The drop down menus in the word problem are: The present value of investment opportunity A is $_____ and the present value of the invest opportunity B is $________. Investment opportunity (A or B) should be chosen because the present value of cash flows is (higher or lower) than the present value of investment opportunity (A or B)

The drop down menus in the word problem are: The present value of investment opportunity A is $_____ and the present value of the invest opportunity B is $________. Investment opportunity (A or B) should be chosen because the present value of cash flows is (higher or lower) than the present value of investment opportunity (A or B)

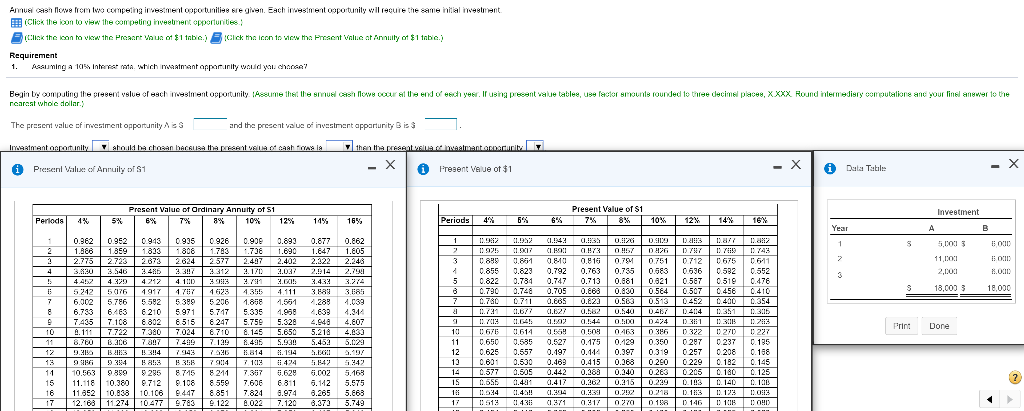

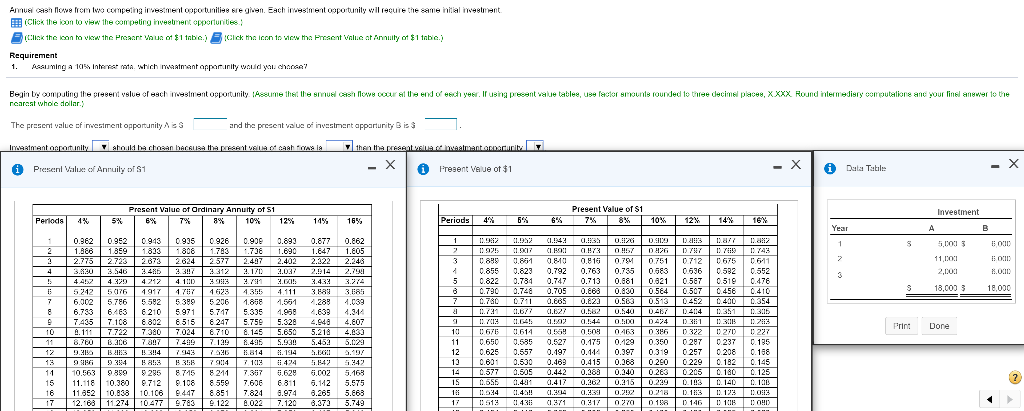

musical em to competing investment opportunities seguen Esch investment opportunity will recure the same initial investment (Click the icon to view the competing investment opportunities Click the icon to view the Preact Vous of $1 tabic. Cick me icon to view the Present Valu.cat Annuity of $1 tnbc.) Requirement 1. Assuming A Inter which w a nt a prinity would you choos? Begin by computing the present volue creschwestment opportunity Assume that the smalcas low o nearest whole dollar. r at the end of each year. If using procent value tables, use lactor mounts rounded to three decimal places, XXXX Round intermediary computations and your linel answer to the The present value of investment opportunity and the present value of investment apportunity is $ Investment opportunity should be chosen because the presta ocash raj then the presentes matiantaranuit i Present Value of Anruily of S1 - X Fresent Value of $1 - X | Dula Tistiles - X Present Value of $1 7% 8% Present Value of Ordinary Annuity of S1 6% 7% 1 8 % 10% Investment Periods 4% 5% 12% 14% 16% Periods 48 6 % 6% 10% 12% 14% 16% 1 0.362 1.888 2.775 3.830 4.4 0.952 1859 2.723 3.546 4.320 0943 09350 926 1813 1808 1743 2873 2.824 2 577 3.485 33!!7 3312 42124 100 333 0.90 .70 2.497 2.170 3.75 0.893 1.690 2.402 2.037 3.6.1! 0.877 1.847 2.322 2.914 3.432 0.862 1.805 2.243 2.790 3.274 3 19.9821.982 1.143 0. 1925 1917 LAI 0.73 0.8891.87110.800.916 0.855 0.823 0.7920.763 .822 0.784 0.747 0.713 0.790 0.748 0.705 0.883 .780 0.71 0.685 0.823 .731 1.677 0.027 0.582 0.0026 0.81109 D S 0.87 0.22 0.57 076 077 178 1743 0.794 0.751 0742 0675 4711 0.755 0.5830536 0.532 0.552 0.681 0.021 0.587 0.519 0.476 0.43 0.58405070.4560.410 0.583 0.513 0452 0.400 0.354 0.540 0.47 0.41: 4 0.351 0.3:15 11.2001 2.000 BOCII 1.000 18.000 5 0 $ 18,000 3 7 2 0 0 8 6 6 7 10 118 12 9 6.002 .753 .405 .11: .760 .319 5.786 559253995 206 1.888 64 63 62105971 5.7475.335 7.1086 802 651562475.759 7.712739070247 0 .145 316 7 317 7.44 7.13 8.495 353 354 7.6143 7035 15.814 .591 4.959 5.328 5.650 5.435 3.1914 .289 2.633 2.649 5.218 .452 .10 4.039 4.344 4.807 4.633 5.129 . Prin: Done 101 1167614 057 0.650 9.585 0.527 12 0.625 0.557 0.197 100.6010.500 0.489 14 0.5770.505 0.442 058 0463 0376 03221 2700227 0.175 0.1290 350 0297 0.237 0.1140.3970 319 0257 0.208 0.168 0.415 0.268 02600 229 0.182 0.145 0.2880.240 0.283 0205 0.180 0.125 1. 31 0.22 0.28 0.1013 02.123 1.0913 03170270 0 10 0 146 01:15 :00 14 10.563 9 359 92858 745 8211 15 11.118 0.3809712 1088 559 16 11.8520 .833 10.106 447 & 851 172 .63 11 274 10 47770 122 7387 7.606 7.824 .022 0.629 6311 3.974 7.120 6.6OZ 9.142 3.285 3.373 5.163 5.575 5.663 5.749 18 1 .524 171513 .1.4.!! 1 438 C3614 1371

The drop down menus in the word problem are: The present value of investment opportunity A is $_____ and the present value of the invest opportunity B is $________. Investment opportunity (A or B) should be chosen because the present value of cash flows is (higher or lower) than the present value of investment opportunity (A or B)

The drop down menus in the word problem are: The present value of investment opportunity A is $_____ and the present value of the invest opportunity B is $________. Investment opportunity (A or B) should be chosen because the present value of cash flows is (higher or lower) than the present value of investment opportunity (A or B)