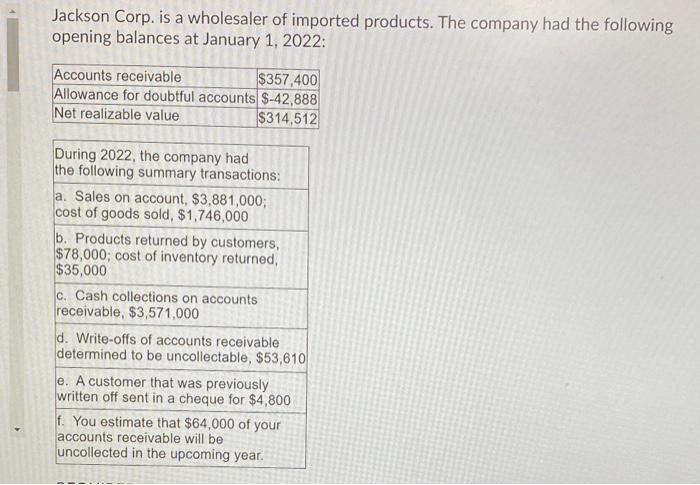

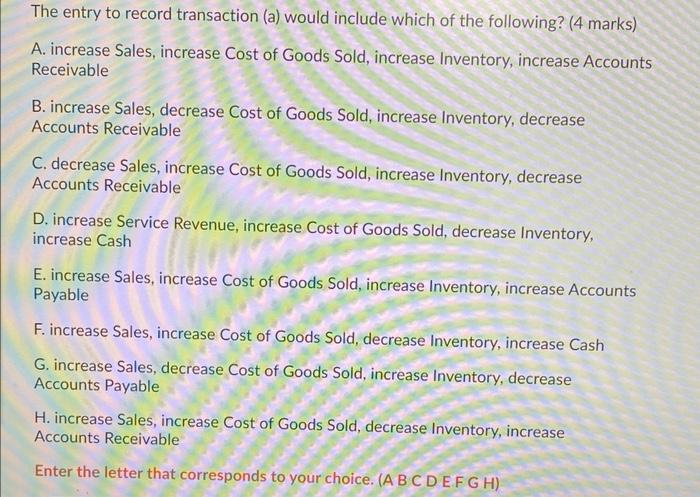

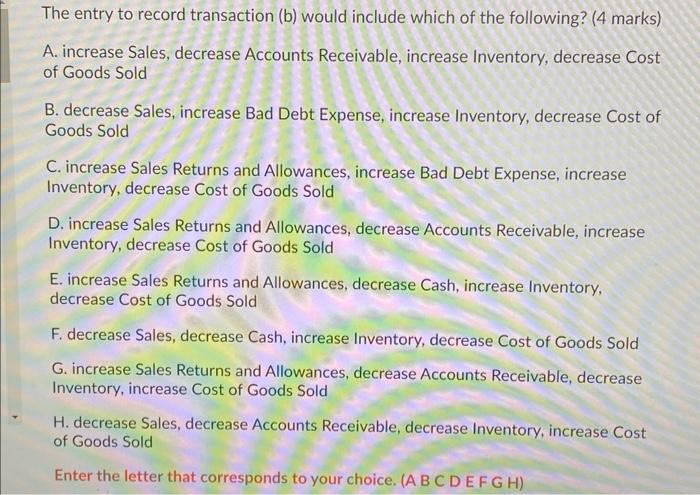

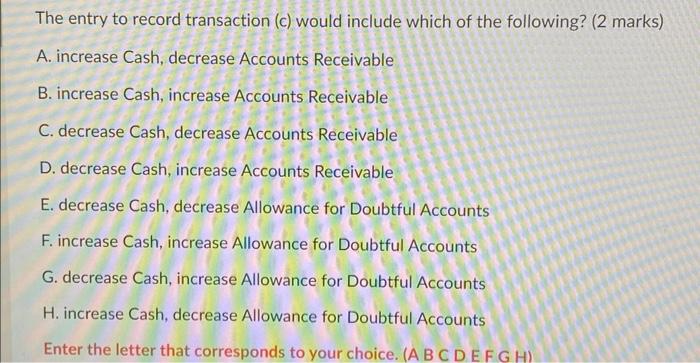

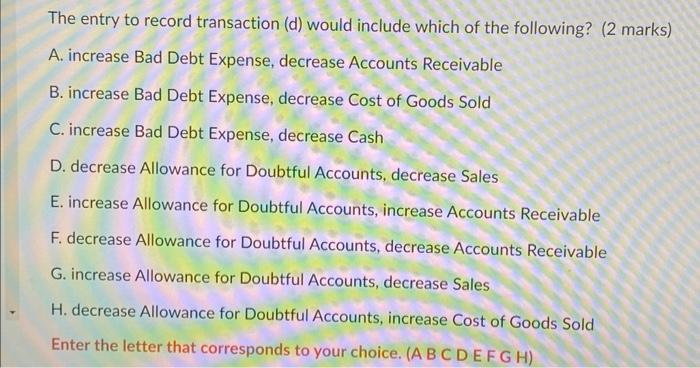

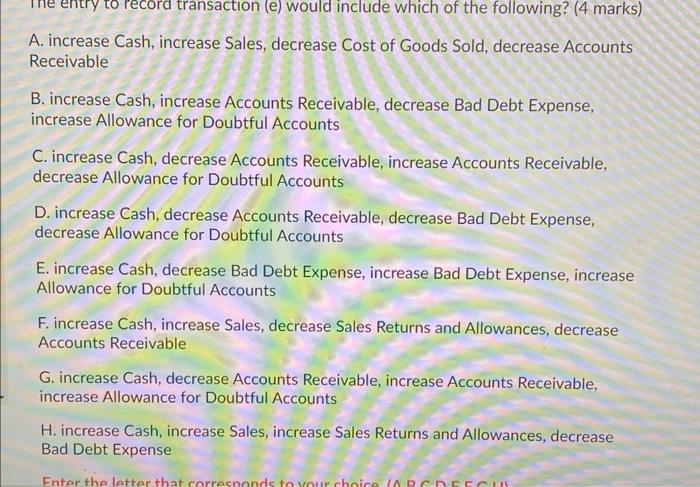

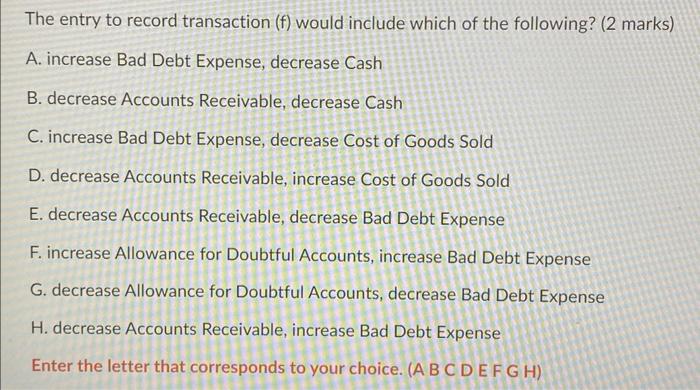

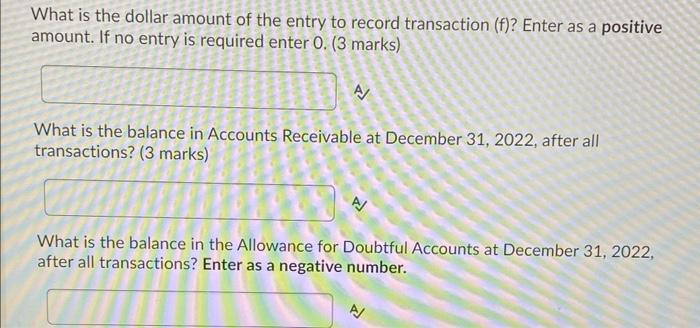

The entry to record transaction (c) would include which of the following? (2 marks) A. increase Cash, decrease Accounts Receivable B. increase Cash, increase Accounts Receivable C. decrease Cash, decrease Accounts Receivable D. decrease Cash, increase Accounts Receivable E. decrease Cash, decrease Allowance for Doubtful Accounts F. increase Cash, increase Allowance for Doubtful Accounts G. decrease Cash, increase Allowance for Doubtful Accounts H. increase Cash, decrease Allowance for Doubtful Accounts Enter the letter that corresponds to your choice. (A BCDEFG Jackson Corp. is a wholesaler of imported products. The company had the following opening balances at January 1,2022 : The entry to record transaction (d) would include which of the following? (2 marks) A. increase Bad Debt Expense, decrease Accounts Receivable B. increase Bad Debt Expense, decrease Cost of Goods Sold C. increase Bad Debt Expense, decrease Cash D. decrease Allowance for Doubtful Accounts, decrease Sales E. increase Allowance for Doubtful Accounts, increase Accounts Receivable F. decrease Allowance for Doubtful Accounts, decrease Accounts Receivable G. increase Allowance for Doubtful Accounts, decrease Sales H. decrease Allowance for Doubtful Accounts, increase Cost of Goods Sold Enter the letter that corresponds to your choice. (A B C D E F G H) What is the dollar amount of the entry to record transaction (f)? Enter as a positive amount. If no entry is required enter 0 . ( 3 marks) What is the balance in Accounts Receivable at December 31, 2022, after all transactions? (3 marks) What is the balance in the Allowance for Doubtful Accounts at December 31, 2022, after all transactions? Enter as a negative number. The entry to record transaction (a) would include which of the following? ( 4 marks) A. increase Sales, increase Cost of Goods Sold, increase Inventory, increase Accounts Receivable B. increase Sales, decrease Cost of Goods Sold, increase Inventory, decrease Accounts Receivable C. decrease Sales, increase Cost of Goods Sold, increase Inventory, decrease Accounts Receivable D. increase Service Revenue, increase Cost of Goods Sold, decrease Inventory, increase Cash E. increase Sales, increase Cost of Goods Sold, increase Inventory, increase Accounts Payable F. increase Sales, increase Cost of Goods Sold, decrease Inventory, increase Cash G. increase Sales, decrease Cost of Goods Sold, increase Inventory, decrease Accounts Payable H. increase Sales, increase Cost of Goods Sold, decrease Inventory, increase Accounts Receivable Enter the letter that corresponds to your choice. (A B C D EFG H) The entry to record transaction (b) would include which of the following? (4 marks) A. increase Sales, decrease Accounts Receivable, increase Inventory, decrease Cost of Goods Sold B. decrease Sales, increase Bad Debt Expense, increase Inventory, decrease Cost of Goods Sold C. increase Sales Returns and Allowances, increase Bad Debt Expense, increase Inventory, decrease Cost of Goods Sold D. increase Sales Returns and Allowances, decrease Accounts Receivable, increase Inventory, decrease Cost of Goods Sold E. increase Sales Returns and Allowances, decrease Cash, increase Inventory, decrease Cost of Goods Sold F. decrease Sales, decrease Cash, increase Inventory, decrease Cost of Goods Sold G. increase Sales Returns and Allowances, decrease Accounts Receivable, decrease Inventory, increase Cost of Goods Sold H. decrease Sales, decrease Accounts Receivable, decrease Inventory, increase Cost of Goods Sold Enter the letter that corresponds to your choice. (A B C D EFG H) A. increase Cash, increase Sales, decrease Cost of Goods Sold, decrease Accounts Receivable B. increase Cash, increase Accounts Receivable, decrease Bad Debt Expense, increase Allowance for Doubtful Accounts C. increase Cash, decrease Accounts Receivable, increase Accounts Receivable, decrease Allowance for Doubtful Accounts D. increase Cash, decrease Accounts Receivable, decrease Bad Debt Expense, decrease Allowance for Doubtful Accounts E. increase Cash, decrease Bad Debt Expense, increase Bad Debt Expense, increase Allowance for Doubtful Accounts F. increase Cash, increase Sales, decrease Sales Returns and Allowances, decrease Accounts Receivable G. increase Cash, decrease Accounts Receivable, increase Accounts Receivable, increase Allowance for Doubtful Accounts H. increase Cash, increase Sales, increase Sales Returns and Allowances, decrease Bad Debt Expense The entry to record transaction ( f ) would include which of the following? ( 2 marks) A. increase Bad Debt Expense, decrease Cash B. decrease Accounts Receivable, decrease Cash C. increase Bad Debt Expense, decrease Cost of Goods Sold D. decrease Accounts Receivable, increase Cost of Goods Sold E. decrease Accounts Receivable, decrease Bad Debt Expense F. increase Allowance for Doubtful Accounts, increase Bad Debt Expense G. decrease Allowance for Doubtful Accounts, decrease Bad Debt Expense H. decrease Accounts Receivable, increase Bad Debt Expense Enter the letter that corresponds to your choice. (A B C D E F G H)