Answered step by step

Verified Expert Solution

Question

1 Approved Answer

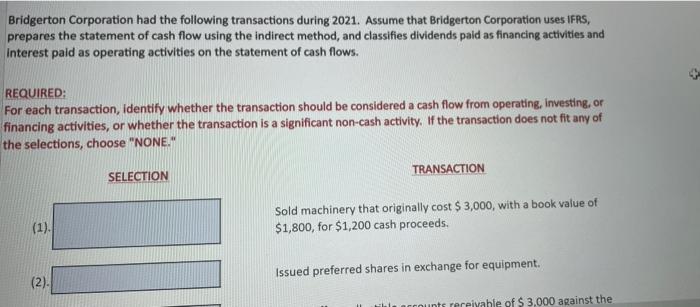

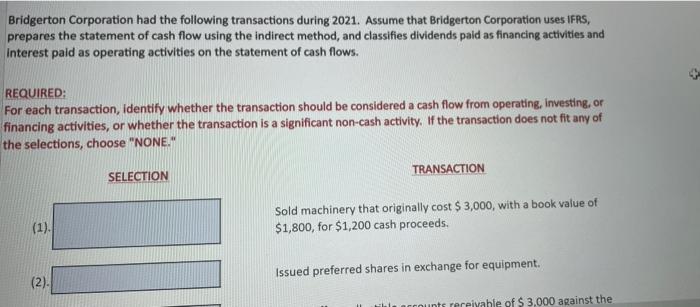

the dropdown option is same for all the parts Bridgerton Corporation had the following transactions during 2021. Assume that Bridgerton Corporation uses IFRS, prepares the

the dropdown option is same for all the parts

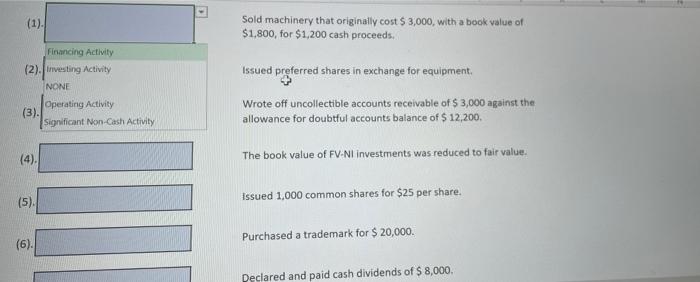

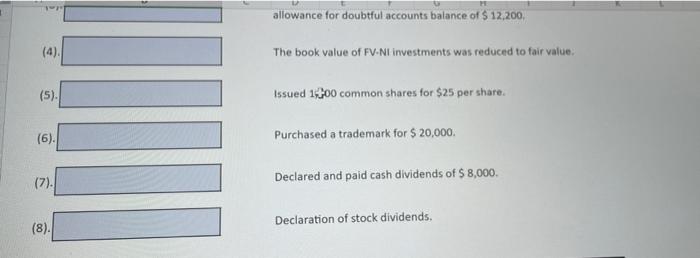

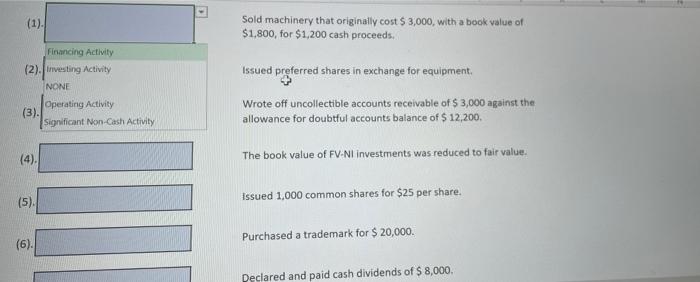

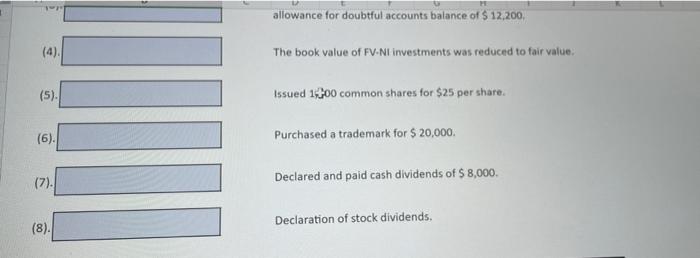

Bridgerton Corporation had the following transactions during 2021. Assume that Bridgerton Corporation uses IFRS, prepares the statement of cash flow using the indirect method, and classifies dividends paid as financing activities and Interest paid as operating activities on the statement of cash flows. REQUIRED: For each transaction, identify whether the transaction should be considered a cash flow from operating. Investing, or financing activities, or whether the transaction is a significant non-cash activity. If the transaction does not fit any of the selections, choose "NONE." SELECTION TRANSACTION (1). Sold machinery that originally cost $3,000, with a book value of $1,800, for $1,200 cash proceeds. Issued preferred shares in exchange for equipment. (2). 2 counts receivable of $3,000 against the - (1). Sold machinery that originally cost $3,000, with a book value of $1,800, for $1,200 cash proceeds. Issued preferred shares in exchange for equipment, Financing Activity (2). Investing Activity NONE operating Activity (3). Significant Non-Cash Activity Wrote off uncollectible accounts receivable of $ 3,000 against the allowance for doubtful accounts balance of $ 12,200. (4). 4). The book value of FV-Nl investments was reduced to fair value. (5) ) Issued 1,000 common shares for $25 per share. 6) Purchased a trademark for $ 20,000. (6). Declared and paid cash dividends of $ 8,000 allowance for doubtful accounts balance of $ 12,200, The book value of FV.Ni investments was reduced to fair value (5) Issued 1700 common shares for $25 per share. (6). Purchased a trademark for $ 20,000 (7) Declared and paid cash dividends of $ 8,000 (8) Declaration of stock dividends

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started