Answered step by step

Verified Expert Solution

Question

1 Approved Answer

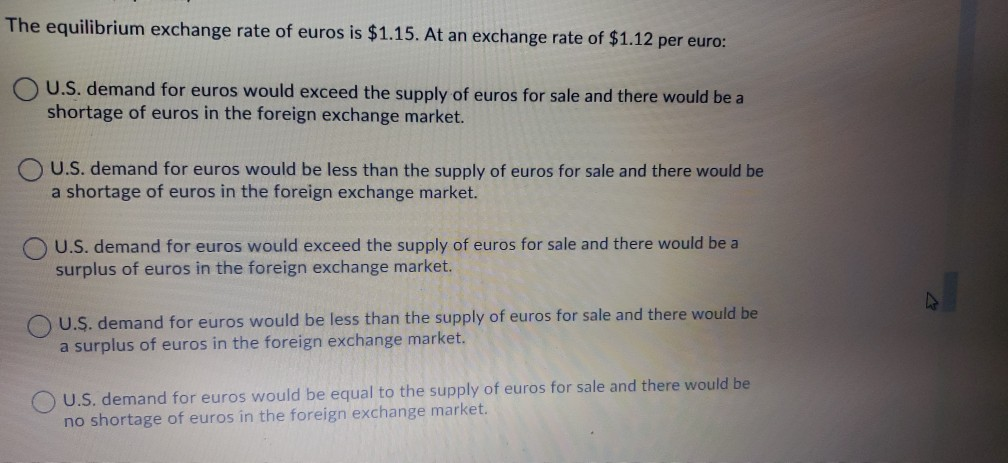

The equilibrium exchange rate of euros is $1.15. At an exchange rate of $1.12 per euro: U.S. demand for euros would exceed the supply of

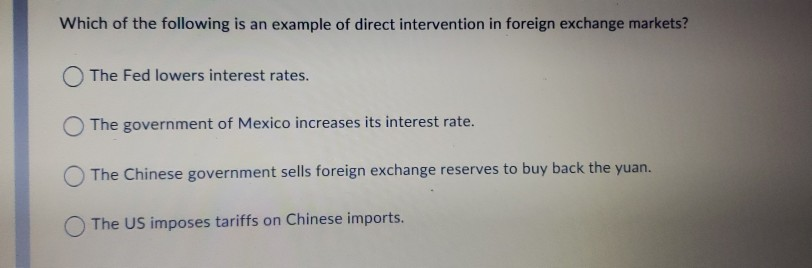

The equilibrium exchange rate of euros is $1.15. At an exchange rate of $1.12 per euro: U.S. demand for euros would exceed the supply of euros for sale and there would be a shortage of euros in the foreign exchange market. U.S. demand for euros would be less than the supply of euros for sale and there would be a shortage of euros in the foreign exchange market. U.S. demand for euros would exceed the supply of euros for sale and there would be a surplus of euros in the foreign exchange market. U.S. demand for euros would be less than the supply of euros for sale and there would be a surplus of euros in the foreign exchange market. U.S. demand for euros would be equal to the supply of euros for sale and there would be no shortage of euros in the foreign exchange market. Which of the following is an example of direct intervention in foreign exchange markets? The Fed lowers interest rates. The government of Mexico increases its interest rate. The Chinese government sells foreign exchange reserves to buy back the yuan. The US imposes tariffs on Chinese imports

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started