Answered step by step

Verified Expert Solution

Question

1 Approved Answer

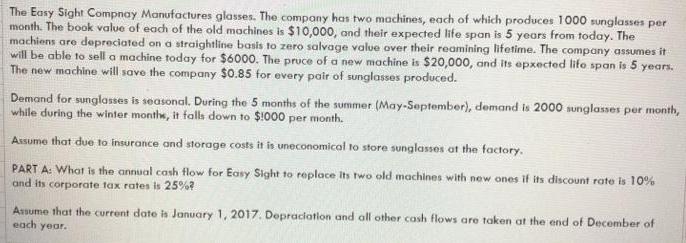

The Easy Sight Compnay Manufactures glasses. The company has two machines, each of which produces 1000 sunglasses per month. The book value of each

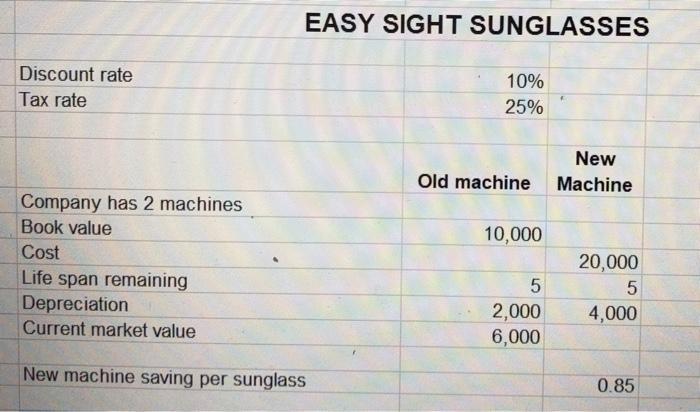

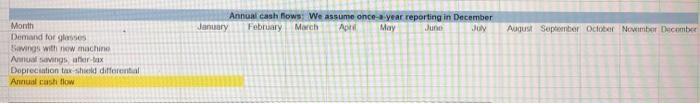

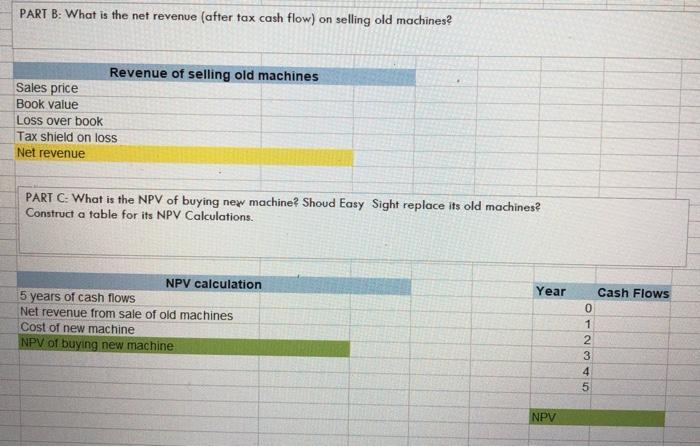

The Easy Sight Compnay Manufactures glasses. The company has two machines, each of which produces 1000 sunglasses per month. The book value of each of the old mochines is $10,000, ond their expected life span is 5 years from today. The machiens are dopreciated on a straightline basis to zero salvage value over their reamining lifetime. The company assumes it will be able to sell a machine today for $6000. The pruce of a new machine is $20,000, and its epxected lifo span is 5 years. The new machine will save the company $0.85 for every pair of sunglasses produced. Demand for sunglasses is seasonal. During the 5 months of the summer (May-September), demand is 2000 sunglasses per month, while during the winter monthe, it falls down to $1000 per month. Assume that due to insurance and storage costs it is uneconomical to store sunglasses at the factory. PART A: What is the annual cash flow for Easy Sight to replace its two old machines with new ones if its discount rate is 10% and its corporate tax rates is 25%? Assume that the current date is January 1, 2017. Depraclatlon and all other cash flows are taken at the end of December of each year. EASY SIGHT SUNGLASSES Discount rate 10% Tax rate 25% New Old machine Machine Company has 2 machines Book value 10,000 Cost 20,000 Life span remaining Depreciation Current market value 2,000 4,000 6,000 New machine saving per sunglass 0.85 Annual cash lows: We assume once-a year reporting in December Apri Month January February March May June JUv August Septenber October November December Demand for gloses Savngs with new machino Annual savings uter-tax Dopreciation tar-shield differental Annual casti flow PART B: What is the net revenue (after tax cash flow) on selling old machines? Revenue of selling old machines Sales price Book value Loss over book Tax shield on loss Net revenue PART C: What is the NPV of buying new machine? Shoud Easy Sight replace its old machines? Construct a table for its NPV Calculations. NPV calculation Year Cash Flows 5 years of cash flows Net revenue from sale of old machines Cost of new machine NPV of buying new machine NPV 2123 45

Step by Step Solution

★★★★★

3.38 Rating (173 Votes )

There are 3 Steps involved in it

Step: 1

Solution a Demand for glasses 2000 pairs from may to sep rest of months 1000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started