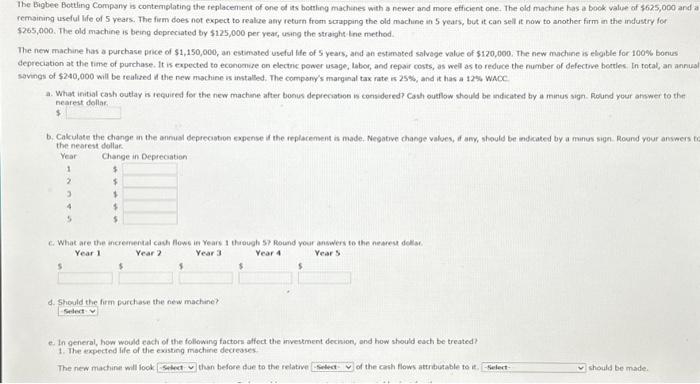

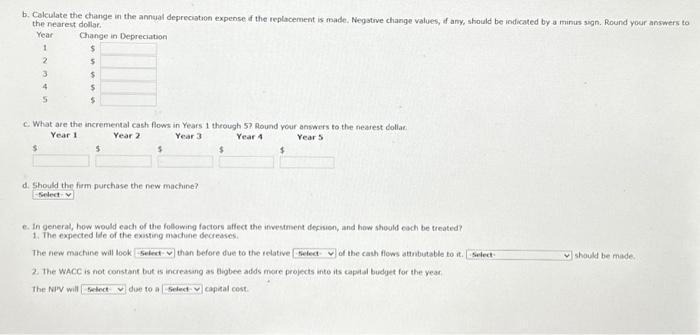

The Eigbee Botting Company is contemplating the replacement of one of its botting machines with a newer and more efficient one. The old machine has a bock value of $625,000 and a remaining usefut life of 5 vears. The firm does not expect to realue any return from scrapping the old machine in 5 years, but it can sell it now to another firm in the industry for $265,000. The old machine is being dopreciated by $125,000 per vear, using the straght the method. The new machine has a purchase pnce of $1,150,000, an estimated useful fife of $ years, and an estamoted salvage value of $120,000. The new machine is eligible for 100% bonus depreciation at the time of purchase. It is expected to econocnue on electnc power usage, Lbor, and repair costs, as well as to reduce the number of defectove borties. In rocal, an annua sovings of $240,000 will be teilfred it the new mochine is installed. The company's marginat tax rate is 25%, and it has a 12% WMOC nearest dollas. $ b. Cakulate the change in the annusl deprecastion oppense if the replacement is made. Negative change values, if amy, should be ndicated by a minus sign. Round your answers t the nearest dollar. \begin{tabular}{cc} Year & Change in Depreciation \\ 1 & 5 \\ 2 & 5 \\ 3 & 5 \\ 4 & 5 \\ 4 & 5 \end{tabular} c. What are the incremental cach fows in Years 1 thoush 57 Round your answers to the newert deklas. 4. Shinaild thar firm porchase the new machine? e. In general, how would each of the followang factors affect the investment decinion, and how should each be treated? 1. The expected life of the exsting machine decreases. The new machinie will look thun before due to the relative of the cash flow atudutable to is. should be made. c. What are the incremental cash flows in Years 1 theough 5? Round vour answers to the nearest dollae: Year 1 Year 2 Year 3 Year 4 Year 5 5 3 5 5 d. Should the firm purchase the new machine? e. In general, how would each of the following foctors aflect the investment decision, and how should cach be treated? 1. The expected lie of the exsting and ine decreases. The hew machine will look than before due to the relative of the cath flews attubistable to it. should be made. 2. The WACC is not constant but is increasang as Bigbee adds more projects inte its capalal buduet for the vear. the Nir will die to a coperal cost