Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The emergence of global financial markets is due in no small part to advances in computer and telecommunications technology enforcement of the Soviet system of

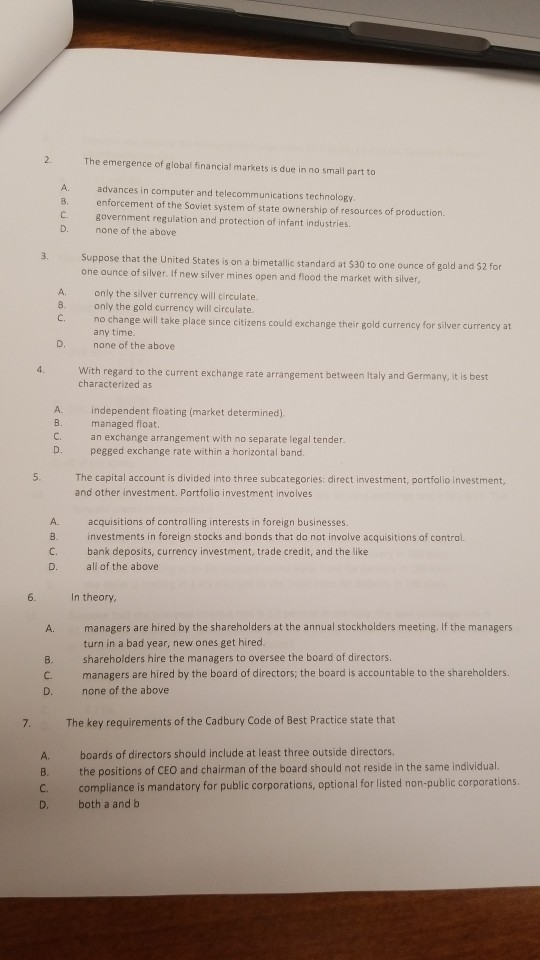

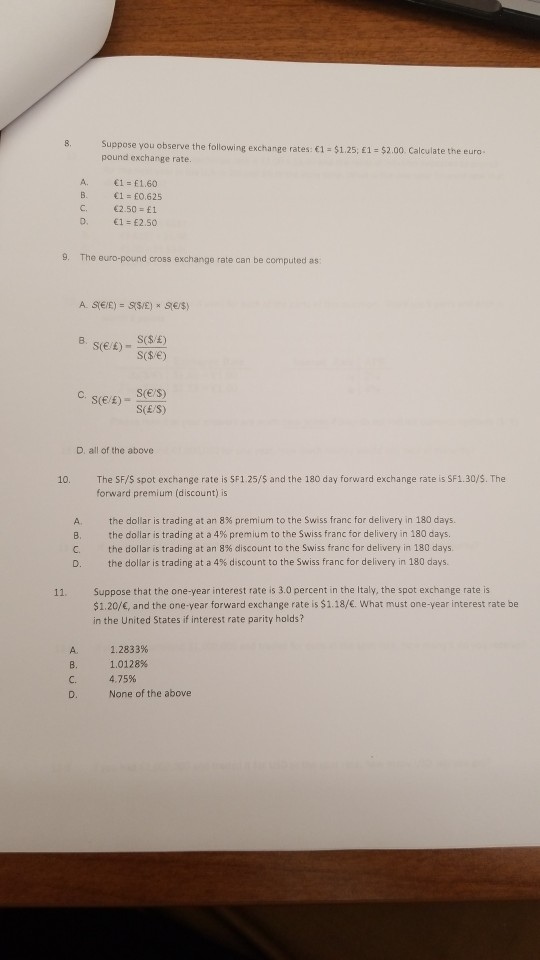

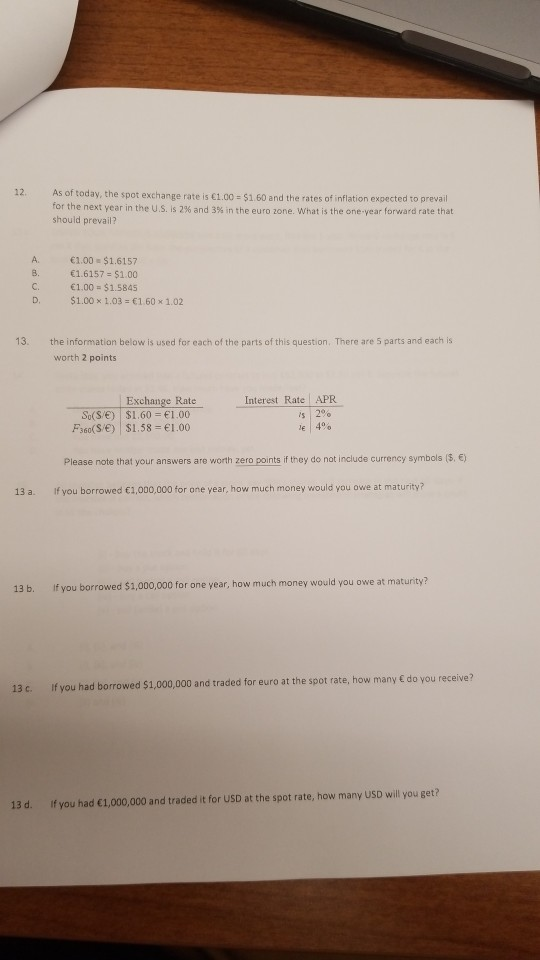

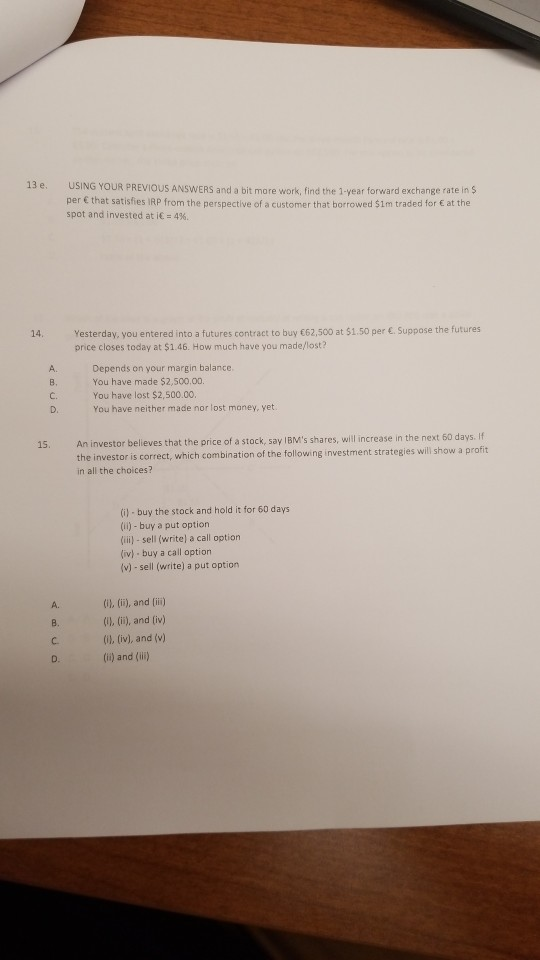

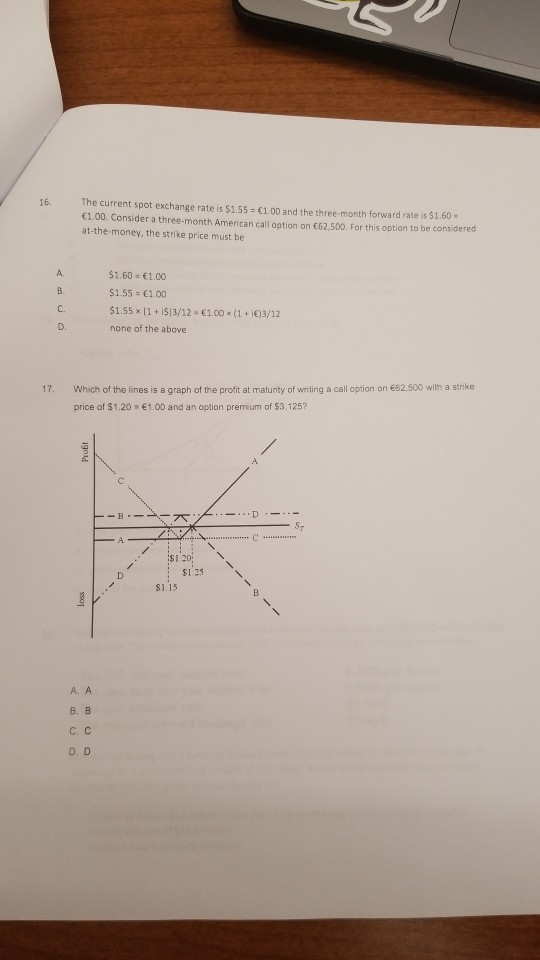

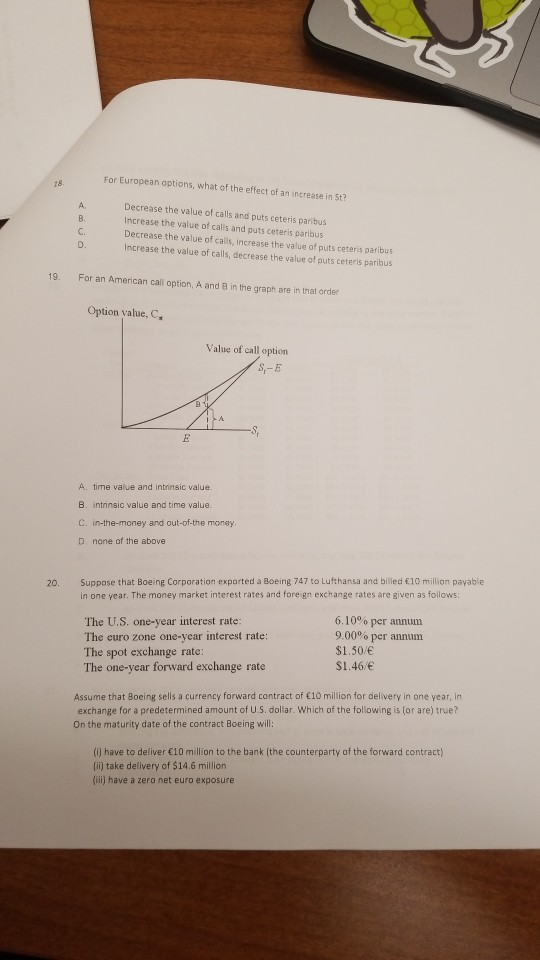

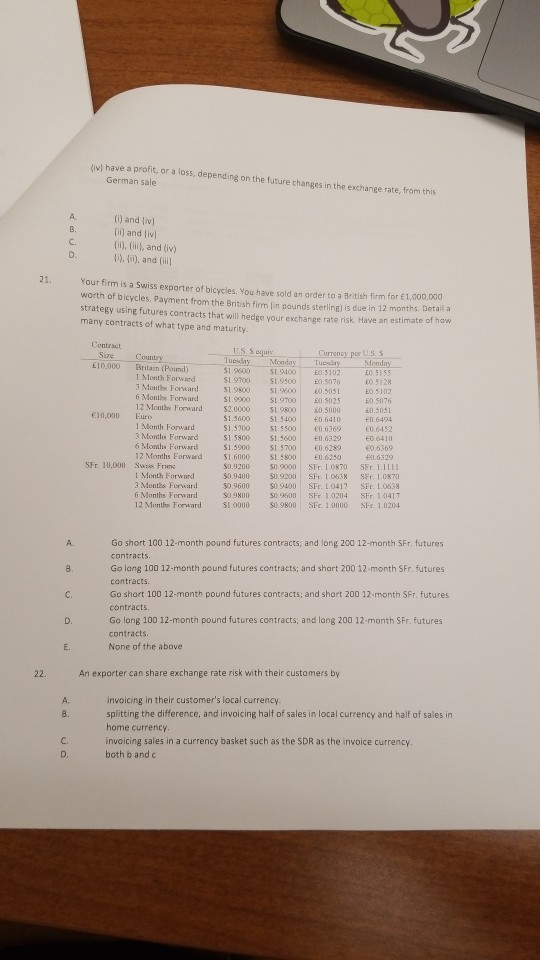

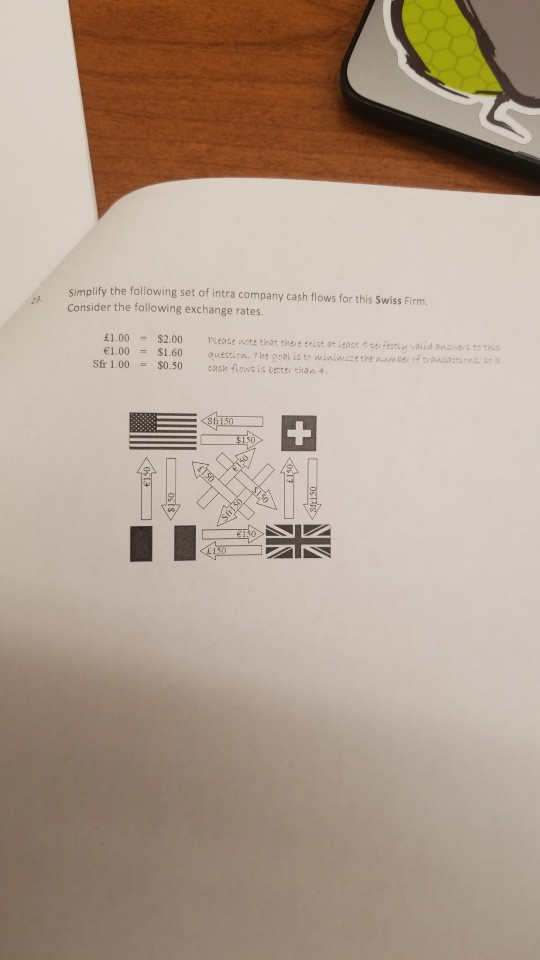

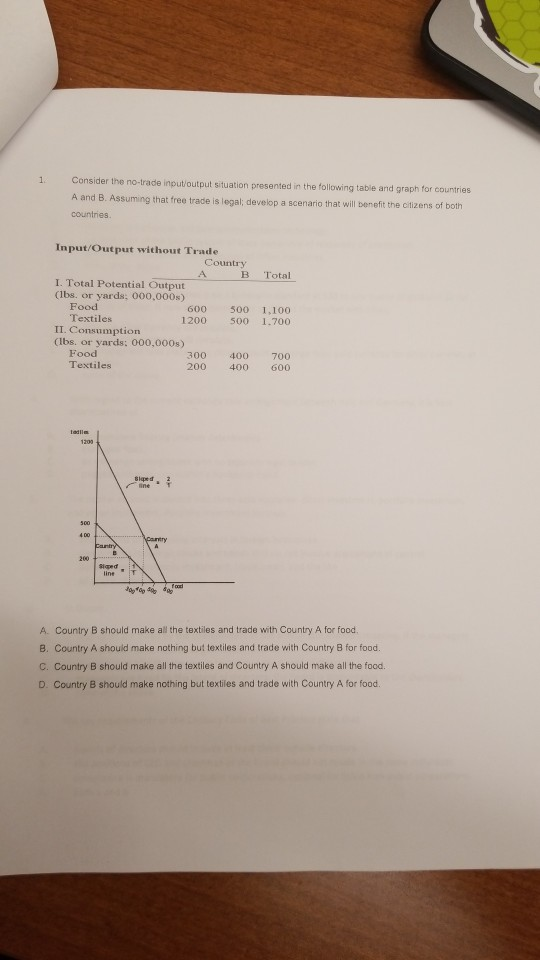

The emergence of global financial markets is due in no small part to advances in computer and telecommunications technology enforcement of the Soviet system of state ownership of resources of production. C D. government regulation and protection of infant n du stres none of the above 3. Suppose that the United States is on a bimetallic standard at $30 to one ounce of gold and $2 for one ounce of silver. If new silver mines open and flood the market with silver A only the silver currency will circulate. 8. only the gold currency will circulate. C, no change will take place since citizens could exchange their gold currency for silver currency at any time none of the above With regard to the current exchange rate arrangement between Italy and Germany, it is best characterized as independent fioating (market determined). managed float. an exchange arrangement with no separate legal tender A. D. pegged exchange rate within a horizontal band. 5. The capital account is divided into three subcategories: direct investment, portfolio investment, and other investment. Portfolio investment involves A acquisitions of controlling interests in foreign businesses C. D. investments in foreign stocks and bonds that do not involve acquisitions of control. bank deposits, currency investment, trade credit, and the like all of the above 6. In theory, managers are hired by the shareholders at the annual stockholders meeting. If the managers turn in a bad year, new ones get hired shareholders hire the managers to oversee the board of directors. A. B. C. managers are hired by the board of directors; the board is accountable to the shareholders D none of the above 7. The key requirements of the Cadbury Code of Best Practice state that A. 8. C. D. boards of directors should include at least three outside directors the positions of CEO and chairman of the board should not reside in the same individual. compliance is mandatory for public corporations, optional for listed non-public corporations both a and b Suppose you observe the following exchange rates: 1-$1.25, E1- $2.00. Calculate the eura pound exchange rate 8. A 1 1.60 B 1 E0.625 C 2.50-1 D. 1=2.50 9. The euro-pound cross exchange rate can be computed as 8. see- Ses) S(E/S) D. all of the above 10. The SF/S spot exchange rate is SF1.25/$ and the 180 day forward exchange rate is SF1.30/S. The forward premium (discount) is the dollar is trading at an 8% premium to the Swiss franc for delivery in 180 days. the dollar is trading at a 4% premium to the Swiss franc for delivery in 180 days. the dollar is trading at an 8% discount to the Swiss franc for delivery in 180 days the dollar is trading at a 4% discount to the Swiss franc for delivery in 180 days. A, C, 11. Suppose that the one-year interest rate is 3.0 percent in the Italy, the spot exchange rate is $1.20/, and the one-year forward exchange rate is $1.18/. What must one-year interest rate be in the United States if interest rate parity holds? A B. C. D. 1.2833% 1.0128% 4.75% None of the above 12. As of today, the spot exchange rate is 1.00 $1.60 and the rates of inflation expected to prevail for the next year in the us, is 2% and 3% in the euro zone, what is the one-year forward rate that should prevail? A. 1.00 $1.6157 8. 1.6157 $1.00 . 1.00-SIS845 $1.00 x 1.03 1 60 x 1.02 13. the information below is used for each of the parts of this question. There are 5 parts and each is worth 2 points So(S/) $1.60 1.00 F360(S) $1.58 1.00 Interest Rate APR /3 2% le | 4% Please note that your answers are worth zero points if they do not include currency symbols ($. E) 13 a. If you borrowed 1,000,000 for one year, how much money would you owe at maturity? 13 b. If you borrowed $1,000,000 for one year, how much money would you owe at maturity? 13 c. If you had borrowed $1,000,000 and traded for euro at the spot rate, how many do yo 13 d. If you had 1,000,000 and traded it for USD at the spot rate, how many USD will you get? 3 e. USING YOUR PREVIOUS ANSWERS and a bit more work, find the 1-year forward exchange rate in $ per that satisfies IRP from the perspective of a customer that borrowed $1m traded for spot and invested at i 496. at the Yesterday, you entered into a futures contract to buy 62,500 at $1.50 per . Suppose the futures price closes today at $1.46. How much have you made/lost? 14 Depends on your margin balance You have made $2,500.00. You have lost $2,500.00 A. C. D. You have neither made nor lost maney, yet. An investor believes that the price of a stock, say 1BM's shares, willincrease in the next 60 days. If the investor is correct, which combination of the following investment strategies will show a profit in all the choices? 15. (i) buy the stock and hold it for 60 days (i)- buy a put option (ii)- sell (writel a call option (iv)- buy a call option v) - sell (write) a put option (OIl, (i), and [ii) 8.01,0), and (iv) (, liv), and (v) (ii) and (ii) B. C. The current spot exchange rate is $1551.00 and the three-month forward rate is $1.60 1.00. Consider a three-month American call option on 62,500. For this option to be considered at-the-money, the strike price must be 16. A. $1.60 1.00 $1.55 1.00 $1.55 x [1 + i13/12 none of the above C. 1.00 x (1 + 1)3/12 17. Which of the lines is a graph of the profit at maturity of writing a all option on 62,500 with a striko price of $1.20 1.00 and an option premium of $3.125? A. $1.20 $1 25 S1.15 A. A , c, c D. D For European options, what of the effect of an increase in St? 18. Decrease the value of calls and puts ceteris paribus Increase the value of calls and puts ceteris paribus Decrease the value of cals, increase the value of puts ceteris paribus Increase the value of calls A. C. D. , decrease the value of puts ceteris paribus 19. For an American call option, A and B in the graph are in that order Option value, C Value of call option A. time value and intrinsic value B. intinsic value and time value. C. inshe-money and out olahe money D none of the above Suppose that Boeing Corporation exported a Boeing 747 to Lufthansa and billed 10 million payable in one year. The money market interest rates and foreign exchange rates are given as follows 20. The U.S. one-year interest rate: The curo zone one-year interest rate: The spot exchange rate: The one-year forward exchange rate 6.10% per annum 9.00% per annum $1.50/ S1.46/e Assume that Boeing sells a currency forward contract of 10 million for delivery in one year, in exchange for a predetermined amount of U.S. dollar. Which of the following is (or are) true? On the maturity date of the contract Boeing will (i) have to deliver 10 million to the bank (the counterparty of the forward contract) lii) take delivery of $14.6 million (ii) have a zero net euro exposure (iv) have a profit, or a loss, depending on the future changes in the exchange rate, from this German sale A. () and (v) (i) and [iv) (il), (ii), and (iv) T), li), and (ii 21. Your firm is a Swiss exporter of bicycles. You have sold an order to a British firm for 1,000,000 worth of bicycles, Payment from the British firm [in pounds sterling) is due in 12 months. Detail a strategy using futures contracts that will hedge your exchange rate risk. Have an est many contracts of what type and maturity timate of naw Contrat County Currency per US S E10.000 Britain (Pound) S1 9600 900 E0.3102 1 Month Forward 3 Months Forward 6 Monthe Forward S 12 Months Forward $2.0000 19000.5000 $1.9700 sl .9500 EO5076 51,9800 .9600 0.5051 S1.900 $1.9700 E.5025 E0 5128 E0.5076 0.5051 E0.6452 06369 10,000 Eur 1.5600 .540 0.6410 1.5300 1 5800 1.5600 E1.6329 1 Month Forward S1 5500 0.6369 3 Months Forward $1 $1.5900 6 Monmhs Farward 12 Months Forward $1.6000 .5800 0620 SI,5700 0.6289 0.6329 SFr. 10,0O ss Frane 1 Month Forward 3 Months Foeward 6 Months Forward 12 Monthe Forward $0.9200 0.9000 Sr L087O SEr. 1.ILL 0.9400 09200 SFr. 1.0638 SFr.1.0870 $0 9600 0 9800on SFr 10204 SFr. 10417 SLO0000 $0.9800 SFr. 1.0000 SFr. 1.0204 $0.9400 SFr. L017 SFr. L.0638 Go short 100 12-month pound futures contracts, and long 200 12-month SFr. futures contracts Go long 100 12-month pound futures contracts; and shart 200 12 month SFr, futures contracts Go short 100 12-month pound futures contracts, and short 200 12.month SFr. futures contracts. Go long 100 12-month pound futures contracts, and lang 200 12-month SFr. futures contracts. None of the above A. C. D. E. An exporter can share exchange rate risk with their customers by A. 8. invoicing in their customer's local currency splitting the difference, and invoicing half of sales in local currency and half of sales in home currency C. invoicing sales in a currency basket such as the SDR as the invoice currency D. both b and c Simplify the following set of intra company cash flows for this Swiss Firm. Consider the following exchange rates 1.00 = $1.60 question. The prot ist, ninw.izethe niente, rftansaction.tr Sfr 1.00$0.50 cashfi is Better than 4 1 1. Consider the no-trade input output situation presented in the following table and graph for countries A and B. Assuming that free trade is legal: develop a scenario that will benefit the citizens of both countries. Input/Output without Trade Country B Total I. Total Potential Output (lbs. or yards: 000,000s) Food Textiles 600 500 1,100 1200 500 1.700 II. Consumption (lbs. or yards: 000.000s) Food Textiles 300 400 700 200 400 600 Country B should make all the textiles and trade with Country A for food. B. Country A should make nothing but textiles and trade with Country B for food C. Country B should make all the textiles and Country A should make all the food. D. Country B should make nothing but textilies and trade with Country A for food

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started