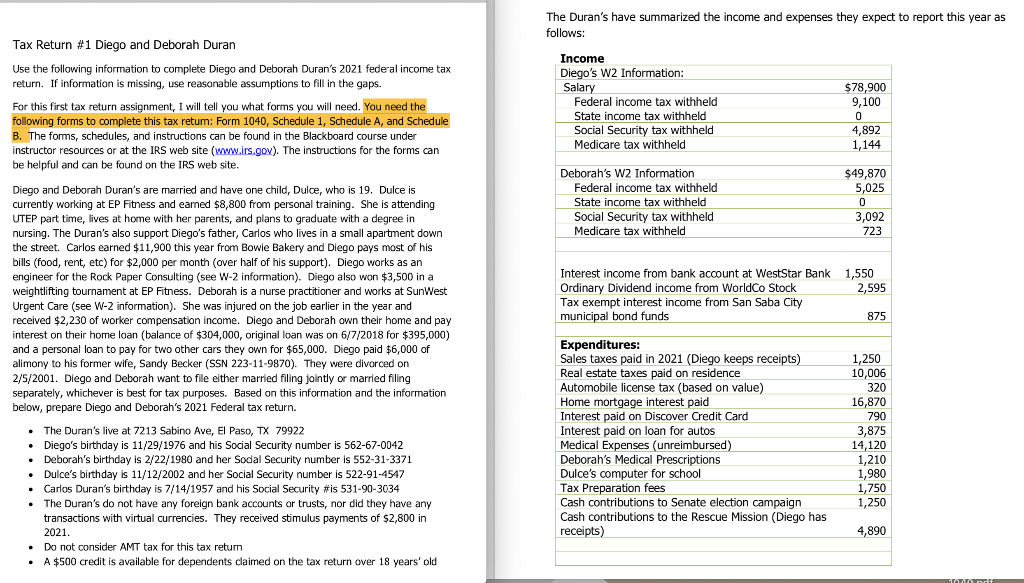

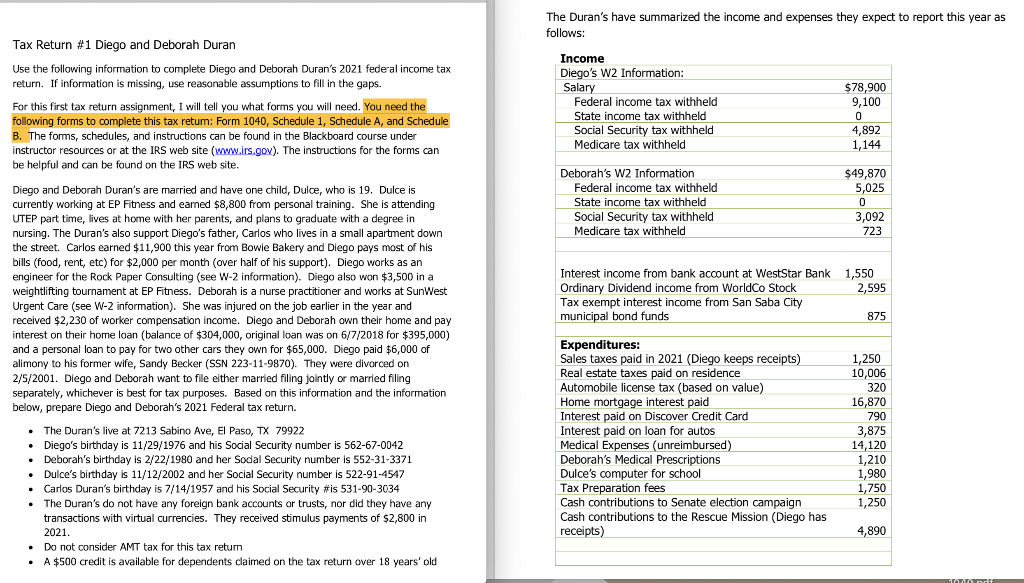

The Duran's have summarized the income and expenses they expect to report this year as follows: Tax Return #1 Diego and Deborah Duran Use the following information to complete Diego and Deborah Duran's 2021 federal income tax return. If information is missing, use reasonable assumptions to fill in the gaps. $78,900 For this first tax return assignment, I will tell you what forms you will need. You need the following forms to complete this tax retum: Form 1040, Schedule 1, Schedule A, and Schedule B. The forms, schedules, and instructions can be found in the Blackboard course under instructor resources or at the IRS web site (www.irs.gov). The instructions for the forms can be helpful and can be found on the IRS web site. Income Diego's W2 Information: Salary Federal income tax withheld State income tax withheld Social Security tax withheld Medicare tax withheld 9,100 0 4,892 1,144 Deborah's W2 Information Federal income tax withheld State income tax withheld Social Security tax withheld Medicare tax withheld $49,870 5,025 0 3,092 723 1,550 2,595 Interest income from bank account at WestStar Bank Ordinary Dividend income from WorldCo Stock Tax exempt interest income from San Saba City municipal bond funds 875 Diego and Deborah Duran's are married and have one child, Dulce, who is 19. Dulce is currently working at EP Fitness and earned $8,800 from personal training. She is attending UTEP part time, lives at home with her parents, and plans to graduate with a degree in nursing. The Duran's also support Diego's father, Carlos who lives in a small apartment down the street. Carlos earned $11,900 this year from Bowie Bakery and Diego pays most of his bills (food, rent, etc) for $2,000 per month (over half of his support). Diego works as an engineer for the Rock Paper Consulting (see W-2 information). Diego also won $3,500 in a weightlifting tournament at EP Fitness. Deborah is a nurse practitioner and works at SunWest Urgent Care (see W-2 information). She was injured on the job earlier in the year and received $2,230 of worker compensation income. Diego and Deborah own their home and pay interest on their home loan (balance of $304,000, original loan was on 6/7/2018 for $395,000) and a personal loan to pay for two other cars they own for $65,000. Diego paid $6,000 of alimony to his former wife, Sandy Becker (SSN 223-11-9870). They were divorced on 2/5/2001. Diego and Deborah want to file either married filing jointly or married filing separately, whichever is best for tax purposes. Based on this information and the information below, prepare Diego and Deborah's 2021 Federal tax return. The Duran's live at 7213 Sabino Ave, El Paso, TX 79922 Diego's birthday is 11/29/1976 and his Social Security number is 562-67-0042 Deborah's birthday is 2/22/1980 and her Sodal Security number is 552-31-3371 Dulce's birthday is 11/12/2002 and her Social Security number is 522-91-4547 Carlos Duran's birthday is 7/14/1957 and his Social Security #is 531-90-3034 The Duran's do not have any foreign bank accounts or trusts, nor did they have any transactions with virtual currencies. They received stimulus payments of $2,800 in 2021 Do not consider AMT tax for this tax return A $500 credit is available for dependents claimed on the tax return over 18 years' old Expenditures: Sales taxes paid in 2021 (Diego keeps receipts) Real estate taxes paid on residence Automobile license tax (based on value) Home mortgage interest paid Interest paid on Discover Credit Card Interest paid on loan for autos Medical Expenses (unreimbursed) Deborah's Medical Prescriptions Dulce's computer for school Tax Preparation fees Cash contributions to Senate election campaign Cash contributions to the Rescue Mission (Diego has receipts) 1,250 10,006 320 16,870 790 3,875 14,120 1,210 1,980 1,750 1,250 4,890 . GETICE The Duran's have summarized the income and expenses they expect to report this year as follows: Tax Return #1 Diego and Deborah Duran Use the following information to complete Diego and Deborah Duran's 2021 federal income tax return. If information is missing, use reasonable assumptions to fill in the gaps. $78,900 For this first tax return assignment, I will tell you what forms you will need. You need the following forms to complete this tax retum: Form 1040, Schedule 1, Schedule A, and Schedule B. The forms, schedules, and instructions can be found in the Blackboard course under instructor resources or at the IRS web site (www.irs.gov). The instructions for the forms can be helpful and can be found on the IRS web site. Income Diego's W2 Information: Salary Federal income tax withheld State income tax withheld Social Security tax withheld Medicare tax withheld 9,100 0 4,892 1,144 Deborah's W2 Information Federal income tax withheld State income tax withheld Social Security tax withheld Medicare tax withheld $49,870 5,025 0 3,092 723 1,550 2,595 Interest income from bank account at WestStar Bank Ordinary Dividend income from WorldCo Stock Tax exempt interest income from San Saba City municipal bond funds 875 Diego and Deborah Duran's are married and have one child, Dulce, who is 19. Dulce is currently working at EP Fitness and earned $8,800 from personal training. She is attending UTEP part time, lives at home with her parents, and plans to graduate with a degree in nursing. The Duran's also support Diego's father, Carlos who lives in a small apartment down the street. Carlos earned $11,900 this year from Bowie Bakery and Diego pays most of his bills (food, rent, etc) for $2,000 per month (over half of his support). Diego works as an engineer for the Rock Paper Consulting (see W-2 information). Diego also won $3,500 in a weightlifting tournament at EP Fitness. Deborah is a nurse practitioner and works at SunWest Urgent Care (see W-2 information). She was injured on the job earlier in the year and received $2,230 of worker compensation income. Diego and Deborah own their home and pay interest on their home loan (balance of $304,000, original loan was on 6/7/2018 for $395,000) and a personal loan to pay for two other cars they own for $65,000. Diego paid $6,000 of alimony to his former wife, Sandy Becker (SSN 223-11-9870). They were divorced on 2/5/2001. Diego and Deborah want to file either married filing jointly or married filing separately, whichever is best for tax purposes. Based on this information and the information below, prepare Diego and Deborah's 2021 Federal tax return. The Duran's live at 7213 Sabino Ave, El Paso, TX 79922 Diego's birthday is 11/29/1976 and his Social Security number is 562-67-0042 Deborah's birthday is 2/22/1980 and her Sodal Security number is 552-31-3371 Dulce's birthday is 11/12/2002 and her Social Security number is 522-91-4547 Carlos Duran's birthday is 7/14/1957 and his Social Security #is 531-90-3034 The Duran's do not have any foreign bank accounts or trusts, nor did they have any transactions with virtual currencies. They received stimulus payments of $2,800 in 2021 Do not consider AMT tax for this tax return A $500 credit is available for dependents claimed on the tax return over 18 years' old Expenditures: Sales taxes paid in 2021 (Diego keeps receipts) Real estate taxes paid on residence Automobile license tax (based on value) Home mortgage interest paid Interest paid on Discover Credit Card Interest paid on loan for autos Medical Expenses (unreimbursed) Deborah's Medical Prescriptions Dulce's computer for school Tax Preparation fees Cash contributions to Senate election campaign Cash contributions to the Rescue Mission (Diego has receipts) 1,250 10,006 320 16,870 790 3,875 14,120 1,210 1,980 1,750 1,250 4,890 . GETICE