Question

The equation below forecasts personal income tax (PIT) using two explanatory variables, personal income (PI) in dollars and the personal income tax rate (R) in

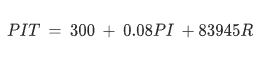

The equation below forecasts personal income tax (PIT) using two explanatory variables, personal income (PI) in dollars and the personal income tax rate (R) in percentage points (e.g. if the tax rate is 4% then R=4).

Personal income is currently $1,000,000 and the tax rate is 4%. The Governor proposes reducing the tax rate to 3% and suggests that the impact of income growth during the next year will offset the revenue loss from the tax rate reduction. What will personal income have to be with a 3% tax rate to yield the same revenue that would result with personal income of $1,000,000 and a 4% tax rate?

A) $2,049,313

B) $3,050,789

C) $4,678,098

D) $1,567,980

E) None of the above.

F) All of the above.

PIT = 300 + 0.08PI + 83945RStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started