees 12 hours 40 hours 8 hours 46 clients 35 clients 48 clients 40 clients 36 clients 52 clients Calculate the costs associated with this plan. Regular-time labor Cost Overtime Cost Total Cost $ tA SA $ EA

Step by Step Solution

★★★★★

3.44 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the costs associated with the Draper Tax Companys plan we need to consider the labor needed to service clients every week and then calcul...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started