Question

The employees of Morton's Horticultural Products (MHP) are given call options on the stock. A call option gives the employee the right (but not the

The employees of Morton's Horticultural Products (MHP) are given call options on the stock. A call option gives the employee the right (but not the obligation) to buy the stock of MHP at a pre-specified price at a certain time in the future1. Valuing such options is important for employees to assess the value of their compensation packagesand alsofor the company to report the fair value of the compensations they offer.

Joseph has been offered a job at

MHP in July 2013. The compensation will include 20,000 stock options that will

vest2in 4 years. The contract stipulates that Joseph can buy, at the end

of 4 years (i.e.July

2017), up to 20,000 shares of MHP at the current price of $30 per share. As a

policy, MHP does not distribute dividends to its shareholders and instead

retains the earnings for future use. This ensures that all the growth in the

company is translated into its market capitalization3. The current money market

accounts/treasury bonds provide arisk freereturn of 5% per

year.

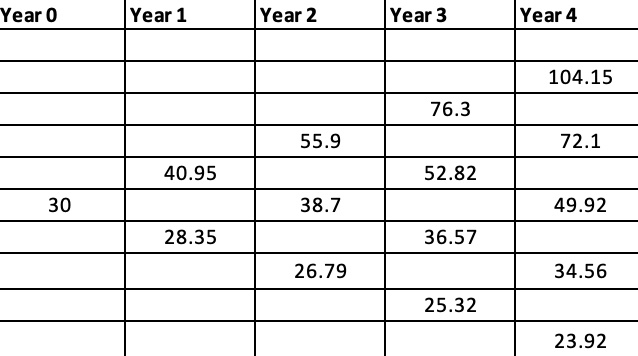

Joseph sits down and estimates the

market and cash flows for Morton's products. He guesstimates that each year the

stock price of MHP would either go up by 30% or go down by 10% over and above

therisk freereturn. In other words, he expects that a stock of MHP

would at the end of first year be either worth 30 (1.05) (1.3) = $40.95 or

30 1.05 (0.9) = $28.35. The company is expected to continue to exhibit a

similar performance during the remaining three years relevant to the analysis.

Realizing from his trading experience and what he has heard on numerous

occasions from financial analysts, he understands that the stock prices are

reflective of future free cash flows from the company based on the currently

available public information about the company.Therefore, he concludes

that the growth of the stock in one year may be considered independent of the

growth in the other years. Using his assumptions, Joseph figures that the stock

price for MHP could take one of many possible values in each year. Performing

some calculations, he constructs the following table, which lists, in each

column, the possible stock prices at the end of that year.

In order tounderstand the future of MHP better, Joseph would like to figure out the expected value of a stock of MHP at the end of four years. Assuming that it is equally likely that the stock price goes up or down each year, what is the expected value of the stock price according to Joseph's predictions? You may assume that these probabilities remain the same in each of the following years. It should be clear that if the stock price is more than $30 after 4 years, the stock options awarded to him will have some monetary value for Joseph in 2017. Otherwise, they will expire without providing him any return. As such, Joseph argues that if the expected value of the stock is above $30, he would derive some profit from the stock options. Is this reasonable? What do you think should be the expected value of the stock options given Joseph's assumptions?

Joseph is still concerned whether the above calculations over-/under-estimate the value of his stock options.In an effort tobetter understand the value of the stock options offered to him, Joseph consults Joshua, an old friend, who has had some experience in financial engineering. Joshua informs Joseph that valuing stock options is a problem that has been studied at length and these problems are frequently encountered in the derivative industry4. He informs Joseph that these ideas form the basis of developing risk hedging strategies developed and practiced by many companies and banks. However, he warns Joseph that this material is somewhat involved and requires quite a bit of effort to understand and apply.

Joseph is, however, undaunted by Joshua's statements and is keen on enhancing his understanding of these financial instruments. After his meeting with Joshua, Joseph spent some time thinking about the stock options. Despite his efforts, he could not fathom why, if at all, his assessment is flawed. So, he approached Joshua again. After some discussions, Joshua was stillnot able to justify that Joseph's arguments may not be correct. Joshua had always found these ideas a bit intricate and given his lack of recent involvement with the derivative industry, the key ideas in this area had already faded away from his memory. In addition, Joshua was also concerned about an important presentation he is scheduled to make to some of his international clients next week. So, Joshua left Joseph with a book on stochastic calculus for finance that includes some material on stock option valuation. (You have the advantage of a condensed and much simplified version of the treatment attached as an appendix with this case.) After looking through the material, Joseph decides to first consider the problem of valuing the stock options that can be exercised in one year at a strike price of $30. By restricting himself to this simpler case, he hopes that, if his valuation turns out to be far from what the material suggests, he would be in a better position to understand the root cause of the difference. This would also satisfy his penchant for financial analysis, something he has been interested in since the days he started trading securities in financial markets.

Joseph values the stock options for the single-year period at approximately $5.21 using his earlier methodology. His intuition is unable to find any flaws in the original assessment. On the other hand, the stock option valuation arguments presented in the book send his mind spinning since they are replete with sophisticated mathematical arguments ideas that he correctly assesses are probably too sophisticated for addressing the problem at hand.

Can you help Joseph understand the valuation of his stock options using the treatment available in the appendix? Do you think his valuation reasonable according to your estimates? How does the stock option valuationtake into accountthe probability with which the stock value goes up or down? The following setup helps shed some light on the binomial asset pricing model and its origins. It can be safely assumed that if Joseph values the stock options at a certain price, he should be willing to buy additional stock options at that price. Now, enters Mark, who is a rich investor. He buys 9125 shares of MHP using $27,375 of personal money and borrows the rest of the money at the risk-free rate of 5%. Then, he offers 10,500 stock options to Joseph at his valued price (Assume this is a one-year option). What kind of an investment is this for Mark?What are the different payoffs for Mark and what is his risk in this investment?

The next hurdle Joseph wants to tackle is the extension of the ideas to account to multiple periods. What are the main challenges in this extension? Is there a reasonable way to extend the analysis to tackle the valuation of a multi-period option?

1.Expected value of the MHP stock discounted to 2013

2.Expected value of MHP stock option

1.Comparison of Joseph's prediction for the single-period stock option with that obtained via the binomial asset pricing model

2.Analysis of Mark's investment

3.Relation of stock option valuation and probability of stock going up/down

\f

\f Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started